Overview

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

Credit Card Issuer Processing: State of the Industry

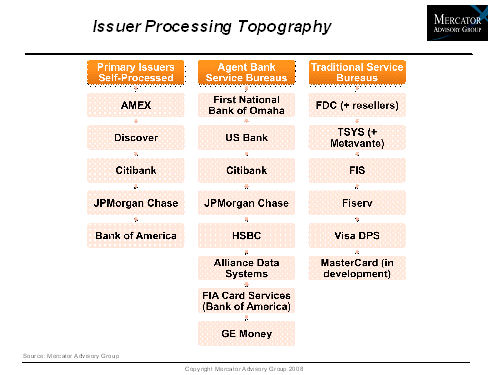

This report from Mercator Advisory Group, "Credit Card Issuer Processing: State of the Industry" is a review and discussion of the current state of the credit card processing service bureau industry in the United States. In this study, the major account management service providers to the credit card issuing industry are reviewed, including both traditional service bureaus and agent bank service bureaus. The history of the major players is examined, as are emerging solution providers.

The research indicates that a prolonged period of software development and acquisition is over, signaling a new era of product innovation based on customer-centric products and services. Professional services in the form of strategic product consulting is being used to create increased value from the issuer/processor relationship, as service providers strive to become their clients trusted advisor and confidant in all aspects of portfolio management.

Patricia Hewitt, author of the report, states: "As the largest issuers only get larger, what will the impact be on the next tier issuers? The competition for a larger share of the mid-sized issuer segment will only become fiercer and in turn, these lenders will require more highly competitive products than ever before. In addition, the revenue model changes being forced on the industry by regulators will result in issuers looking for an increased ability to reduce risk, improve profitability, and derive more value out of their existing account base."

One of the 14 Figures included in this report

This report contains 40 pages and has 13 exhibits.

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world