Credit Card Charge-off Collections Takes Brains not Brawn

- Date:August 14, 2019

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

The Consumer Finance Protection Bureau is in the process of modernizing the Fair Debt Collection Practices Act (FDCPA), which is an appropriate move for the credit card industry. It is the perfect time for credit card issuers to consider their current collections strategies while the economy is performing well. Mercator Advisory Group’s latest research report, Credit Card Charge-Off Collections Takes Brains not Brawn The report explains the importance of third-party collection agents and why proposed regulatory updates are appropriate for the U.S. credit card business.

Readers will learn how the credit card aging process works, why third-party agencies help manage financial institution account overflow, and how the FDCPA creates guard rails for the industry.

“The timing of the original Fair Debt Collection Practices Act was perfect. Revolving debt in the U.S. hit $50 billion,” comments the author of the research report, Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group. “Today, the U.S. credit card market has more than $1 trillion of revolving debt. Loss rates are at normal levels, yet more than 1 million U.S. cardholders end up at collection agencies each year. FDCPA was born in a world before cellphones, email, and texts. FDCPA 2.0 addresses all these functions and curtails litigation in zombie debt. Both are appropriate next steps,” says Riley.

This research report contains 22 pages and 11 exhibits.

Companies and other organizations mentioned in this research report include: ACI Alorica, Banco Bradesco, Citi, Encore Capital Group, Equifax, Experian, Expert Global Solutions,FICO, NCO, Portfoliio Recovery Associates, PRA Group, TransUnion

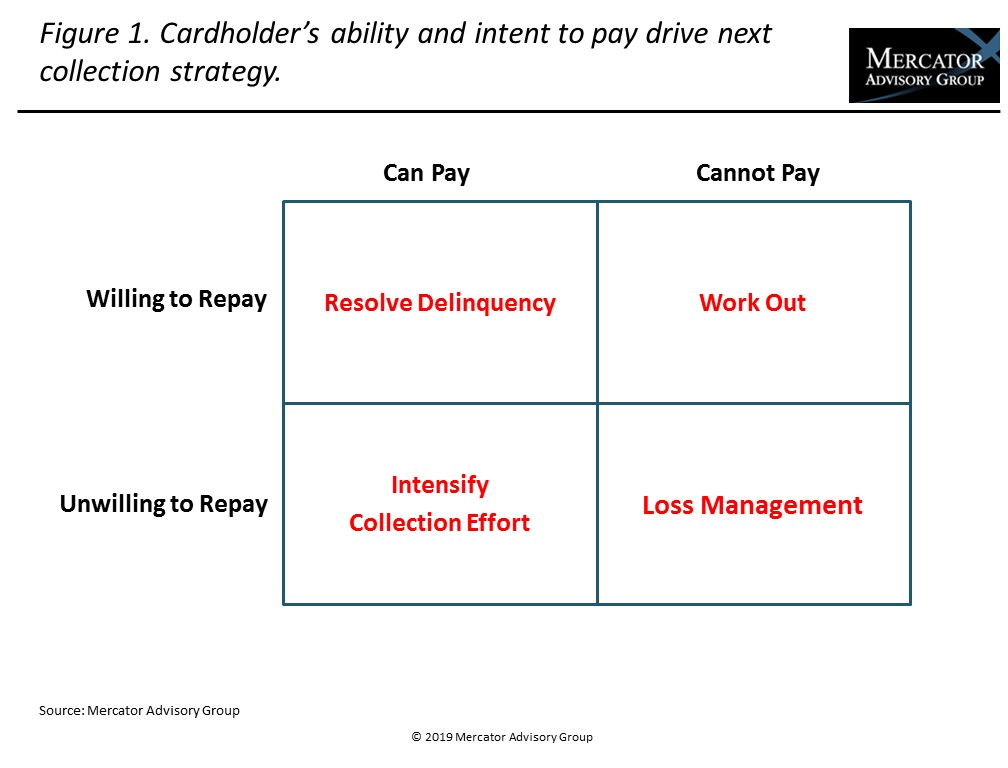

One of the exhibits included in this report:

Highlights of the research report include:

- A thorough explanation of credit card aging

- Bankrupcy trends (2006–2019F)

- Revolving debt trends in the U.S. (1968–2027F)

- Charge-off rates for U.S. credit cards (2006–2023F)

- Percentage of U.S. consumer accounts placed at collection agencies (2006–2018)

- Regulatory controls impacting third-party collections

- Customer complaints about collections by type

- Collection process flow

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world