Credit Card as a Service: Vendors You Need to Know

- Date:December 14, 2021

- Author(s):

- Ben Danner

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

Credit Card as a Service Products Are Changing the Payments Landscape

Mercator Advisory Group released a report covering vendors in the emerging Credit Card as a Service (CCaaS) market, titled Credit Card as a Service: Vendors You Need to Know. The research explains the current credit market and forecast, discusses the latest in credit products, such as Buy Now, Pay Later (BNPL) lending, and examines the effects of the COVID-19 pandemic on the consumer credit industry. Further, this research examines how companies are offering embedded finance products such as CCaaS to allow customers the ability to offer their own credit card product. By way of four evaluative criteria, general advice is provided for those seeking a relationship with a fintech provider.

“Exploring a partnership with a fintech is a viable option for launching new products, testing and evaluation,” comments Ben Danner, Analyst at Mercator Advisory Group and the author of the research report. Through API integrations, partners can easily integrate new financial service technologies into their existing portfolio to respond quickly to changing consumer demand.

This document contains 17 pages and 3 exhibits.

Companies mentioned in this research note include: Alphabet, Inc., Amazon, Chime, Federal Reserve Bank, Galileo, i2C, Inc., Marqeta, Microsoft, Zeta.

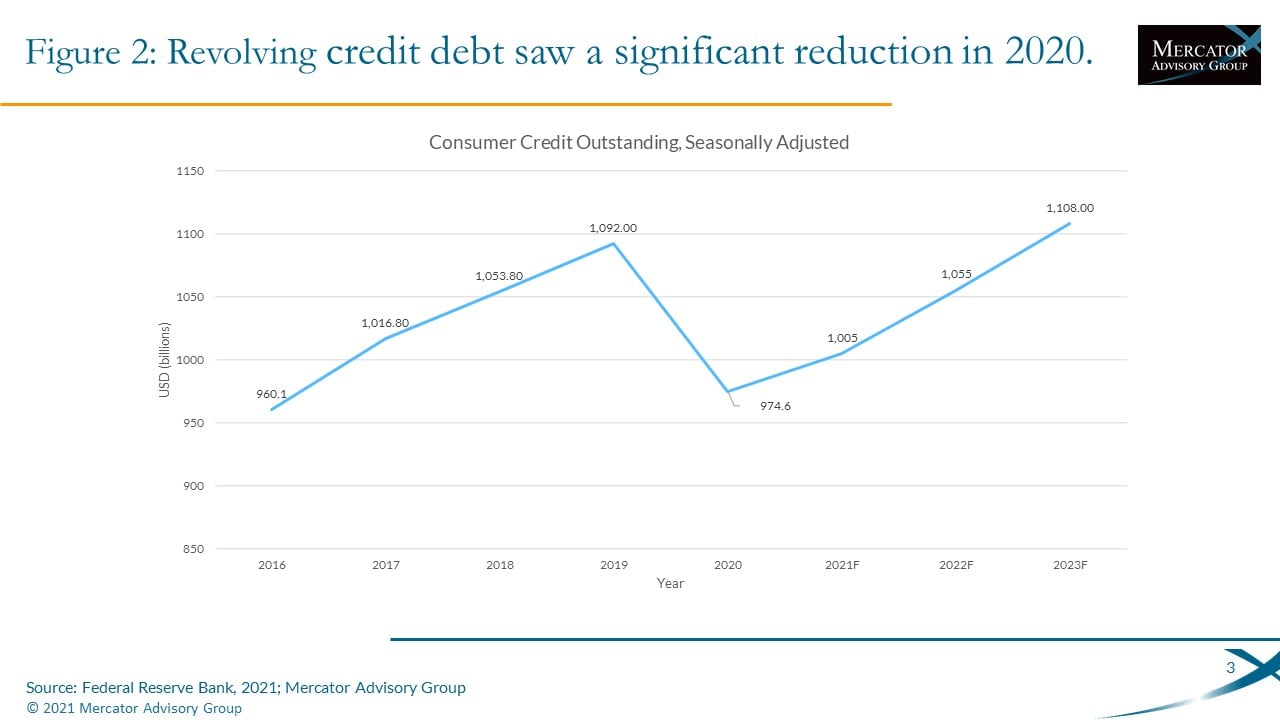

One of the exhibits included in this report:

Highlights of the research note include:

- Effects of COVID-19 on the consumer credit industry

- U.S. credit and debit purchase transactions

- Consumer trends and forecast for Buy Now, Pay Later (BNPL) lending

- An overview of some CCaaS vendors in the market

- Advice for evaluating a fintech partnership

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world