Credit Card Acquisitions: Maximizing Results amid Change

- Date:January 30, 2018

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

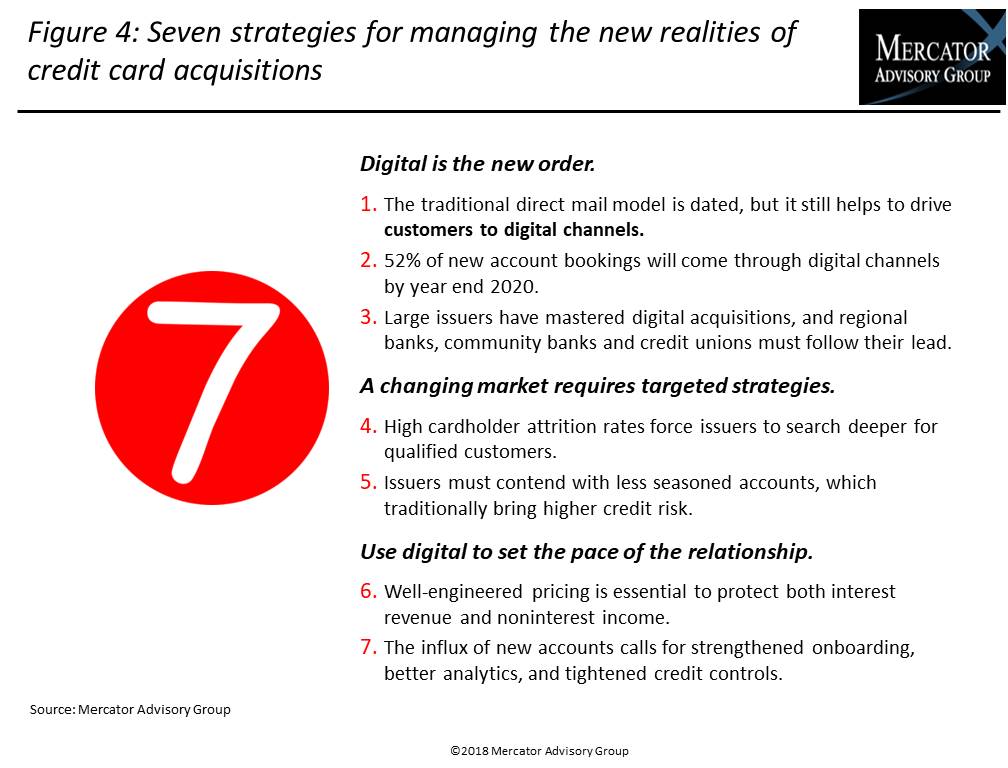

Credit card issuers in the U.S. market booked 66.6 million new accounts in 2017, but the total volume of accounts grew by only 2.3 million because of account attrition. Mercator Advisory Group’s latest research report, Credit Card Acquisitions: Maximizing Results amid Change, discusses the high volume of account attrition and the industry trend toward digital acquisitions, projects how the credit card acquisition model will shift through 2022, and recommends practical strategies for credit card issuers to adapt to a changing market.

“Issuers in the U.S. credit card industry should be urgently concerned,” commented Brian Riley, Director, Credit Advisory, at Mercator Advisory Group and author of the research note. “Issuers continue to open large volumes of new accounts. Since 2015, we have seen more than 60 million new accounts annually in the U.S. market, but total account growth occurs at a snail’s pace. This means cardholders are leaving their issuers almost as quickly as issuers book new accounts. As can be observed from many issuers’ loss numbers, accounts in the portfolios have not seasoned, so risk and delinquency are high. Also, these results show that the rewards model is flawed. Could it be that consumers have outfoxed the rewards incentive model? Have they outfoxed the issuers by shifting their loyalty to the best introductory offer? In a 2017 report, Mercator Advisory Group identified how the return on asset (ROA) metric for credit cards in the U.S. plummeted from 7.65% in 2006 to a projected 3.74% in 2017. One of the driving factors is net revenue per account, and attrition is an obvious component.”

This research report contains 14 pages and 6 exhibits.

Companies mentioned in this research report include: Bank of America, BB&T, Capital One, Chase, Citi, Discover, FICO, First Data, FIS, Fiserv, Mastercard, PNC, SunTrust, TSYS, and Visa.

One of the exhibits included in this report:

- U.S. cardholder attrition rates

- Total numbers of new accounts

- New account bookings by year

- Sources of U.S. card acquisitions

- Projected card acquisition volumes by channel through 2022

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world