- PAID CONTENT

Overview

Mercator Advisory Group released a review of top credit card system providers titled Consumer Debt Collection Software: Vendor Assessment. While Mercator Advisory Group does not suggest changing technologies supporting the collection function during a recession, the timing is right to consider current shortfalls and prepare for enhancing the operation when the economy recovers.

Four vendors are included: ACI Worldwide, CGI, FICO, and Zoot. These four players are well established in supporting the credit card function and can fill the requirements for a wide range of credit card platforms, whether operated on-premise, through the cloud, or with a platform service provider.

"Collection systems must accomplish three broad goals: They need to support operational analytics, so the business knows where it is going and where it should be. It also must facilitate production for manual calling, auto-dialers, and communication. Finally, the system needs to interface with the core platform and document all actions,” comments Brian Riley, Director, Credit Advisory, at Mercator Advisory Group, and the author of the research note. Riley adds that, "the power in collection systems centers on the user’s ability to work the controls and drive the technology. The four vendors selected in this pool provide excellent user support and training. Although each system relies on artificial intelligence, well-trained users deliver the best result.”

This document contains 18 pages and 8 exhibits.

Companies mentioned in this research note include: ACI Worldwide, CGI, FICO, Zoot, FIS, Fiserv, TSYS, Worldpay

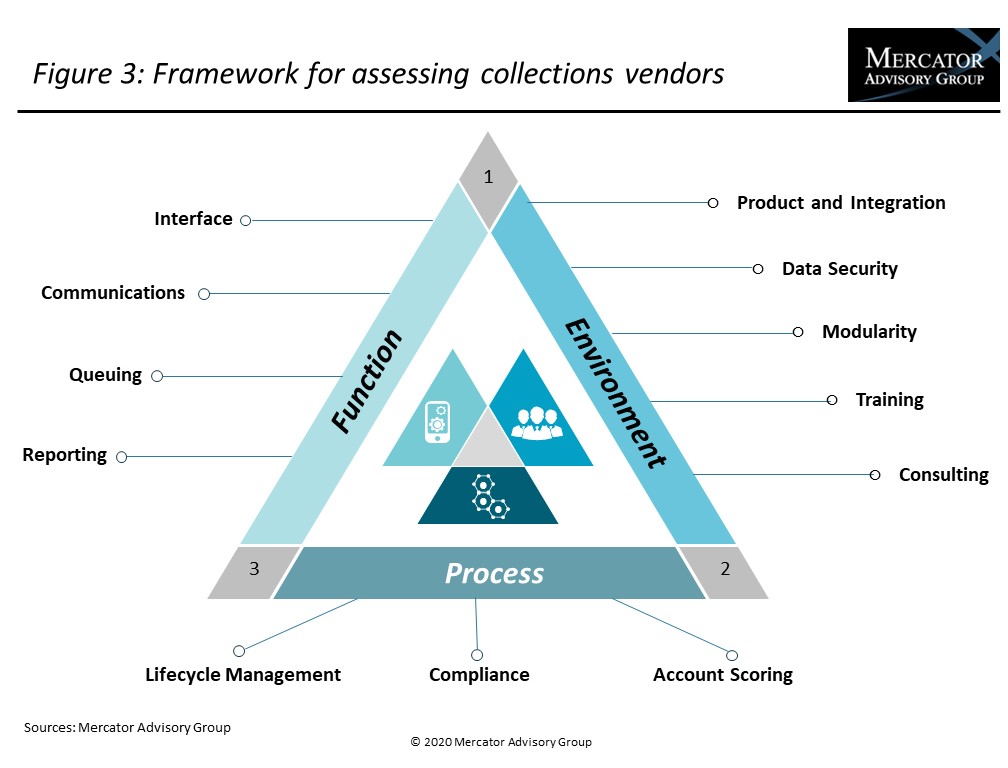

One of the exhibits included in this report:

Highlights of the research note include:

- The new normal in collections

- Our assessment framework

- Comprehensive platforms

- Specialty Products

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world