Brazil, Russia, India, and China: Payment Developments in the BRIC Countries

- Date:October 10, 2017

- Author(s):

- Brian Riley

- PAID CONTENT

Overview

A new research report from Mercator Advisory, Brazil, Russia, India and China: Payment Developments in the BRIC Countries, discusses how the BRIC nations, while similar in their long-term potential, face unique challenges based on economic, political, and social issues. The report also identifies how each country, in its own ways, is moving toward a more country-driven payments model rather than just integrating the universal branded payments scheme.

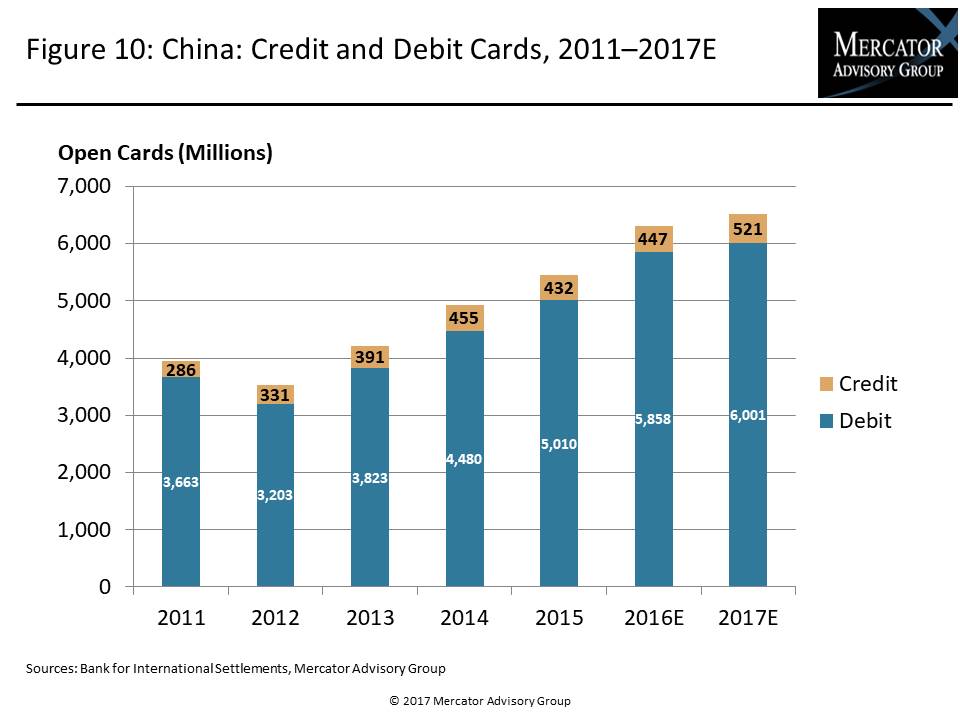

“In about 15 years, China UnionPay has built out a payments function that dwarfs the U.S. market in terms of deployed credit and debit cards, plus terminal installations,” commented Brian Riley, Director, Credit Advisory Service and author of the report. “Another interesting facet of the BRIC markets is their use of domestic payment schemes, such as ELO in Brazil, Mir Card in Russia, RuPay in India, and UnionPay in China. These will not eliminate the need for international payment cards, but they will certainly divert transaction volume.”

This research report contains 22 pages and 11 exhibits.

Companies mentioned in this report include: Alfa-Bank, American Express, Banco Santander, Citi, Deutsche Bank, Discover, Elo, Equifax, Experian, FICO, First Data, Goldman Sachs, HDFC Bank, HSBC, ICICI Bank, Itaú Unibanco, Mastercard, Standard Chartered Bank, TransUnion, TSYS, Visa, and VTB 24.

One of the exhibits included in this report:

- Key economic indicators in the BRIC markets

- Projected credit and debit card volumes

- The implications of indigenous payment networks that run outside or in tandem with global payment systems

- Discussion of why China payments flourish and India payments languish

- Long-range implications to the payments industry

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world