2018 Mobile Banking Scorecard: Tactical Tweaks Take Priority Over Strategic Enhancements

- Date:October 10, 2018

- Author(s):

- Emmett Higdon

- Tyler Brown

- Report Details: 38 pages, 28 graphics

- Research Topic(s):

- Digital Banking

- Mobile & Online Banking

- PAID CONTENT

Overview

Javelin’s 2018 Mobile Banking Scorecard seeks to help financial institutions lay out a strategic road map that leads to deeper engagement and more lasting customer relationships. It provides a data-driven assessment of more than 200 mobile features at 28 top financial institutions, and spotlights trends, best practices, and features that make a bank a leader in six categories: Money Movement, Ease of Use, Security Empowerment, Financial Fitness, Customer Service, and Account Opening. While Bank of America repeated as best overall app, it was joined this year by eight other banks recognized as mobile leaders in various categories. Perennial leaders such as USAA, Navy Federal, and BBVA Compass were joined by fast movers Wells Fargo, U.S. Bank, BB&T, SunTrust, and Ally Bank.

Key questions discussed in this report:

- What strategic principles should shape an FI’s decision to adopt new mobile banking features?

- Which features have seen the greatest growth in the past year?

- What critical features still see low adoption from many banks?

- What areas of mobile banking have the greatest potential to engage users more deeply?

Companies Mentioned:

Methodology

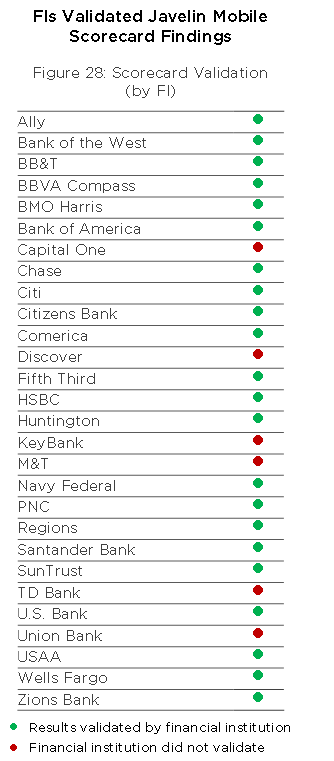

Javelin’s 2018 Mobile Banking Scorecard measures the availability of more than 200 criteria at 28 of the nation’s largest retail FIs, as measured by total deposits. Javelin analysts weight individual features based on their strategic value, tactical necessity, and industry and consumer trends, pointing FIs toward strategic opportunities and user experience innovation. The overall score is a composite of six categories weighted by consumer responses about what is most important to their satisfaction with mobile banking: Money Movement (23%), Ease of Use (22%), Security Empowerment (21%), Financial Fitness (17% each), Customer Service (11%), and Account Opening (6%). Data was collected from April to June 2018. Each financial institution was invited to validate the results. Twenty-one FIs validated the results. (Figure 28)

Consumer data in this report is based on information gathered in Javelin surveys administered in 2018 and 2017. Data was gathered and weighted to reflect a representative sample of the adult U.S. population:

- A random-sample panel of 10,768 consumers in a June/July 2018 online survey. The margin of sampling error is ± 0.94% at the 95% confidence level. The margin of sampling error is higher for questions answered by subsegments.

Book a Meeting with the Author

Related content

Growing Adoption, Low Satisfaction Raise Risks for Mobile Customer Service

Mobile banking has surged past online use, becoming the primary channel for everyday financial tasks. Yet as reliance grows, so do expectations for fast, intuitive support and mean...

Winning the Upgrade to the Business Credit Card

Business credit cards are marketed as rewards-driven products in a crowded, rate-focused category. But owners often adopt them for operational reasons—separating personal and busin...

Chime’s Digital Lending Playbook: Small Dollars, Big Ideas

Rather than competing with banks on loan volume or profitability, Chime’s lending playbook focuses on solving basic consumer cash flow issues through proactive decisioning, frictio...

Make informed decisions in a digital financial world