Lending to Gen Z

- Date:November 14, 2019

- Author(s):

- Austin Kilgore

- Report Details: 18 pages, 11 graphics

- Research Topic(s):

- Digital Lending

- PAID CONTENT

Overview

- What makes Gen Z unique?

- How do its members use technology and consume media?

- What are their priorities and preferences when shopping for consumer loans?

- What gaps currently exist in lenders’ relationships with Gen Z?

- What strategies must lenders employ to modernize their technology and product offerings to meet the needs of Gen Z consumers?

Methodology

The consumer data in this report was primarily collected from the following:

- A random-sample survey of 2,000 respondents conducted online in August 2018, including 189 Gen Z respondents.

- Supplementary data was provided by secondary sources such as the U.S. Census Bureau and Pew Research Center.

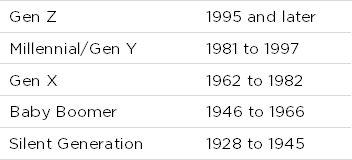

As generations are not defined strictly and some people on the cusp may identify with either generation, Javelin’s definitions leave some overlap in the years that determine a consumer’s generation. In addition, the cutoff for Millennial and Gen Z and even the term “Gen Z” are still being debated and solidified by market researchers. For this report, Javelin delineates generations as follows:

Finally, textual references to “Gen Z” in this report refer to the generation as a whole. But because Javelin surveys adults only, data points are for consumers born between 1995 and 2000 (age 19-24 at the time of writing).

The name “Silent Generation” is perhaps a lesser-known moniker and refers to those who were born before and up to the end of World War II. The term was coined by Time magazine in 1951.4 In studying young people’s reaction to events such as the Korean War and the rise of a nuclear Soviet Union, Time characterizes them as “grave and fatalistic” and refers to the generation’s ability to “[take] its upsetting uncertainties with extraordinary calm.” It also refers to the generation’s perceived adherence to social norms.

Book a Meeting with the Author

Related content

Chime’s Digital Lending Playbook: Small Dollars, Big Ideas

Rather than competing with banks on loan volume or profitability, Chime’s lending playbook focuses on solving basic consumer cash flow issues through proactive decisioning, frictio...

What Lenders Can Learn from Fintech Chatbots

Javelin’s diagnostic analysis of AI-powered consumer-facing chatbots for 11 fintechs, non-bank lenders, and retail banks found that retail FIs consistently fail to provide personal...

2026 Digital Lending Trends

The expectation of interest rate cuts in 2026 will trigger a historic game of catch-up for tradition-bound lenders that have failed to keep pace with savvy FIs and “refi-ready” fin...

Make informed decisions in a digital financial world