2017 Identity Fraud: Securing the Connected Life

- Date:February 01, 2017

- Author(s):

- Test

- Kyle Marchini

- Sarah Miller

- Report Details: 65 pages, 42 graphics

- Research Topic(s):

- Fraud Management

- Fraud & Security

- PAID CONTENT

Overview

The study was made possible in part by LifeLock, Inc. and is provided complimentary to Javelin's Advisory Services clients. This report is for internal use only and not to be released or used externally without Javelin permission.

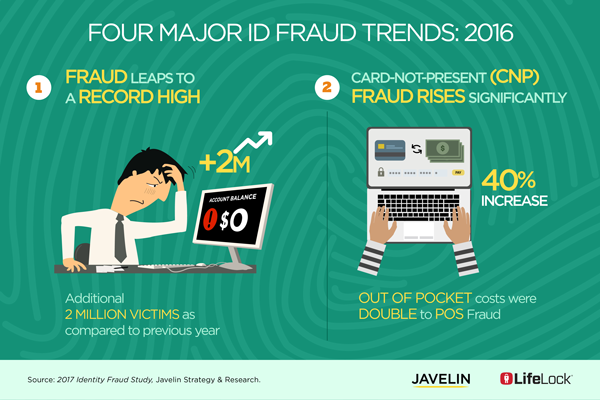

2016 will be remembered as a banner year for fraudsters as numerous measures of identity fraud reached new heights. The overall fraud incidence rose 16% to affect 6.15% of U.S. consumers, from 5.30% in 2015 — the highest on record. And while losses increased by a relatively modest $700 million, the growing prevalence of fraud types that challenge an FI or issuer’s ability to sustain a relationship with a customer dealt additional damage to profitability. Even high points must be tempered for while average consumer costs were down, they were down only because more consumers experienced fraud on existing-card accounts. Fortunately, lessons from 2016 for better managing fraud abound. Unfortunately, risks inherent to growing connectivity combined with weak identity verification, the rise of EMV, and the circumvention of antiquated controls created an environment where fraud thrived and everyone paid the price.

Download Infographic to Learn More

Want to learn more? Visit the press release for this study.

Methodology

The Javelin Identity Fraud Report provides businesses, financial institutions, government agencies, and other organizations an in-depth and comprehensive examination of identity fraud and the success rates of methods used for prevention, detection, and resolution.

2016 Survey Data Collection

Javelin Strategy & Research took over this Identity Fraud survey from the Federal Trade Commission in 2003. Javelin fielded the ID Fraud survey through the KnowledgePanel® to obtain the most representative sample of U.S. adults. KnowledgePanel is the only probability-based online panel in the U.S. Through mail, the panel recruits households with no access to Internet (at the time of recruitment) as well as cell phone-only households. The panel offers a mix of RDD-based recruitment (1999–present) and address-based sampling (introduced in 2008 and rolled out in full in 2009).

The 2017 ID Fraud survey was conducted among 5,028 U.S. adults over age 18 on KnowledgePanel; this sample is representative of the U.S. census demographics distribution, recruited from the Knowledge Networks panel. Data collection took place from November 5-21, 2016. Final data was weighted by Knowledge Networks, while Javelin was responsible for data cleaning, processing, and reporting. Data is weighted using 18+ U.S. Population Benchmarks on age, gender, race/ethnicity, education, census region, and metropolitan status from the most current CPS targets.

Contributing Organizations

The study was made possible in part by LifeLock, Inc. To preserve the project’s independence and objectivity, the sponsors of this project was not involved in the tabulation, analysis, or reporting of final results.

Book a Meeting with the Author

Related content

Crypto Investment Scams: How Banks Can Disrupt These Criminal Operations

Cryptocurrency investment scams have evolved into organized, global operations that are stealing billions of dollars from consumers. Recent enforcement actions and platform disrupt...

Foolproof Payments: How AI is Revolutionizing Payment Fraud

Payment fraud is becoming harder to detect as transactions move faster and fraud tactics evolve. Fraud teams are being pushed to make quick decisions with limited context, leading ...

2025 Know Your Customer and Know Your Business Solution Scorecard

KYC and KYB tools play critical roles in preventing fraud and supporting compliance efforts. This report compares 17 leading KYC and KYB vendors in the U.S. market and examines how...

Make informed decisions in a digital financial world