Working Capital Solutions Update: Efficiencies Will Take Time

- Date:June 25, 2015

- Author(s):

- Richard Hall

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

As the economic environment continues to recover, companies of all sizes continue to be faced with how to most effectively manage their buyer/supplier relationships. Management of working capital and payment terms is a daily set of activities that is gaining visibility from solution providers globally.

Mercator Advisory Group's research, Working Capital Solutions Update: Efficiencies Will Take Time, looks at the options available to companies and recent advances that have taken place to manage the complexities of the corporate payments system and potential impacts to the mix of providers to the segment.

"We have seen a significant increase in the number of solutions working to increase the level of visibility and automation in managing corporate payments,” comments Richard A. Hall, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service and author of the report. “Truly providing value for both buyers and suppliers remains challenging. Providers focused on managing working capital have a number of factors to address. In order to make a real impact, all parties are going to have to rethink how to approach things and move beyond traditional siloes of responsibility.”

The report is 20 pages long and contains 8 exhibits.

Members of Mercator Advisory Group's Commercial and Enterprise Payments Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Companies mentioned in this report include Ariba, Basware, Taulia, Traxpay.

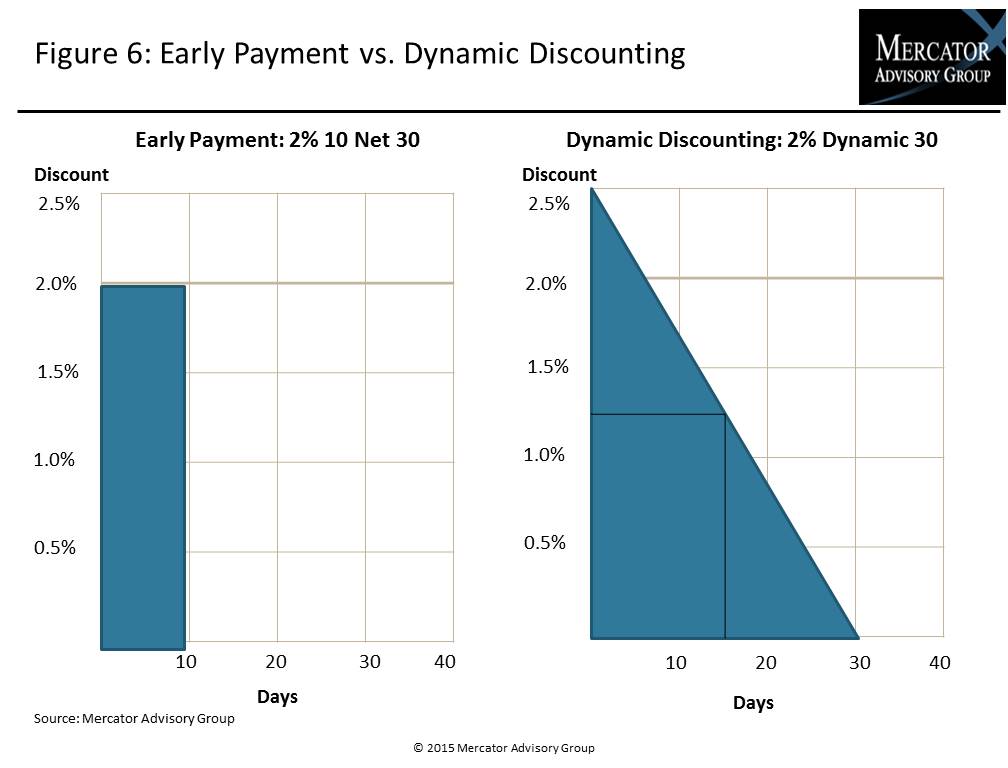

One of the exhibits included in this report:

Highlights of the report include:

- Evaluation of the current corporate payments environment

- Options for managing buyer/supplier payment relationships

- The importance of setting and managing performance metrics

- Potential impacts to existing participants in corporate payments

Book a Meeting with the Author

Related content

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

2026 Commercial & Enterprise Trends

Commercial payment providers are strategically reimagining their infrastructure, pricing, sales, and risk management strategies. This strategic flexibility ensures they purpose-fit...

Make informed decisions in a digital financial world