Overview

Boston, MA

July 2006

Walk-in Bill Payment

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

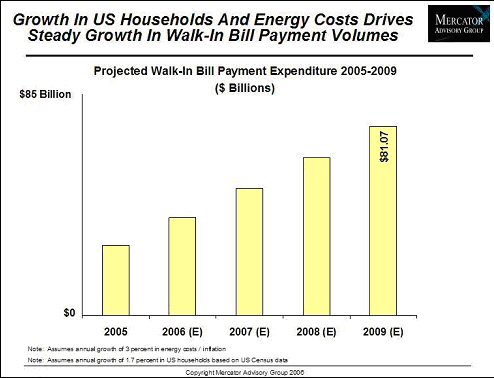

A new study by Mercator Advisory Group finds that walk-in bill payments represent a significant portion of the recurring bill payment market in the United States. At the current rate of growth, over $80 billion in walk-in bill payments will be processed by 2009.

Walk-in bill payments have been traditionally dominated by non-bank providers including direct billers, money service businesses and retail outlets. As a result fee revenues and access to traffic, including a large number of unbanked and underbanked customers, remains out of reach to banks. Furthermore, recent moves to expand the payment services offered to walk-in bill payment customers threatens to further solidify this customer base in the non-bank sector and away from banks and financial institutions.

"With the introduction of new services like insurance and prepaid, walk-in bill payment is becoming a wedge between the underserved markets and traditional banking relationship," states Michael Friedman, Director of Mercator Advisory Group's Emerging Technologies Service and principal analyst on the report. "Banks will want to rethink their walk-in payments strategy to expand their customer base and foster organic growth."

In addition to sizing the walk-in bill payments market and projecting growth, the report looks at the four models for walk-in bill payment services: attend direct, attended aggregation, unattended direct, and unattended aggregation. These walk-in bill payments cover those conducted at retail locations, biller offices, banks and money service business locations, both with the assistance of an attendant and via kiosk. The report goes on to examine the costs, on a per transaction basis, of the various walk-in bill payment solutions and also identifies the processes around the different walk-in bill payment services for customers/payees, merchants, and billers.

Mercator Advisory Group's research identifies the benefits of providing walk-in bill payments including:

* Revenue growth through fee generation

* Expanded access to the unbanked and underbanked

* Increased consumer traffic and opportunities for up-sell and cross- sell

Lastly, the report reviews the competitive offerings of players in the walk-in bill payment space and defines the competitive landscape by including a look at providers of bill payment services and kiosk manufacturers.

The report is 26 pages and contains 6 exhibits.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

Building the Bridge to Payments: 3 Investment Trends for 2026 and Beyond

Investment in fintechs’ payment technology in 2026 is being shaped by a strong shift toward “bridging technologies” that connect legacy systems with emerging capabilities. Investor...

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

Make informed decisions in a digital financial world