Overview

Boston, MA

January 2009

Virtual Point-of-Sale: Diving in and Disappearing into the Line of Business Application

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

Mercator Advisory Group is pleased to announce the release of its latest report, Virtual Point-of-Sale: Diving in and Disappearing into the Line of Business Application.

Since its inception, browser-based vPOS has helped countless merchants with MOTO and low-volume walk-up sales. It remains a useful approach for small merchants with only occasional need to handle card-based payments. It even has the option of supporting card present sales.

Beyond looking after these simple transactions, vPOS capability is diving into the line of business application that drives the merchant's sales process. From small businesses running Quickbooks to large enterprise users of Salesforce.com or SAP, payment capability is now an embedded feature of core business applications.

Payment enablement of a line of business application, arguably the best place for payments to take place, requires considerable effort. This new report examines two approaches to the problem of card payment enablement. The report concludes with an examination of how business applications on the iPhone are becoming payment enabled.

Highlights from this report include:

- Browser-based virtual point of sale (vPOS) continues to offer value to MOTO and low-volume walk-up merchants.

- vPOS capability, software-based payment transactions, is optimal when subsumed into a merchant's line of business application (LOB).

- The dedicated application add-in model, embedding payment processing capability into a line of business application, is a viable vPOS tactic for merchant acquirers and processors.

- IP Commerce flips the application add-in model by using a general purpose payments interface that speeds payment-enablement for the LOB software developer and gives wider choice as to processing partner to the merchant or LOB application user.

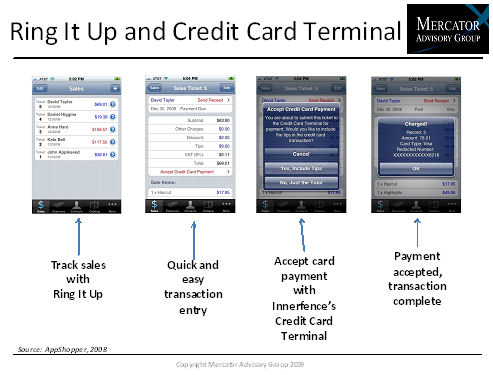

- Mobile vPOS is following an evolutionary path similar to PC-based approaches. Integrated LOP applications for very small merchants, including payments, are available now on the iPhone.

"While virtual point of sale terminals continue to do yeoman's work for small merchants with low walk-up volumes, the action is in enabling business application software to make and take payments," comment Elisa Athonvarangkul Tavilla, Senior Analyst of Mercator Advisory Group's Emerging Technologies Advisory Service. "As a volume driving strategy for merchant acquirers and processors, connecting up the line of business application's sales functions with payments capability makes sense. For merchants, it saves time and simplifies operations."

One of the 6 Figures and 2 Tables included in this report:

This report contains 26 pages, 6 figures, and 2 tables.

Book a Meeting with the Author

Related content

Building the Bridge to Payments: 3 Investment Trends for 2026 and Beyond

Investment in fintechs’ payment technology in 2026 is being shaped by a strong shift toward “bridging technologies” that connect legacy systems with emerging capabilities. Investor...

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

Make informed decisions in a digital financial world