Overview

Fintechs take center stage to improve the bill pay experience for all

The drudgery of paying bills has gotten a new technology spin and an ever-improving user experience for consumers in recent years. This multi trillion-dollar corner of the payments industry is receiving more scrutiny from financial institutions, billers, and the many other participants in the value chain looking to simplify and improve the process. Mercator Advisory Group’s most recent report, U.S. Vendor Comparison of Consumer Bill Pay Providers: Laying the Foundation for Future Intelligent Use of Payment Data, highlights the capabilities and product differentiators of several fintech providers in this market.

“The market for bill pay is rightfully receiving attention to rationalize this critical payment. Fintech firms in this market, including those we review in this report, are applying technology to vastly improve the bill pay process for all involved. Further development is expected including integration of real-time payments and leveraging the data associated with a bill payment to its full extent,” comments Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group and co-author of the report.

This report has 23 pages and 4 exhibits.

Companies mentioned in this report include: Aliaswire, Allied Payment Network, BillGO, doxo, Early Warning Services, Finovera, FIS, Fiserv, Jack Henry, Mastercard, PayNearMe, Payrailz, Payveris, Paymentus, The Clearing House, Walmart, Western Union.

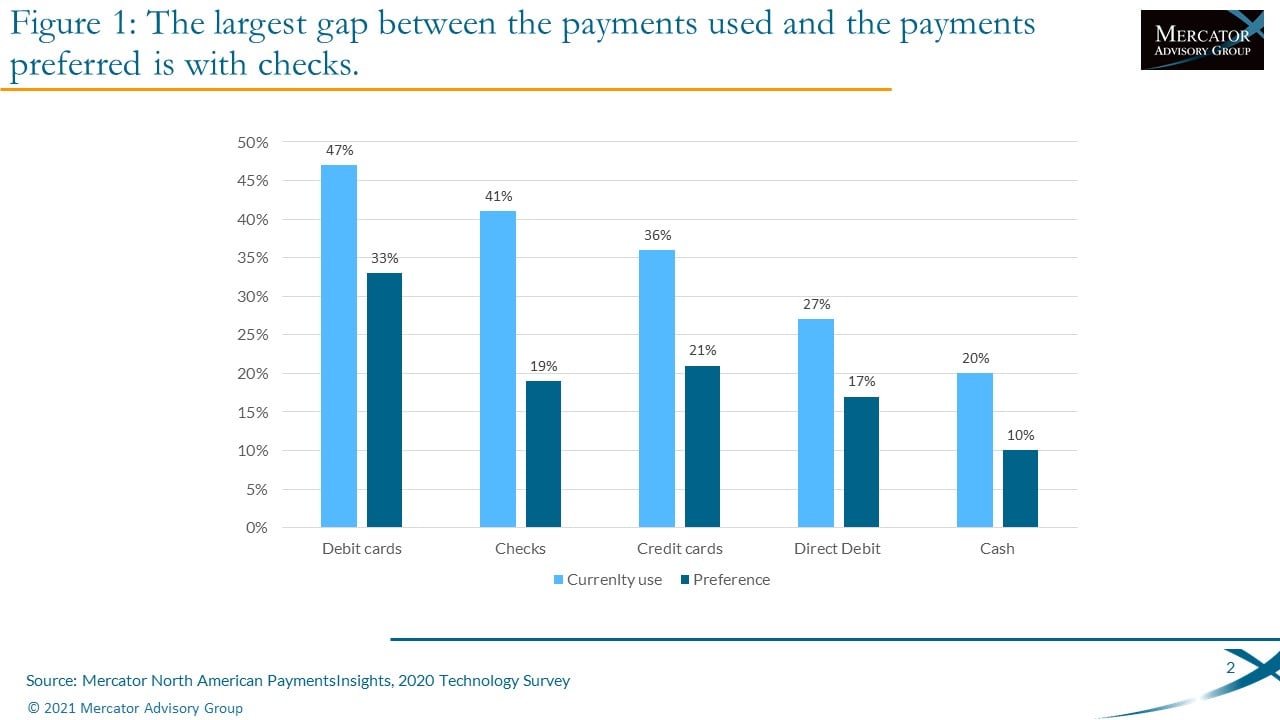

One of the exhibits included in this report:

Highlights of the report include:

- Review of the complex realities of the bill pay market

- Bill pay market size and forecast of the shift of payment types used

- Discussion of features required to complete a modern bill pay experience

- Definitions of key terms and concepts

- Review of five bill pay solution providers with in-market solutions that banks, credit unions, and fintech may want to consider

- A comparison to financial institution solution with bill pay providers in important, adjacent markets including:

- direct-to-consumer,

- biller-direct, and

- white-label, financial institution biller-direct

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world