Overview

Mobile apps with integrated payment features are now mainstream ways for consumers to shop, order and pay for almost any product or service. The emergence of mobile significantly impacts the value chain of payments from merchant acquirers to card networks/issuers to merchants. A new research report from Mercator Advisory Group, U.S. Mobile Payments Market Forecast, 2016–2025: Merchants Grow as Mobile Goes Mainstream, discusses the developing segments of the mobile pay landscape and how consumer behavior is impacting various players. Additionally, the report presents Mercator’s mobile payments market data forecast.

“Consumers are in the driver’s seat related to deciding when, where, and how to buy from merchants. Lifestyle commerce reflects people on the go, making quick and frequent stops, for coffee or a snack as well as for the convenience of ordering meals for takeout or delivery. Mobile payment apps fit this buying model perfectly, and we should expect more vertical retail markets to meet these trending consumer patterns,” commented Raymond Pucci, Director, Merchant Services at Mercator Advisory Group, and author of this report.

This report is 20 pages long and has 9 exhibits.

Companies mentioned in this report: Alipay, Amazon, Apple, Best Buy, CardFree, Citi, CVS Health, Facebook, Google, Grubhub, JP Morgan Chase, Kohl’s, LevelUp, Mastercard, PayPal, Samsung, Shell, Starbucks, Target, Visa, Walmart, and WeChat.

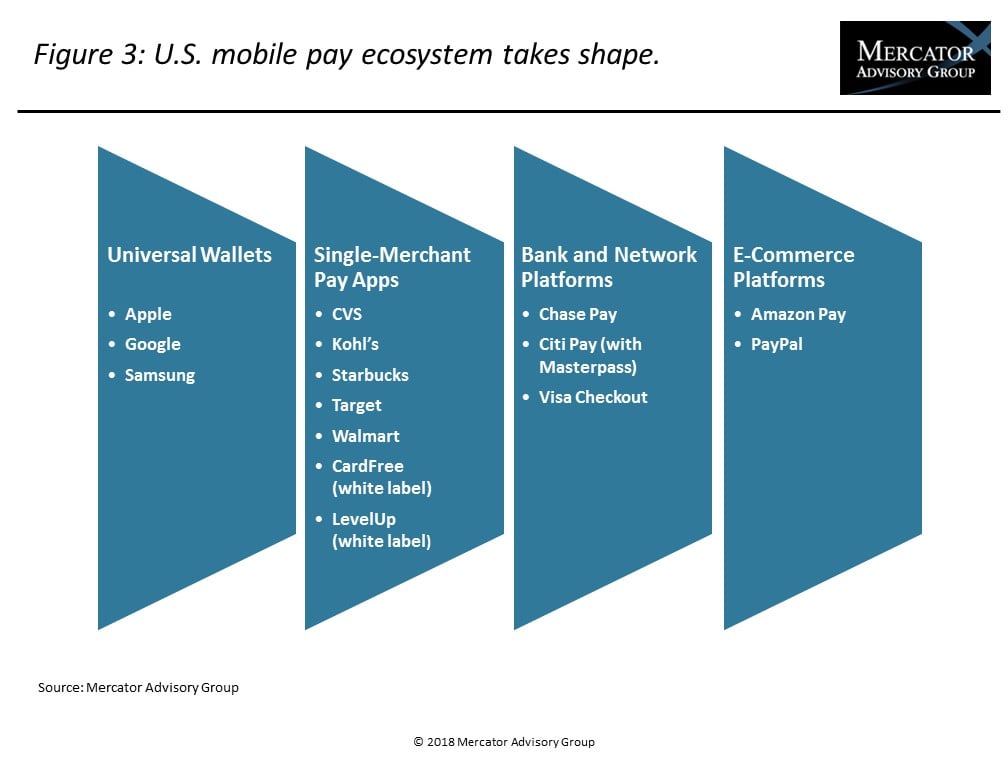

One of the exhibits included in this report:

Highlights of this research report include:

- Digital shopping and mobile payments dynamics

- Opportunities and challenges impacting mobile payments

- U.S. mobile payment ecosystem

- Mercator mobile payment market data forecast

- Vertical market mobile pay growth prospects

Book a Meeting with the Author

Related content

Agentic Commerce: Green Light or Flashing Yellow for Merchants?

Agentic commerce is forecasted to reach $500 billion in sales by 2030, but what’s driving that growth? Consumers will vote with their wallets on which product categories and sales ...

Merchants Should Planogram Payments

Enterprise merchants have increasingly adopted payment orchestration strategies to drive new payment types, increase payment success rates, and optimize platform performance. Howev...

2026 Merchant Payments Trends

As payment technology advances and offers greater options and flexibility for consumers, merchants are put in the position of prioritizing how to manage payment acceptance, what pl...

Make informed decisions in a digital financial world