Overview

Boston, MA

March 2007

U.S. Mobile Banking and Payments: Finding the Seams, Accelerating the Pace

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

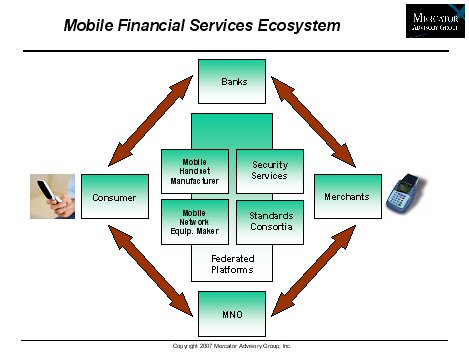

Mercator Advisory Group is pleased to announce that its review of its latest report, US Mobile Banking And Payments: Finding The Seams, Accelerating The Pace. The report reviews the recent upswing in mobile banking initiatives and mobile payments pilots as well as the drivers behind this charge. The report examines preconditions for mobile success, key technology advances that make success far more likely than in the past and, most important, examines the business models that have emerged to engage the participation of ALL members of the mobile ecosystem: banks, mobile operators, vendors, and payment network operators.

The US Mobile Banking and Payments report includes separate forecasts of fee revenue for mobile banking and mobile payments volumes. The report reviews success criteria and what's different about the current initiatives.

Six dozen initiatives are described in detail that exemplify changes of significance in the mobile banking and payments domain. These programs include MasterCard Nearby, Firethorn Holdings, Metavante/Monitise, Cellular South, Obopay, the MobileLime and Cuesol merger and VIVOtech. An appendix contains a comprehensive listing of 14 mobile banking and mobile payments initiatives in the US.

Highlights of the report include:

- US mobile banking and mobile payments activity is seeing a major uptick in activity as some of the largest banks including Citi, Bank of America, Wachovia, and others work with mobile operators and technology providers to roll-out broadly available mobile banking solutions while actively piloting multiple mobile payments methods.

- Mercator Advisory Group forecasts mobile banking fee revenues available to the mobile ecosystem of banks, mobile operators, vendors and networks to exceed $1B in 2011.

- Mercator Advisory Group forecasts mobile payments volume to exceed $6.9B in 2011.

- The evolving business models leave fee revenue on the table for mobile operators, banks and their vendors. For mobile operators, mobile banking drives minutes of use and multiple fee opportunities. For banks and payment networks, services fees and switching charges are available. For the first time, at least some of the interests of every element in the mobile ecosystem are served.

"Unlike previous one-sided efforts by mobile operators and banks, today's mobile banking applications leave something on the table for all the participants in the mobile financial services ecosystem. That's what has been missing up to now; business models that work for banks, mobile operators, platform and network vendors," comments George Peabody, Research Manager of Mercator Advisory Group's Debit Advisory Service. "More targeted mobile payments programs continue to explore and exploit opportunities that, again, meet the needs of more participants than ever."

One of the two Exhibits included in this report.

This report is 28 pages long and contains 2 exhibits, 5 tables and a Glossary of Terms.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

2025 Emerging Biometric Authentication at the Point of Sale Scorecard

This inaugural Javelin Strategy & Research scorecard assesses the emerging market for biometric authentication at the point of sale and identifies three Pillars in this emerging te...

Make informed decisions in a digital financial world