Overview

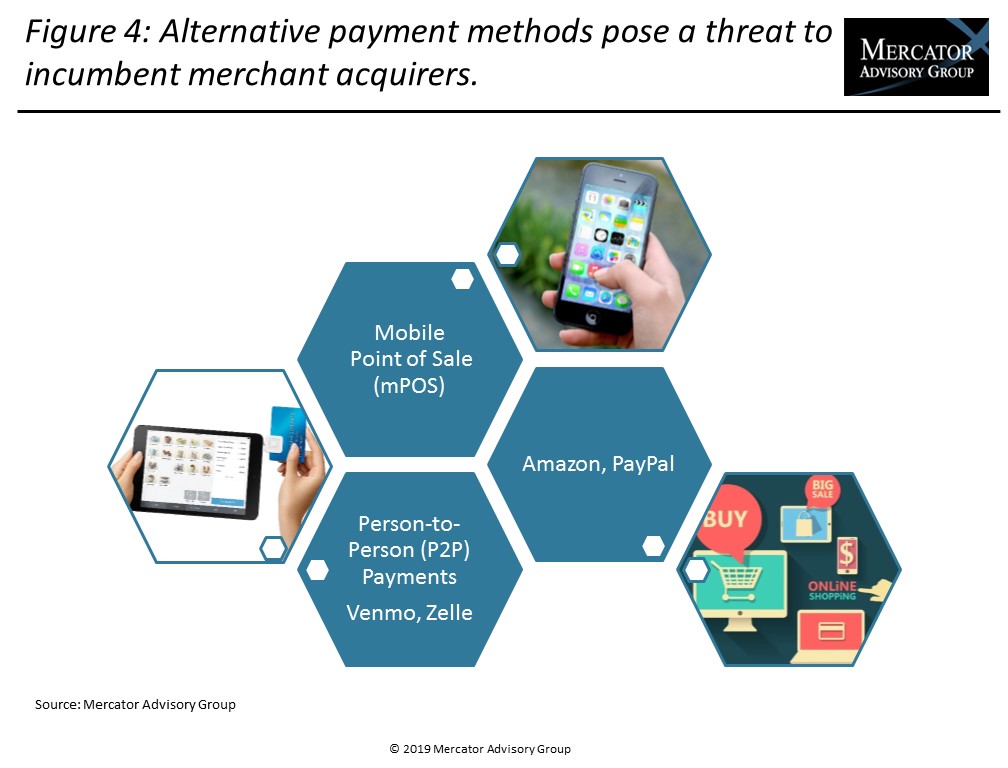

Changing competitive dynamics are the new normal within the U.S. payments industry. Increasing disruptive forces and new entrants present strategic threats to traditional merchant acquirers. A new research report from Mercator Advisory Group, U.S. Merchant Acquirers Confront Disruptive Payments Industry Forces, discusses major factors impacting the industry’s long-time players. Additionally, the report profiles leading merchant acquirers and estimates their U.S. market share.

“Incumbent merchant acquirers have not been oblivious to changes taking place within their segment of the U.S. payments ecosystem. Most have been offering more added-value services in recent years as well as actively pursuing mergers and acquisitions. But now, rapidly evolving consumer shopping behavior, and growth of e-commerce and mobile payments methods, have become game-changers, forcing traditional acquirers to take action or be left behind,” commented Raymond Pucci, Director, Merchant Services, at Mercator Advisory Group, and author of this report.

This report is 20 pages long and has 7 exhibits.

Companies mentioned in this report: Adyen, Affirm, Amazon, Bank of America, Best Buy, BlueSnap, CardFree, Checkout.com, Citibank, BBVA Compass, Early Warning, Elavon, First Data, Fiserv, Global Payments, Home Depot, Klarna, Lowe’s, Macy’s, Mastercard, PayPal, Paysafe, PNC Bank, Poynt, Santander, ShopKeep, Square, Stripe, SunTrust, Target, TSYS, US Bank, Verifone, Visa, Walmart, Wells Fargo, and Worldpay.

One of the exhibits included in this report:

Highlights of this research report include:

- Disruptive forces facing merchant acquirers

- Expanding merchant business needs

- New opportunities appearing in the payments landscape

- Leading merchant acquirer competitive summaries

- Comparative market positioning

Book a Meeting with the Author

Related content

Payment Hubs Stand at a Crossroads

Payment hubs promised to simplify payments, but many never lived up to that vision. As real-time payments, open banking, and platform modernization reshape the landscape, banks are...

Stablecoins vs. Tokenized Deposits

Stablecoins and tokenized deposits are redefining how banks participate in digital money. Much of the current discussion centers on which of these instruments banks should emphasiz...

Real-Time Payments: Use Cases in Acquiring

The real time payments made possible through The Clearing House’s RTP and the Fed’s FedNow payment rails are making headlines, with promises of efficiency and lightning fast paymen...

Make informed decisions in a digital financial world