U.S. Fleet Card Market: The Need for Competitive Differentiation

- Date:February 03, 2015

- Author(s):

- Richard Hall

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

Fleet card networks in the United States operate in an increasingly competitive environment. Closed-loop and open-loop networks are looking for ways not only to compete for greater purchase volume in a highly penetrated market but also to differentiate their offerings in the evolving commercial payments landscape.

Mercator Advisory Group's research report, U.S. Fleet Card Market: The Need for Competitive Differentiation, looks at the fleet cards in the context of commercial card segments and examines key network providers and strategic drivers for growth in 2015 and beyond.

"The fleet card segment represents an intriguing way to look at challenges across the broad spectrum of commercial payments,” comments Richard Hall, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service and author of the report. “While closed-loop networks continue to maintain significant market share advantage in the United States and provide customers and merchants with incentives, Mercator Advisory Group anticipates that slower growth in overall fleet purchase volume will cause key providers to begin to find new forms of innovation in order to differentiate their offerings.”

The report is 28 pages long and contains 14 exhibits.

Companies mentioned in this report include Comdata, FleetCor Technologies, MasterCard, U.S. Bank, Visa, and WEX.

Members of Mercator Advisory Group's Commercial and Enterprise Payments Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

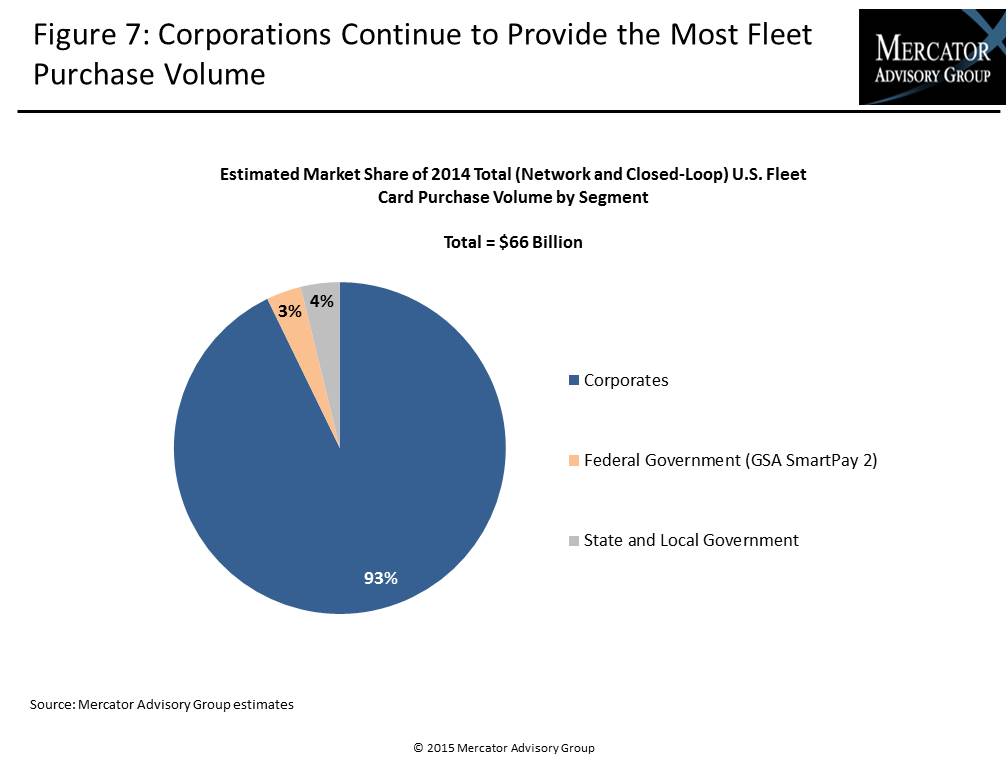

One of the exhibits included in this report:

Highlights of the report include:

- Market sizing estimates for fleet cards in relation to other commercial card segments

- Breakdown of market estimates for open- and closed-loop fleet card providers

- Key segments within the fleet card segment

- Overview of leading fleet network providers

- Strategic considerations for fleet network providers

Book a Meeting with the Author

Related content

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

2026 Commercial & Enterprise Trends

Commercial payment providers are strategically reimagining their infrastructure, pricing, sales, and risk management strategies. This strategic flexibility ensures they purpose-fit...

Make informed decisions in a digital financial world