U.S. Consumers and Social Media: Revisiting Banking's Social Influence

- Date:June 25, 2012

- Author(s):

- David Kaminsky

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

U.S. Consumers and Social Media:

Revisiting Banking's Social Influence

New research from Mercator Advisory Group's CustomerMonitor

Survey Series outlines potential opportunities for FIs provided

by social networking platforms

Boston, MA -- Social networking is developing faster than any other communication medium before it. What was once primarily a medium for students to share personal information has become much more. People of all ages are creating social accounts for countless uses and are also using social networks to interact directly with businesses.

The commercial aspects of social networks are becoming ingrained into society. Television advertisements direct viewers to the advertiser's Facebook page, rather than a website. Billboards promote Twitter handles more prominently than telephone numbers. Social networks provide an interactive connection with consumers with which few other media can compete. Businesses have learned this lesson and are taking advantage of the new medium.

Mercator Advisory Group's new report, U.S. Consumers and Social Media: Revisiting Banking's Social Influence, based on a CustomerMonitor survey, reflects on the status of social networking in the United States as well as the progress financial institutions have made during the last year in utilizing social media to their advantage.

Highlights of the report include:

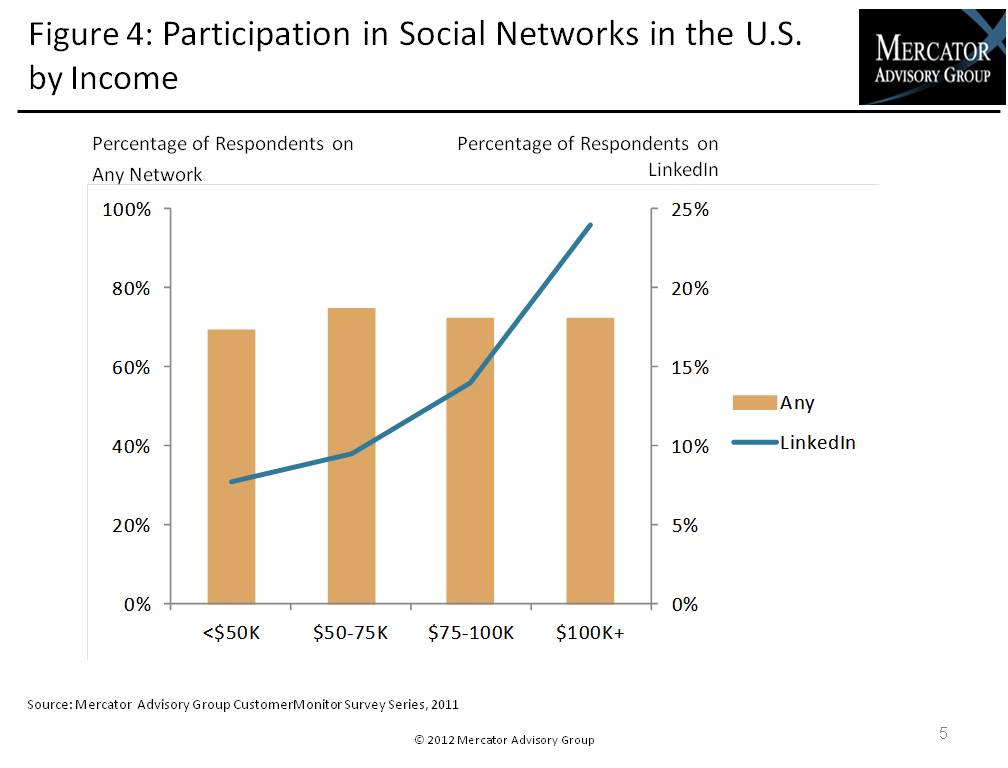

Statistics on the percentage of people using specific social networks, the demographics most attracted to which networks, and a profile of the average social networker

Investigation into the percentage of financial institution customers who are aware of whether or not their primary financial institution is present on various forms of social media, and whether those who are aware have interacted with their FI via social networking

Breakdown of the reasons that convinced consumers who interact with their FI on social media do so, with a particular focus on the value of use of social networks for customer service

"Social platforms inherently provide financial institutions with the ability to connect with current and potential consumers, to provide alerts and information quickly to account holders, and to distribute company news and updates directly to a massive audience," says Dave Kaminsky, Senior Analyst and author of the report. "However, the current state of financial institutions' engagement with customers over social media can best be described as one of high potential that has yet to be reached, and the onus for change falls on the shoulders of the financial institutions."

One of the 15 exhibits in this report:

This report is 26 pages long with 15 exhibits.

Companies mentioned in the report include: Facebook, Twitter, Foursquare, Chirpify, LinkedIn, Google, Myspace, Flickr, LiveJournal, Pinterest, VKontakte, Renren, Friendster, IGN, and bodybuilding.com.

Members of Mercator Advisory Group's CustomerMonitor Survey Series have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

For free industry news, opinions, research, company information and more visit us at www.PaymentsJournal.com.

Follow us on Twitter @ http://twitter.com/MercatorAdvisor

Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors. Mercator Advisory Group is also the publisher of the online payments and banking news and information portal PaymentsJournal.com.

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world