U.S. Consumers and Debit: Fewer Use It for Purchases

- Date:January 18, 2019

- Author(s):

- Karen Augustine

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

The latest Insight Summary Report from Mercator Advisory Group’s CustomerMonitor Survey Series reveals that 54% of all respondents use debit cards for purchases and that figure has declined steadily since 2011, the year following the enactment of the Durbin Amendment. The report, U.S. Consumers and Debit: Fewer Use It for Purchases, presents the findings of an online survey of 3,002 U.S. adults conducted in June 2018.

While consumer ownership of debit cards remains strong and people who have recently opened a checking account are even more likely than average to own a debit card for transactions, the percentage of all U.S. consumers and even those that own debit cards who report using their debit card for transactions is declining.

Today, more U.S. consumers, especially seniors are more likely to use credit cards than any other payments in stores. Young adults and adults whose annual household income is less than $75,000, however, are still more likely to use debit cards than credit cards in stores.

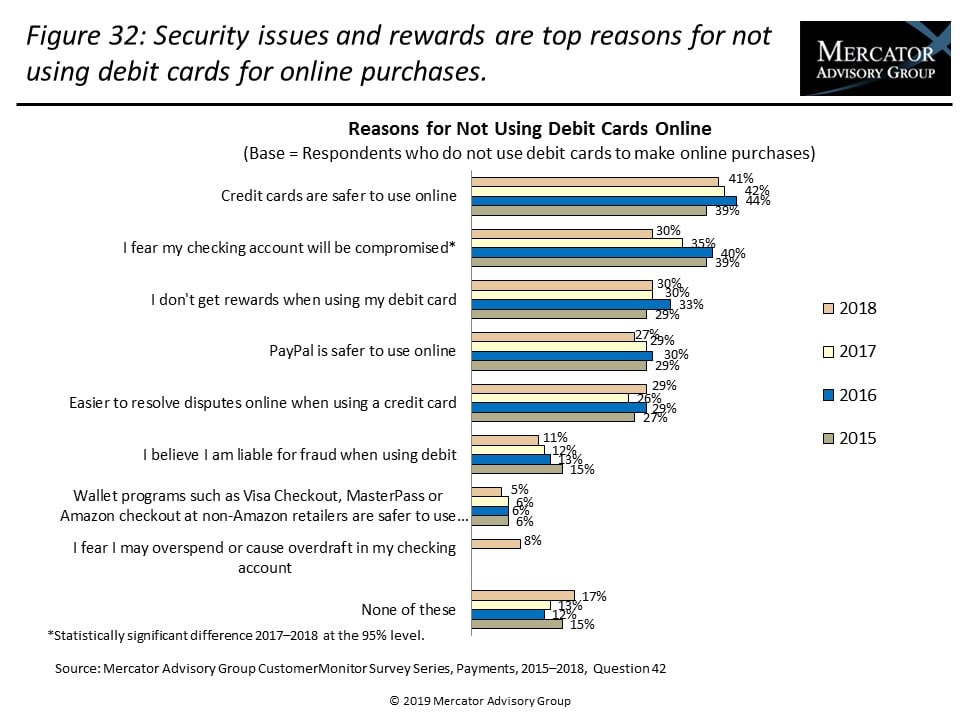

Only half of debit card users report using their card for online purchases. The perception of greater online security with credit cards (41%), fear of checking account compromise (30%), and lack of rewards when using debit cards (30%) are the main reasons consumers do not use debit cards online.

As U.S. consumers make a greater share of purchases online and by mobile using a wider range of payment options, they often prefer credit cards to debit cards online. And with the rising use of online payment services, consumers may start to bypass traditional payment cards and keep funds in their payment service rather than transfer it back to their checking account.

“The rise in use of online and mobile commerce is heightening the need for enhanced security measures such as mobile card controls, especially for debit cards,” states the author of the report, Karen Augustine, senior manager of Primary Data Services at Mercator Advisory Group, which includes the CustomerMonitor Survey Series.

The report is 78 pages long and contains 40 exhibits.

Companies mentioned in the report include: Amazon, American Express, Apple, BillMeLater, Bitcoin, Discover, Google, Facebook, Mastercard, MoneyGram, PayPal, PeoplePay, Popmoney, Zelle, Square, Venmo, Visa, Walmart, and Western Union.

One of the exhibits included in this report:

Highlights of this report include:

- Year-over-year trending of payment type used in households, including debit card use in the U.S. and the ways that consumers use debit cards

- Comparison of debit card ownership to debit card use

- Preferred payments for online purchases and reasons for not using debit cards at online retailers

- Interest and use of mobile card account controls for debit and credit cards

- Preferred payments in stores

- Cash use and reasons for using cash

- Checking account opening, methods used and checking account features including instant issuance

- A shift in demographics of debit cardholders

- Use of person-to-person payments by brand, frequency of use, and use cases

- Use of online payment services by brand, and primary reasons for using online payment services

- Awareness and use of Bitcoin

- Comparison of use of financial institutions of specific payment services with use of alternative services initiated in supermarkets, discount stores, and other outlets

- Types of fees paid for use of checking account

- Cash spending and reasons for use of cash

- Debit card rewards, type of rewards and motivation to use card more often

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world