U.S. Consumers and Credit: Young Adults Return to Credit Card Use

- Date:December 06, 2016

- Author(s):

- Karen Augustine

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

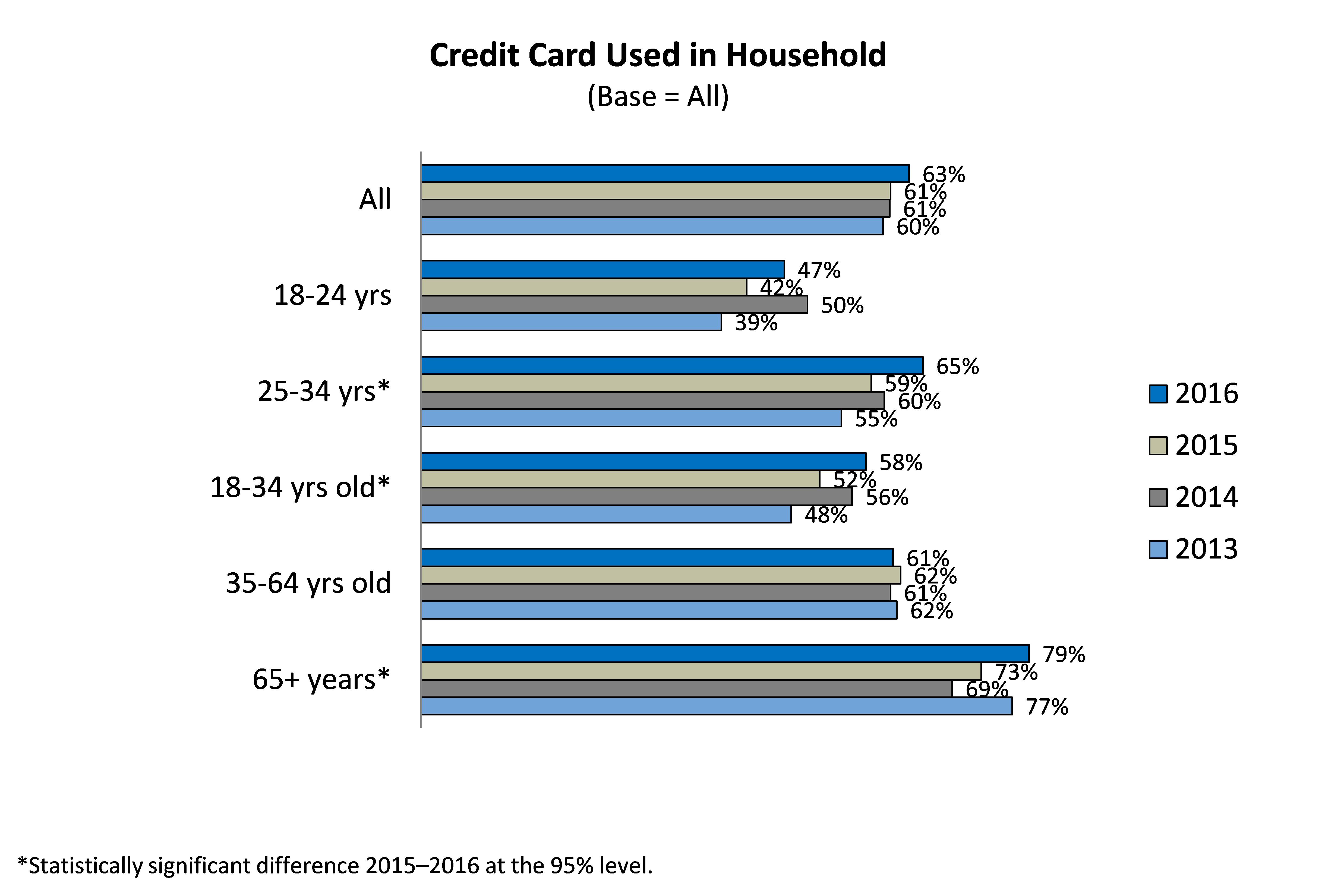

The most recent Insight Summary Report from Mercator Advisory Group’s biannual CustomerMonitor Survey Series, titled U.S. Consumers and Credit: Young Adults Return to Credit Card Use, reveals that 63% of U.S. consumers own general purpose network-branded credit cards, up from 61% who did in 2015. Moreover, young adults, especially the 25–34 year olds, are now, for the first time since we started tracking credit card use in 2009, more likely than average to use general purpose credit cards (65% vs. 63% average), and that figure is rising fast, up from 59% in 2015 and 48% in 2013.

Young adults (58%), especially the 18–24 year olds (47%), who tend to favor debit cards, are still less likely than older adults to use credit cards, but this is changing, particularly due to the shift toward online and mobile shopping. While U.S. consumers today are just as likely to prefer to use a credit card as a debit card in stores, far more prefer to use credit cards at online retailers than debit cards, or any other payment form for that matter. Security issues as well as better rewards for credit card use are the primary reasons they indicate for preferring to use credit cards online. Now that nearly all consumers shop online and e-commerce and m-commerce are gaining a larger share of payment transactions, credit card use is growing, especially among young adults.

U.S. Consumers and Credit: Young Adults Return to Credit, the latest report from Mercator Advisory Group’s Primary Data Service, shows that a surprisingly high percentage of consumers, including 4 in 5 people who pay by mobile phone, have shopped for a new credit card within the past 12 months. Interestingly, the method consumers find most valuable for researching new credit cards is in the branch of their primary financial institution, even among mobile payers.

This study examines the demographic distribution of credit card use in the United States, use of co-branded credit or charge card programs by type, changing patterns of credit card use relative to other payment types, credit card payment habits, and self-assessed credit history, as well as notice of and reaction to merchant steering practices, usage of peer-to-peer lenders by brand and reasons for use, consumer experience of changing fees, APRs, motivators to increase credit card borrowing and credit card spending, methods used to shop for new credit cards, application channels used for general purpose credit cards and store credit cards, and consumers’ notice of and reaction to merchant rules for credit card use and interest in mobile-based account controls.

The report presents the findings from Mercator Advisory Group’s CustomerMonitor Survey Series online panel of 3,009 U.S. adult consumers surveyed in June 2016.

“The changing shopping habits of U.S. consumers to online and mobile shopping are clearly influencing their payment preferences, particularly among the older Millennials with spending power. Financial institutions appear to be aggressively promoting their credit cards, and consumers appreciate it,” states Karen Augustine, manager of Primary Data Services, including CustomerMonitor Survey Series, at Mercator Advisory Group and author of the report.

The report is 83 pages long and contains 36 exhibits.

One of the exhibits included in this report:

Highlights of this report include:

- Year-over-year trending of penetration of credit cards in the U.S. market, cardholder behavior, and changes to features, credit limits, APRs, applications, and turn-downs

- Usage and interest in EMV chip cards by type and user experience in the U.S. and abroad

- Usage of co-branded credit cards by type

- Shifts in the channels that consumers used most recently to apply for general purpose and store credit cards

- General purpose reward card participation, type of rewards available, most valuable reward type

- Interest in applying for new credit cards and most valuable methods of shopping

- Consumer perception and expected reaction to merchant policies and practices restricting credit card use or steering customers to other payment forms

- Interest in mobile-based account controls for use by cardholders to limit fraud on their accounts by card type

- Typical payment habits and use of automatic payments

- Usage of peer-to-peer lenders by brand and reasons for use

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world