Overview

New Research Provides Detailed Overview of Complex

Prepaid Card Regulatory Landscape

Understanding Prepaid Regulation:

A Framework for Asking the Right Questions

Boston, MA -- The prepaid industry is currently experiencing intense growing pains associated with being a relatively young, rapidly evolving market as federal and state government initiatives now at work threaten the progression of this explosive payment segment.

Mercator Advisory Group's newest report, 'Understanding Prepaid Regulations: A Framework for Asking the Right Questions' provides an overview of the regulatory environment surrounding prepaid cards from a business perspective and offers a sense of the complex regulatory environment and a greater ability to have an informed discussion with their counsel as they make business decisions.

This report discusses patent law, the CARD ACT, money laundering, retail bankruptcy, state payroll laws, brand network rules and other critical regulatory and legal issues. This report also provides a useful a list of Web links on regulations, interpretations, white papers, and surveys of state laws.

Highlights of this report include:

The industry needs to educate Congress, regulators, the media, and consumers about the size and diversity of the industry to protect itself from over-reaching regulations.

More regulations on general purpose reloadable (GPR) cards are likely to come; issuers should have worst case scenario plans.

Even resolved issues could cause new problems if issuers make mistakes that incur the ire of consumers, regulators, or legislators.

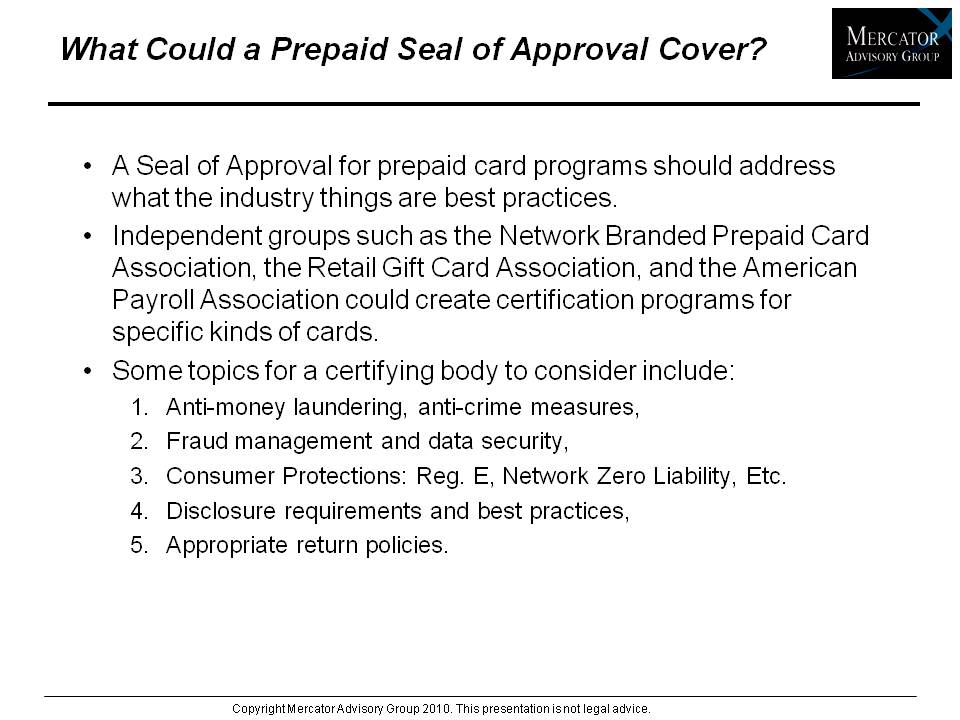

If the industry wants to avoid intrusive regulation, then it should regulate itself. One possibility is to create a seal of approval where a third party says that card programs carrying a particular seal or rating have protections built in for consumers.

Regulations will continue to evolve as new problems arise and various constituencies push for changes in the regulations.

At this writing, several issues remain unresolved, including: treatment of gift cards in bankruptcies, state escheatment laws versus CARD Act expiration restrictions, and money laundering regulations.

"Regulations will vary depending on whether a card is open-loop or closed-loop and depending on the purpose for which the card program is designed. For example, over the past few years, regulations have changed to extend Federal Deposit Insurance and Regulation E protections to payroll cards, but these changes did not extend universally to all prepaid cards. The CARD Act is another example in that it has added a new level of regulation to gift cards but excludes other types of cards," comments Ben Jackson, sr. analyst, Mercator's Prepaid Advisory Service and author of the report. "It is important to note that the CARD Act and other recent changes are by no means the end of the story. Regulations will continue to change and evolve, partially in reaction to the evolution of the industry, and partially in response to the experience that consumers have with the cards."

One of 16 exhibits in this report:

This report contains 40 pages and 16 exhibits.

Disclaimer: Mercator Advisory Group must emphasize that this report is not designed to provide legal advice, and Mercator Advisory Group takes no responsibility for the legal interpretation of the information in this report.

NOTE: As of this writing, Congress was debating the Restoring American Financial Stability Act of 2010. This bill may lead to certain changes that affect the topics discussed in this report. A special report by Mercator advisory Group covering the Durbin Amendment is available for free at mercatoradvisorygroup.com.

Members of Mercator Advisory Group have access to this report as well as upcoming research for the year, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information, please call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

2026 State of the Industry: Commercial Prepaid Cards

The commercial prepaid market continues to provide overall growth, with concern continuing in government verticals. Providers would be well-positioned to focus on business-to-busin...

2026 Prepaid Payments Data Book

The Prepaid Card Data Book creates a baseline to highlight key metrics for the prepaid industry in brief, consolidated updates. This evaluation of the prepaid and stored-value mark...

22nd Annual U.S. Open-Loop Prepaid Card Market Forecast, 2025-2029

Open-loop prepaid programs show resilience and positive growth opportunities across nearly all market verticals. Javelin Strategy & Research continues its annual assessment of open...

Make informed decisions in a digital financial world