Overview

The time is right for unattended commerce.

Unattended commerce is not a new concept; the idea has been around since the 1880s, when the first mechanical vending machine was invented to sell postcards at railway stations. Since that time, convenience vending in the United States alone has grown to a $31 billion industryi, not including automated sales of transportation tickets, cash dispensed at ATMs, and other kiosk-based purchases. Unattended commerce in the 21st century is more than just vending; it strives to combine the speed and convenience of a vending purchase with the product selection and shopping experience that consumers expect at their favorite stores.

A new research report from Mercator Advisory Group, Unattended Commerce: The Store of the Future?, reviews the effects of the pandemic and the continued growth of unattended commerce. This report looks at the key factors that have the potential to accelerate or delay the tipping point for the next phase of retail shopping and payments.

"Customer expectations are on a path of rapid change, as shoppers reward businesses that deliver the best combination of product selection, price, and experience. The constraints around physical commerce and interactions are rebalancing consumers’ value equations, where a positive buying experience is beginning to outweigh product choices and price," stated the author of the report, Don Apgar, Director of the Merchant Services and Acquiring practice at Mercator Advisory Group, and author of this report.

This report is 19 pages long and has 5 exhibits.

Companies mentioned in this report: Albertsons Companies, Inc., Amazon.com, The Carrefour Group, Cerberus Capital Management, Hudson News Distributors, The Kroger Co., McDonald's, Meijer, Inc., Safeway, Walmart, Inc., Whole Foods Market, Zippin

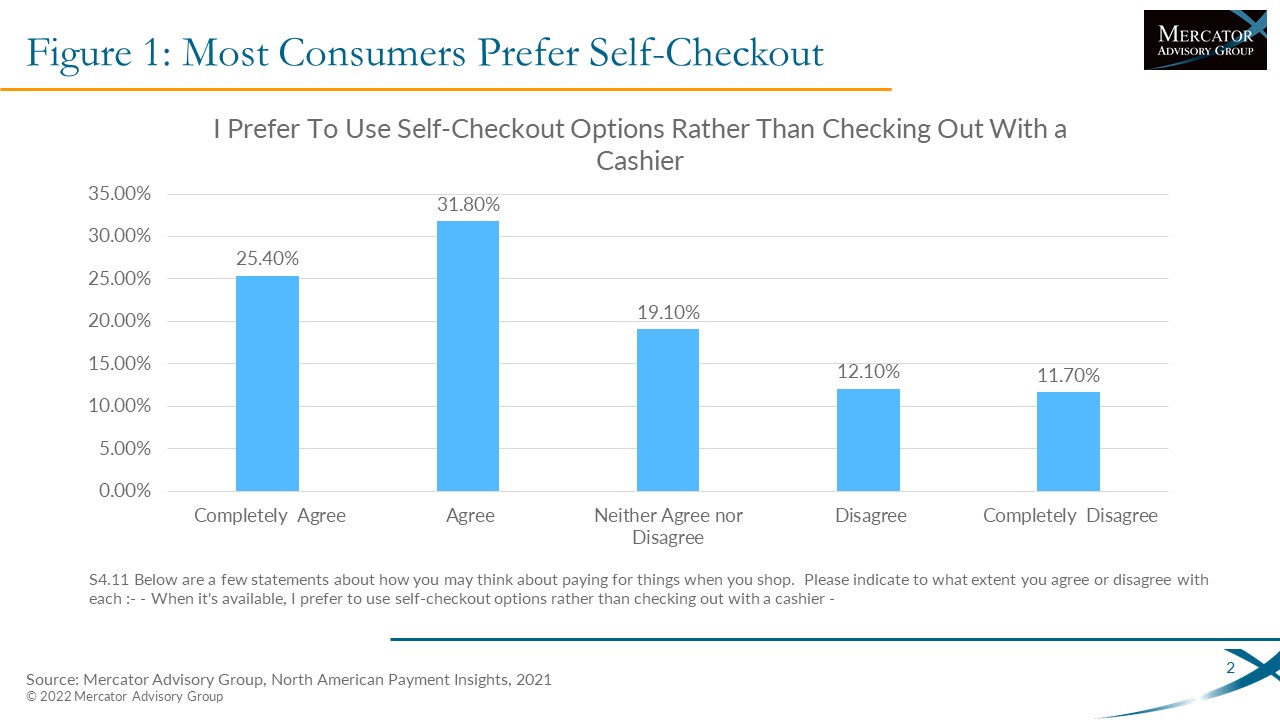

One of the exhibits included in this report:

Unattended Commerce: The Store of

the Future?

Highlights of this research report include:

- Effects of the pandemic

- Continued growth of unattended commerce

- Trends to watch

- Recommendations for merchants

Book a Meeting with the Author

Related content

Vertical SaaS: Best Practices for Monetizing Payments

Electronic payments are increasingly important to businesses of all types and were one of the first value-added features software companies brought to their platforms. Ironically, ...

Agentic Commerce: Green Light or Flashing Yellow for Merchants?

Agentic commerce is forecasted to reach $500 billion in sales by 2030, but what’s driving that growth? Consumers will vote with their wallets on which product categories and sales ...

Merchants Should Planogram Payments

Enterprise merchants have increasingly adopted payment orchestration strategies to drive new payment types, increase payment success rates, and optimize platform performance. Howev...

Make informed decisions in a digital financial world