Overview

October 2008

Text Messaging and Mobilizing Prepaid Financial Services: You Can't Beat Ubiquity

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

Mercator Advisory Group is pleased to announce the release of its latest report, Text Messaging and Mobilizing Prepaid Financial Services: You Can't Beat Ubiquity.

This new report examines the critical role text messaging is playing in the mobile financial services and marketing ecosystem, the willingness of consumers to use SMS and the impact of "superphones" like Apple's iPhone and Android-powered handsets. The report includes a review of the complex ecosystem created to connect prepaid mobile and card accountholders to their provider of specific financial service offerings. The fractured nature of mobile-enable financial services is a function of numerous point solutions brought to market from scores of program issuers.

The report concludes with an appendix containing an overview of the activity and offers from principal providers serving the wireless and prepaid program markets including open and closed loop programs, processors, mobile-enablers of account access, bill payment, remittances, marketing and couponing.

Highlights from this report include:

- SMS is the primary mobile communications method for prepaid and general card information access. Growth in mobile-enabled prepaid cards continues because it is a cost effective channel compared to other communication channels.

- A complex ecosystem has evolved to deliver mobile messaging to consumers.

- There is growing evidence that a rich mobile user interface drives consumer adoption. Over 70% of iPhone owners are using text messaging compared to just over 50% for feature phone owners.

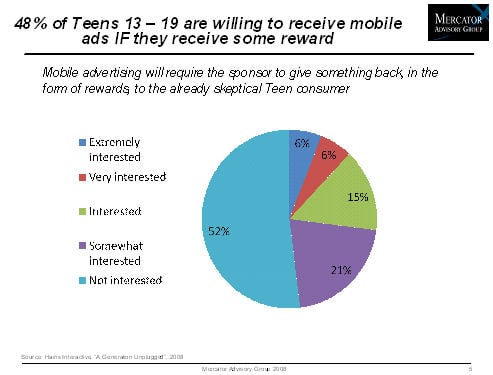

- Consumer receptivity to mobile marketing and advertising, particularly among the young, is growing with over 58% willing to check gift card balances via mobile.

- SMS costs to program managers, content providers and consumers are looming as an issue as Verizon Wireless explores doubling, even quadrupling, the costs FIs and advertisers pay to send alerts, balance inquiries and security messages to consumers.

"The text messaging channel is and will continue to be the principle means of mobile communications between financial service program managers and their accountholders. Nothing on the horizon will replace its utility and ubiquity," comments George Peabody, Director of Mercator Advisory Group's Emerging Technologies Advisory Service. "Given the positive impact of improved user interfaces on SMS traffic, the future should be very bright for text messaging, provided mobile network operators do not kill this golden revenue stream with sharp increases in business to accountholder messaging fees. What's needed is rational, paced pricing."

Companies mentioned in the report include Wausau, PayPal, Cardinal Commerce, FE Mobile, mFoundry, ClairMail, Firethorn, Monitise Americas, Obopay, MoreMagic Solutions, Amazon, Western Union, Trumpet Mobile, Sprint, SK Telecom, Verizon, T-Mobile, AT&T, Leap Wireless' Cricket Communications, MetroPCS, Virgin Mobile, VeriSign, and Sybase Mobile 365.

One of the 7 Figures included in this report:

The report is 29 pages long and contains 7 exhibits and 1 table.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at http://www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

2025 Emerging Biometric Authentication at the Point of Sale Scorecard

This inaugural Javelin Strategy & Research scorecard assesses the emerging market for biometric authentication at the point of sale and identifies three Pillars in this emerging te...

Make informed decisions in a digital financial world