Overview

Boston, MA

December 2007

Super Premium Cards: Enhanced Products Try to Lock in Relationships

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

This report examines the recent emerging segment of super-premium credit cards in the U.S. These cards are defined by Mercator Advisory Group as having the following characteristics:

- Annual account spending of $50,000 or more

- A significant accountholder relationship with the issuer or co-brand partner in terms of spending or assets

- An exceptional level of rewards and service benefits to the cardholder

- Prestige positioning of the product/account

- High likelihood of a significant annual fee

Super-premium cards are just beginning a new push into the top U.S. affluent segments, and present an opportunity to attract highly desirable customers, or just as importantly, to retain their business. With the new bank card-enabled products of the World Elite MasterCard and Visa Signature Preferred, there may be opportunities to upgrade existing card programs or accounts, as well as the emergence of a new and exclusive version of co-branding through existing financial, retail, and service relationships. These relationships provide the basis for identifying and qualifying prospects, as well as providing a "stickier" relationship than a card alone might provide.

Highlights of the report include:

- The target market for super-premium cards is a mix of overlapping asset, rich, high income, and high spending households.

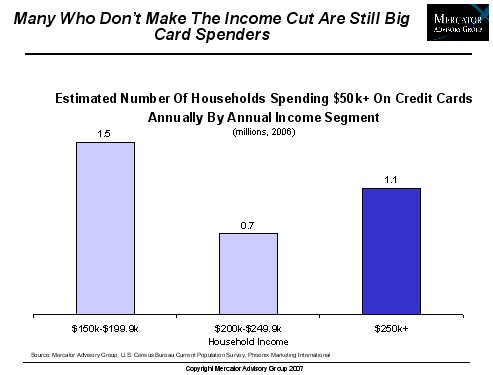

- Of the estimated 3.3MM households spending $50,000 or more on credit cards annually, just 1.8MM have incomes over $200,000, indicating the importance of near-premium cards for mass affluent high spenders.

- The introduction of World Elite MasterCard and Visa Signature Preferred products has created a new platform for issuers to compete in the super-premium segment along with American Express Platinum and Centurion.

- Recently introduced programs concentrate on financial institutions' relationship programs, high-end co-branding partners, and private jet partner programs.

- Estimated penetration of super-premium products in the target segment households is currently low, suggesting new issuing and upgrading opportunities for issuers with an appetite to pursue these narrow segments.

Ken Paterson, Director of the Credit Advisory Service at Mercator Advisory Group and the author of this report comments that, "That the historical record of bank card issuers in maintaining exclusivity is somewhat checkered, as Gold and Platinum products became commoditized, no-fee offerings in pursuit of broader marketing goals. The current generation of super-premium bank cards offers hope that their targeting guidelines will establish and then maintain their exclusivity, which will be critical in competing against American Express' entrenched and successfully maintained presence in the super premium segments."

One of the 16 Exhibits included in this report:

The report is 30 pages long and contains 16 exhibits

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

2026 Credit Card Risk: Happy Days are Here Again (For Top Issuers)

The year bodes well as 2026 approaches the end of the first quarter. Economic indicators are strong, the credit card market is growing at a healthy rate, and credit cards rem...

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Make informed decisions in a digital financial world