Overview

Boston, MA

October 2004

The State of the US Commercial Credit Card Market

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

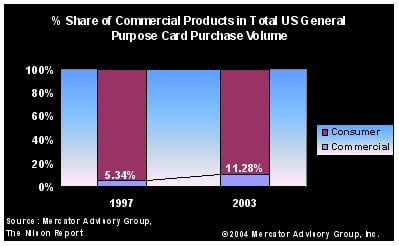

As the growth in consumer credit card volume has slowed, commercial cards have been a major driver of growth for the U.S. card market. The commercial card purchase volume showed double digit growth rates over the last decade and reached $264 billion by the end of 2003. The share of commercial cards within the Visa and MasterCard total general-purpose card volume also increased continuously during this time.

Despite the remarkable growth and the intense competition, the market potential is still far from being tapped. According to Visa's new Commercial Consumption Expenditure (CCE) index, the US commercial spending will reach $14.3 trillion this year; almost twice the size estimated by its Personal Consumption Expenditure (PCE) index, which forecasts $8.2 trillion for 2004. However, commercial cards are not often used as a primary payment method and only account for a small sahre of total commercial spending. There are major barriers to increasing use of electronic payments, such as data integration challenges, and checks continue to be the dominant payment method in the B2B environment.

Evren Bayri, Director of Mercator Advisory Group's Credit Advisory Service comments, "in order to increase the share of commecial cards within B2B payments, issuers should recognize the complex needs of organizations. Barriers to increasing the use of commercial cards can be removed by delivering data-rich/process aware solutions such as the American Express Variance Report, Bank of America Payment Manager and MasterCard e-P3 (tm)."

This report provides a review of the US commercial card market, its segments, and key business requirements of medium to large corporations. The report contains 21 pages and 14 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 508-845-5400 or send email to [email protected].

Book a Meeting with the Author

Related content

2026 Credit Card Risk: Happy Days are Here Again (For Top Issuers)

The year bodes well as 2026 approaches the end of the first quarter. Economic indicators are strong, the credit card market is growing at a healthy rate, and credit cards rem...

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Make informed decisions in a digital financial world