Overview

The State of EMV Adoption: A Global Update

New Research Examines the Worldwide Progress of EMV Technology, Migration, and Acceptance

Boston, MA -- Payment networks decided long ago that EMV was the most effective security standard for reducing fraud. The most progressive countries achieved universal EMV compliance as early as 2007. While numerous countries have since embraced the initiative, many have come up short of upgrading all of their cards and terminals.

Mercator's latest report, The State of EMV Adoption: A Global Update, provides a global update for EMV migration, examines the markets that have room to grow, and identifies the catalysts that may increase demand in the coming years.

Highlights of the report include:

Contact and contactless EMV market overviews for several geographic regions

Country-specific profiles for key EMV markets in Asia-Pacific, Europe, and Latin America

An analysis of global growth trends in EMV cards, POS terminals, and ATMs

A projected timeline for EMV migration at the point of sale in the United States

Michael Misasi, research analyst at Mercator Advisory Group and the author of the report comments: "China is the latest major market to commit to a national EMV migration. The government's support of the initiative will likely ensure a timely and complete migration that will significantly increase the global market for EMV cards and terminals. Visa's U.S. liability shift may have a similar impact in the world's other EMV holdout, but given the country's strong mag-stripe preference, it remains to be seen how swiftly merchants and issuers will respond without a government mandate or a comparable stance from MasterCard."

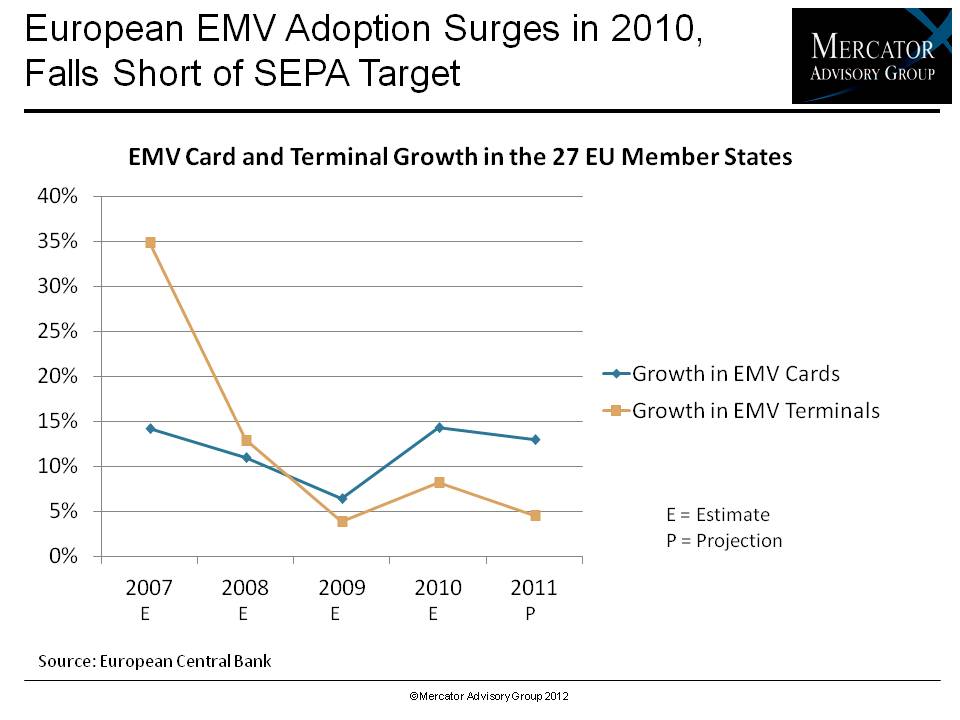

One of the eight exhibits included in this report:

The report is 31 pages long and contains eight exhibits.

Companies mentioned in this report include: Visa, MasterCard, MagTek Inc, Citibank India, ICICI Bank, M-Pesa, China Mobile, China Unicom, China UnionPay, and China Telecom, NTT DoCoMo, Sony Corp., KT Corp., Touch N' Go, Maxis, Nokia, Malayan Banking, StarHub, EZ-Link, DBS Bank, Gemalto, Belgacom, Mobistar, Base, Orlen Germany, T-Mobile, Era, Deutsche Telekom, Telefonica Spain, La Caixa, O2, PKO Bank Polski SA, Orange UK, JPMorganChase, U.S. Bank, Wells Fargo, Citibank.

Members of Mercator Advisory Group's Emerging and International Advisory Services have access to this report as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send email to [email protected].

For free industry news, opinions, research, company information, and more visit us at www.PaymentsJournal.com.

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors. Mercator Advisory Group is also the publisher of the online payments and banking news and information portal PaymentsJournal.com.

Book a Meeting with the Author

Related content

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

2025 Emerging Biometric Authentication at the Point of Sale Scorecard

This inaugural Javelin Strategy & Research scorecard assesses the emerging market for biometric authentication at the point of sale and identifies three Pillars in this emerging te...

Make informed decisions in a digital financial world