State of the Commercial Card Market, 2015

- Date:October 14, 2015

- Author(s):

- Richard Hall

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

The U.S. commercial credit card market continues to demonstrate positive growth despite recent corporate economic challenges and increased levels of investment in corporate payable solutions. While led by increases in purchasing card (P-card) volumes, the recent positive economic signs have also led to higher spend on travel and entertainment (T&E) cards as well.

Mercator Advisory Group's report, State of the Commercial Card Market, 2015, looks at the current market for commercial credit products and the near-term and long-term challenges and opportunities faced by networks, issuers, and corporates.

"The underlying elements of the U.S. commercial card market remain strong as a key component of corporate payable strategies,” comments Richard A. Hall, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service and author of the report. “Despite the challenges to make significant impacts to often large and complex programs, the environment remains positive for stakeholders in the commercial card arena. At the same time, these stakeholders must take a serious look at not just their product offerings but create new forms of value to take advantage of this opportunity.”

The report is 19 pages long and contains 8 exhibits.

Companies mentioned in this report include American Express, Bank of America Merrill Lynch, Citibank, JP Morgan Chase, MasterCard, U.S. Bank, and Visa.

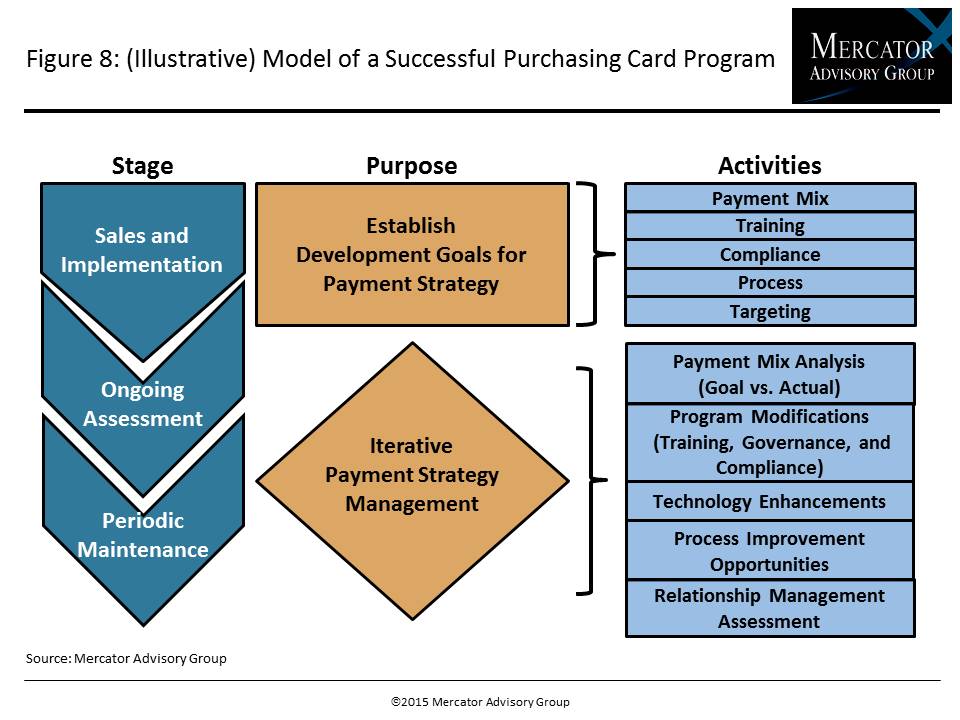

One of the exhibits included in this report:

Highlights of the report include:

- Review of current purchasing card and travel and entertainment card volumes including virtual solutions

- Network performance and key drivers to extended growth

- Performance of top commercial card issuers including growth estimates

- Key elements to successful commercial card programs to sustain growth

- The importance of commercial cards in broader corporate payables strategies

Book a Meeting with the Author

Related content

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

2026 Commercial & Enterprise Trends

Commercial payment providers are strategically reimagining their infrastructure, pricing, sales, and risk management strategies. This strategic flexibility ensures they purpose-fit...

Make informed decisions in a digital financial world