Overview

Small businesses suffer from a lack of expertise, financial services, and capital, leading to a failure rate of close to 50% within five years of start-up, according to the U.S. Small Business Administration. However, the market has been difficult for merchant acquirers to serve, due to price sensitivity, high risk, and a high cost of sales. A new research report from Mercator Advisory Group, Square and Clover Delivering Merchant Services Beyond Payment Acceptance examines the success of Square and Clover as examples of a new approach to serving small businesses using marketplaces that provide choice and flexibility while using commodity hardware.

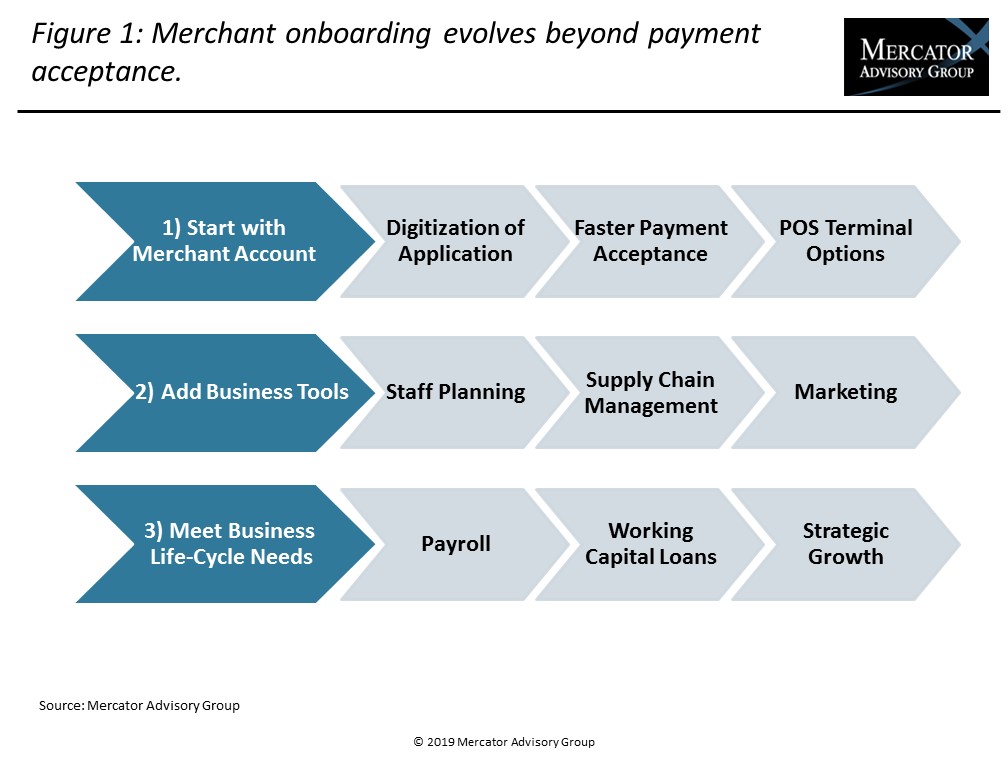

“Instant onboarding is the sizzle, not the steak. While digitized and fast merchant onboarding looks great, small businesses need to understand the fee schedule and the complete range of solutions and apps that directly apply to their specific operational needs and future growth,” commented Raymond Pucci, Director, Merchant Services, at Mercator Advisory Group, and author of this report.

This report is 16 pages long and has 5 exhibits.

Companies mentioned in this report: Android, Apple, Apptizer, Bank of America Merchant Services, Celtic Bank of Utah, Clover, DoorDash, First Data, Fiserv, Intuit, PayPal, Poynt, Sam’s Club, Square, and Walmart.

One of the exhibits included in this report:

Highlights of this research report include:

- How Square pioneered an affordable, rapid acceptance service that appealed to a previously underserved market

- How First Data (now Fiserv) acquired Clover to create a competitor to Square with the reach and financial capabilities of the #1 merchant acquirer

- The introduction of the web-connected mobile point-of-sale market, combining a range of hardware solutions with a marketplace or app store approach, integrating a wide variety of apps

- How marketplaces add to profitability by creating sources of revenue beyond commodity transaction fees

- The restaurant sector as a key opportunity for web-enabled point-of-sale terminals

Book a Meeting with the Author

Related content

Vertical SaaS: Best Practices for Monetizing Payments

Electronic payments are increasingly important to businesses of all types and were one of the first value-added features software companies brought to their platforms. Ironically, ...

Agentic Commerce: Green Light or Flashing Yellow for Merchants?

Agentic commerce is forecasted to reach $500 billion in sales by 2030, but what’s driving that growth? Consumers will vote with their wallets on which product categories and sales ...

Merchants Should Planogram Payments

Enterprise merchants have increasingly adopted payment orchestration strategies to drive new payment types, increase payment success rates, and optimize platform performance. Howev...

Make informed decisions in a digital financial world