Overview

Disruptive new technology or business models in the payments industry is not a new theme. The latest disruption comes from alternative, nontraditional players—namely social media and mobile messaging application providers seeking to enter the payments market by offering payment services valued by customers. Historically, new players have started by offering “basic” payment services like person-to-person (P2P) money transfers, but these market entrants have developed payment services that provide consumers a more comprehensive solution.

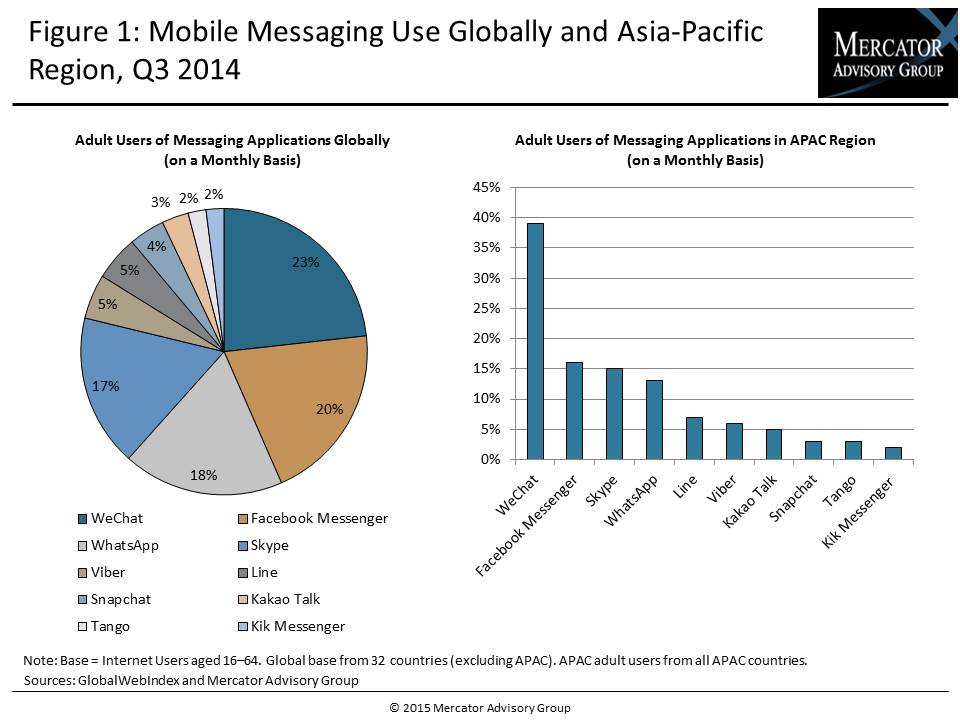

Mercator Advisory Group’s research note, Social Media and Mobile Messaging Providers’ Payment Apps: More Than Just P2P, examines the popularity and potential opportunity for social media and messaging companies looking to provide payment services globally. The more robust solutions come from the Asia-Pacific region, in particular from Japan, South Korea, and China. This research note looks at their popularity and opportunities in the region more specifically. The note also describes different solutions available today and their implications for the banking and payments industry.

“With consumers notoriously fickle about social media and mobile messaging services, traditional payment service providers might be quick to underestimate the potential impact these players might have in the payments industry. Even though some of these new providers may fail to generate the momentum to become serious players in the payments market, traditional payment service providers should not become complacent and ignore the potential of these new players. In fact, traditional providers should take this opportunity to seriously consider how to work with these players rather than attempt to compete or defend against their rise. In the current digital environment, social media and mobile messaging services play a critical role in consumers’ lives, as they will likely continue to do in the future. Thus, understanding how to work with and utilize their services is very important for traditional payment service providers to be successful over the long run,” comments Tristan Hugo-Webb, Associate Director of the Global Payments Advisory Service and the author of the note.

This research note contains 11 pages and 4 exhibits.

Companies mentioned in this research note include: Tencent (WeChat), Alibaba, Line, Kakao, Snapchat, Twitter, Facebook, Google, Apple, PayPal, Square, Amazon, Groupe BPCE, and Royal Bank of Canada.

Members of Mercator Advisory Group’s Global Payments Advisory Service have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

One of the exhibits included in this report:

Highlights of this research note include:

- Statistics that highlight the popularity, user base, and payment capabilities of leading social media and mobile messaging application providers

- Examination of select payment solutions in the marketplace that are either directly operated by social media and mobile messaging application providers or the result of their cooperation with traditional payment service providers

- Commentary on the prospects and possible hurdles to broad deployment of payment services provided by social media and mobile messaging application providers.

Book a Meeting with the Author

Related content

Payment Hubs Stand at a Crossroads

Payment hubs promised to simplify payments, but many never lived up to that vision. As real-time payments, open banking, and platform modernization reshape the landscape, banks are...

Stablecoins vs. Tokenized Deposits

Stablecoins and tokenized deposits are redefining how banks participate in digital money. Much of the current discussion centers on which of these instruments banks should emphasiz...

Real-Time Payments: Use Cases in Acquiring

The real time payments made possible through The Clearing House’s RTP and the Fed’s FedNow payment rails are making headlines, with promises of efficiency and lightning fast paymen...

Make informed decisions in a digital financial world