Overview

Social Commerce is Changing the Way Consumers Shop

Social media started as a place for people to connect, while search engines were the way consumers shopped for what they wanted. With social commerce, social media sites are becoming more like shopping malls where consumers can both socialize and shop.

Social commerce is the buying and selling of goods or services directly within a social media platform. It changes social media’s role by allowing consumers to complete the entire purchase process without leaving their preferred social media apps.

This research report looks at social commerce, some of the current features and platforms, and where social commerce may be headed in the future.

"Social commerce is completely changing the way consumers shop, with new ways for them to participate as creators, influencers, buyers, and sellers. Features such as the “buy now” button and autofill of payment credentials help make the purchase process easier and faster. Social aspects include chatting with brand experts, discovering new products through influencers, sharing recommendations, participating in live events, and getting feedback from friends with the wisdom of the crowd," stated the author of the report, Don Apgar, Director of the Merchant Services and Acquiring practice at Mercator Advisory Group.

This report is 24 pages long and has 10 exhibits.

Companies mentioned in this report: Meta, TikTok, Pinterest, Twitter, Shopify, Medium, LinkedIn, Facebook, Amazon, Loomly, WeChat, Alipay, Kakao, Venmo, Walmart, Google, PayPal, Publicis Groupe, Pink Tag Boutique, Instagram, Square, Ecwid, PrestaShop, Wix, SHOPLINE, OpenCart, BASE, Bobochic, Decentraland, Savollo.

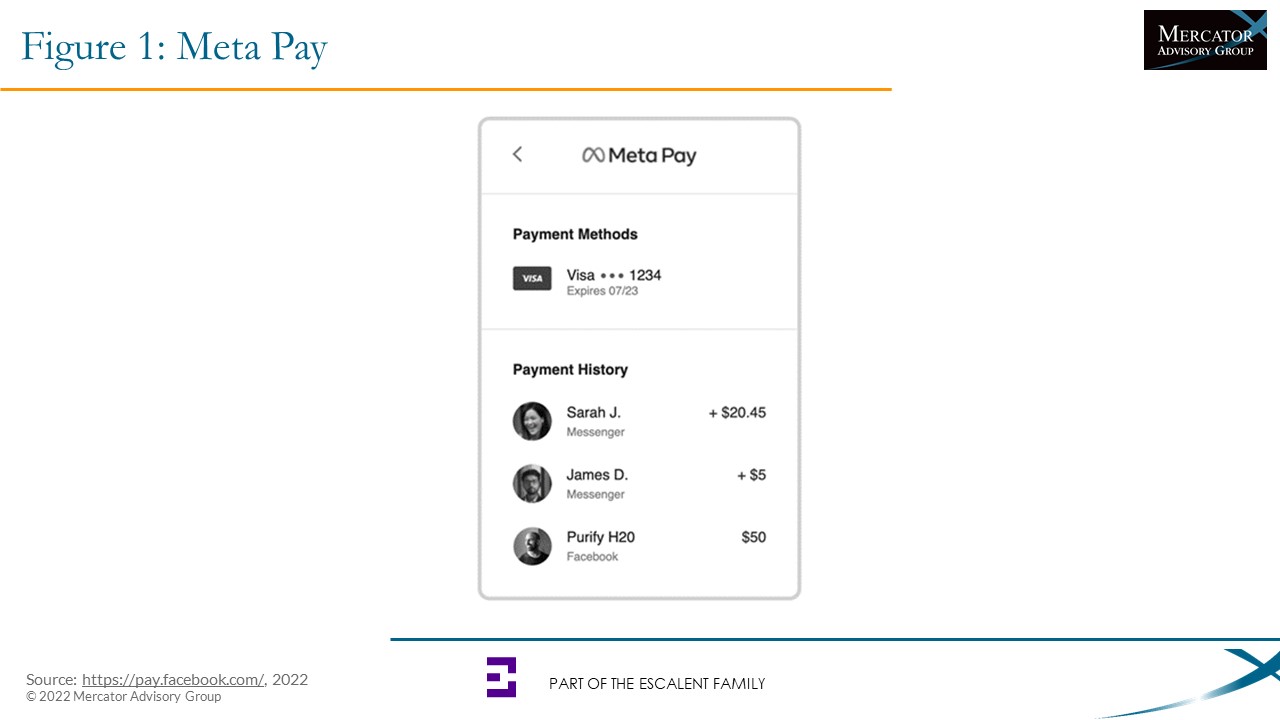

One of the exhibits included in this report:

Highlights of this research report include:

- Social Commerce and Payments

- Related Companies/Features

- Social Media Platforms

- Livestreaming

- The Future

- Recommendations

Book a Meeting with the Author

Related content

Agentic Commerce: Green Light or Flashing Yellow for Merchants?

Agentic commerce is forecasted to reach $500 billion in sales by 2030, but what’s driving that growth? Consumers will vote with their wallets on which product categories and sales ...

Merchants Should Planogram Payments

Enterprise merchants have increasingly adopted payment orchestration strategies to drive new payment types, increase payment success rates, and optimize platform performance. Howev...

2026 Merchant Payments Trends

As payment technology advances and offers greater options and flexibility for consumers, merchants are put in the position of prioritizing how to manage payment acceptance, what pl...

Make informed decisions in a digital financial world