Small Business Credit Cards: The Key to Richer Customer Relationships

- Date:November 05, 2015

- Author(s):

- Alex Johnson

- Research Topic(s):

- Commercial & Enterprise

- Credit

- PAID CONTENT

Overview

In the wake of the recession, U.S. small business owners consistently report that they have little need for or interest in credit, and yet surveys consistently reveal that small business owners are frustrated with their inability to get credit quickly. Credit card issuers continue to see only modest growth in their small business credit card programs, and yet billions of dollars are being funneled into alternative lending platforms specifically focused on serving small businesses. The U.S. small business credit card space appears to be both a sluggish product vertical and a critically underserved market representing opportunity at the same time.

Mercator Advisory Group’s research report, Small Business Credit Cards: The Key to Richer Customer Relationships untangles the seemingly contradictory state of the U.S. small business credit card market and provides a set of strategic recommendations for market participants moving forward.

“The paradoxical nature of the current small business lending environment demonstrates the need for issuers to significantly realign their card products with the needs and preferences of small business owners,” comments Alex Johnson, Senior Analyst at Mercator Advisory Group and the author of the report.

This research report contains 31 pages and 15 exhibits.

Companies mentioned in this report include: Ace Hardware, Amazon.com, American Airlines, American Express, Alaska Airlines, Asiana Airlines, Bank of America, BCSG, Capital One, Carlson Hospitality, Chase, Citi, Constant Contact, Costco, Credit Karma, Delta, Discover, Facebook, Fundbox, Google, Kabbage, Korean Air, Legal Document Builder, Lending Club, LexisNexis Risk Solutions, Lowes, LSQ Funding, Marriott, MasterCard, Mono.net, Mozypro, NerdWallet, OnDeck Capital, PayPal, Prosper, Sage One, Simplify Commerce, SiteWit, Southwest Airlines, Spirit Airlines, Square, Starwood Hotels, Stripe, United Airlines, U.S. Bank, Visa, Wells Fargo, Xero, Xpenditure, and Zendesk.

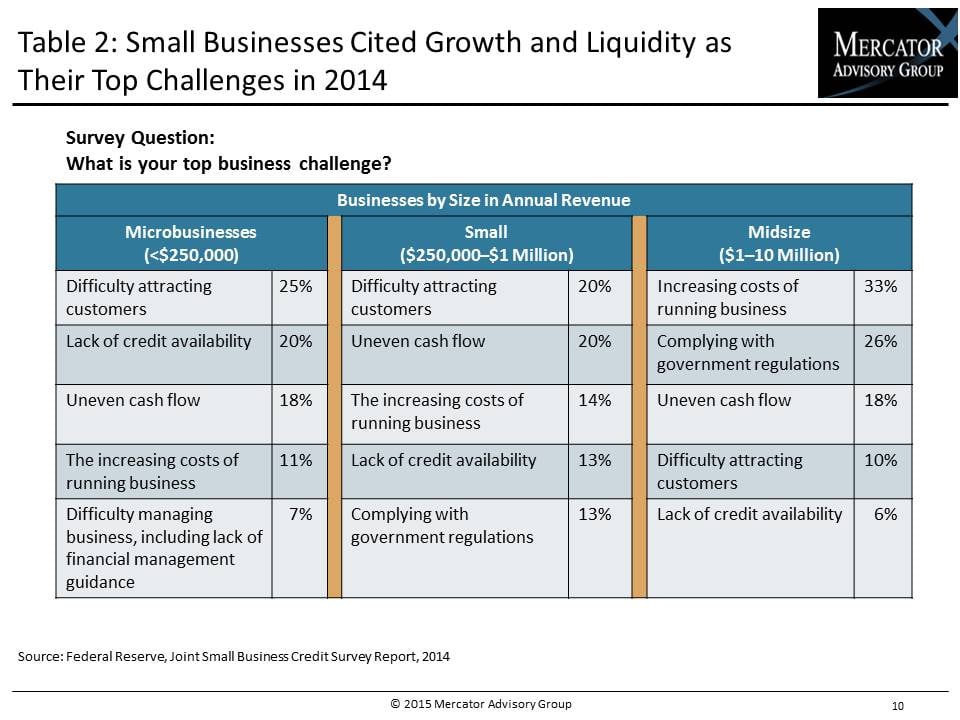

One of the exhibits included in this report:

Highlights of this research report include:

- An overview of the current state of U.S. small businesses and their payment preferences

- A review of the current small business product offerings from the largest U.S. credit card issuers and payment networks

- Estimates and projections on the size and growth trajectories of small business credit card accounts, outstandings, and payment volumes

- Analysis of small business owners' financial services needs and the alignment of those needs with traditional and alternative products

- An exploration of the emerging alternatives in small business lending

- Strategic recommendations for small business credit card issuers

Book a Meeting with the Author

Related content

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

2026 Commercial & Enterprise Trends

Commercial payment providers are strategically reimagining their infrastructure, pricing, sales, and risk management strategies. This strategic flexibility ensures they purpose-fit...

Make informed decisions in a digital financial world