Overview

Boston, MA

July 2007

Sizing Canada's Growing Card Market

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

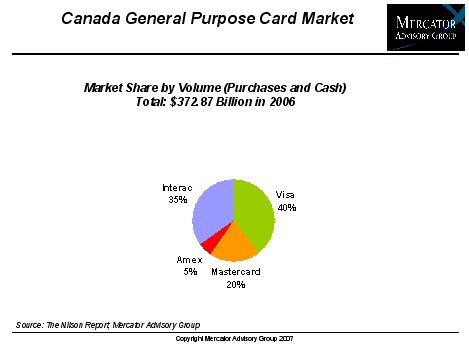

Bordering the world's largest general purpose card market, the Canadian card industry is increasingly vibrant and diverse. Since their introduction, credit and debit cards have become the preferred methods of payment for many Canadian consumers. Canadians are amongst the most frequent general purpose card users in the world. There were more than 101 million cards in circulation across the country in 2006. Canada's card market continues to grow, with consumers and merchants seeking new payment products that offer more efficient and secure ways to make transactions, encompassing new technologies and service features.

The report is 24 pages long and contains 13 exhibits

"Canadian consumers are highly educated and technologically savvy. They love using their debit and credit cards, and are constantly seeking new and innovative ways to meet their various payment needs, faster and more conveniently," notes Elisa Athonvarangkul, Analyst, International Advisory Service. "As a result, the card market in Canada is poised to enjoy continued growth, and will undoubtedly offer an even greater variety of payment products and services to its customers."

The most recent report from Mercator's International Advisory Service provides an update of Canada's general-purpose card market. The report presents an overview of the current state of the Canadian payment card market, an analysis of recent market trends and metrics, a discussion of EMV compliance, and a review of contactless payment and new products and reward programs.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

Payment Hubs Stand at a Crossroads

Payment hubs promised to simplify payments, but many never lived up to that vision. As real-time payments, open banking, and platform modernization reshape the landscape, banks are...

Stablecoins vs. Tokenized Deposits

Stablecoins and tokenized deposits are redefining how banks participate in digital money. Much of the current discussion centers on which of these instruments banks should emphasiz...

Real-Time Payments: Use Cases in Acquiring

The real time payments made possible through The Clearing House’s RTP and the Fed’s FedNow payment rails are making headlines, with promises of efficiency and lightning fast paymen...

Make informed decisions in a digital financial world