Shopping Behavior, Channel Usage, and Loyalty: How Behavior Aligns with Experience

- Date:August 06, 2018

- Author(s):

- Ken Paterson

- Research Topic(s):

- Buyer PaymentsInsights

- PAID CONTENT

Overview

Mercator Advisory Group’s latest Primary Data report, Shopping Behavior, Channel Usage, and Loyalty: How Behavior Aligns with Experience, is based on the company’s new consumer survey, the Customer Merchant Experience Survey. The online survey of 3,002 U.S. adult consumers, which was conducted in February 2018, explores consumers’ merchant experiences as they shop in-store, online, and via mixed channels. The survey was designed with the goal of defining and highlighting consumer expectations for optimal experiences with merchants.

This third report on the survey’s findings builds on the overall experiential analysis of the first and payments experience analysis of the second, and looks more specifically at the emerging behavior patterns of customers as they shop in-store, online, via mobile, and using mixed channels such as remote order and pick-up.

Ken Paterson, VP, Special Projects, Mercator Advisory Group, the author of this report comments, ”While traditional stores remain the most used purchase channel, and e-/m-commerce purchases grow proportionately faster, customers’ behavior is quickly evolving. Conversational commerce and remote order and pick-up are joining now well-established mobile behaviors such as online research and showrooming. It’s an environment spanning traditional and hybrid shopping behaviors.”

This report is has 56 pages (in slide format) with 26 exhibits.

Companies mentioned are: Amazon, BJ’s, Chipotle, Costco, Kohl’s, Lego, Macy’s, McDonald’s, Nordstrom, Office Depot, Panera Bread, Petco, Sephora, Starbucks, Target, Uber, Walgreen’s, and Walmart.

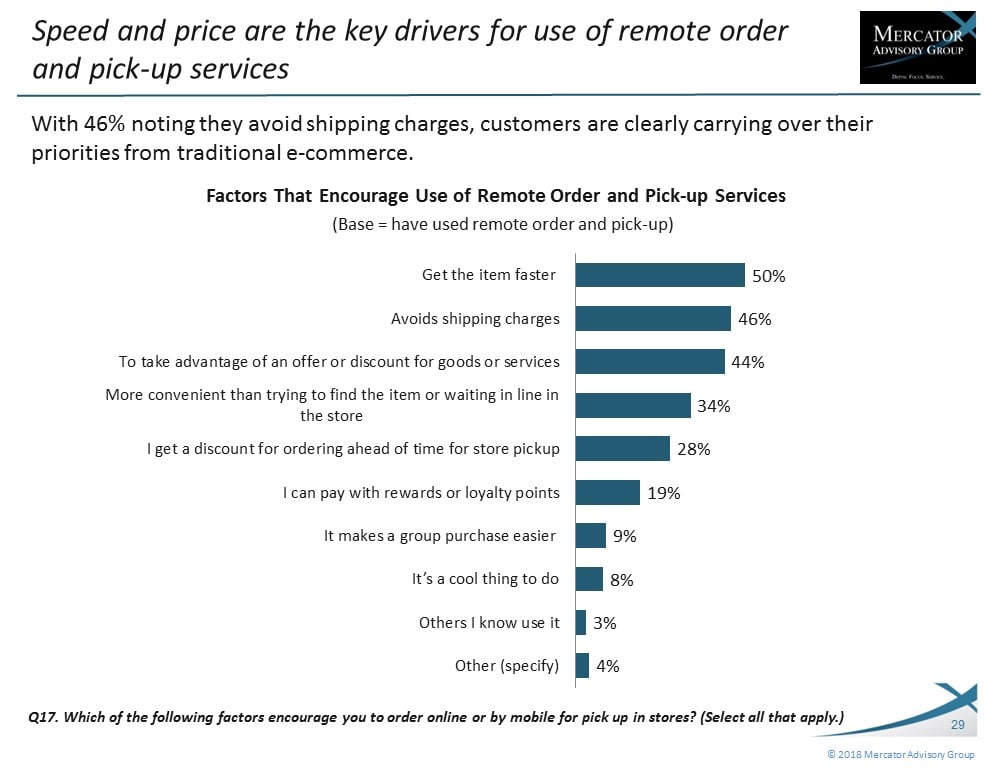

One of the exhibits included in this report:

Among the findings highlighted in this survey report:

- Customers perceive their own shopping practices are changing; nearly half say they do more research before purchase.

- Remote order and pick-up, a hybrid online/mobile and store channel, has already reached half of adults.

- Customers’ loyalty program participation across the 21 merchant verticals and their self-reported incremental spending and store visits attributable to those programs are surprisingly modest.

- A comparative analysis of programs to drive incremental spending found great similarity of results across four program user groups.

Topics explored in this report include:

- Shopping Behavior, Both Dynamic and Traditional

- Proliferation and Blending of Shopping Channels

- Merchant Verticals’ Loyalty Programs: Incidence and Effectiveness

- Behavioral Alignment with Mercator Shopper Segments

Book a Meeting with the Author

Related content

Swipe, Shop, Sell: The New Era of Social Commerce

Social media began with the notion of building community and relationships, but it has also become a significant outlet for e-commerce. This type of shopping is led by Meta product...

2025 Buyer PaymentsInsights: U.S. Exhibit

This report is based on Javelin Strategy’s Buyer PaymentsInsights series’ annual survey. A web-based survey was fielded between September 11-29, 2025, using a U.S. online consumer ...

Loyalty Programs: Year-Over-Year Insights, 2024-2025

Loyalty programs, an essential tool for customer acquisition for merchants of all types, are ubiquitous in the marketplace. This Javelin Strategy & Research note examines the growt...

Make informed decisions in a digital financial world