Seizing the Opportunity of a U.S. Real-Time Network

- Date:October 23, 2015

- Author(s):

- Sarah Grotta

- Research Topic(s):

- Commercial & Enterprise

- Debit

- PAID CONTENT

Overview

“The U.S. has really just begun to think seriously about how a real-time payments platform would take shape. There are many challenging questions to consider regarding cost, leadership, ongoing management, and if a business case for faster payments really exists for its stakeholders,” comments Sarah Grotta, Director, Debit Advisory Service at Mercator Advisory Group and co-author of the research note.

This research note has 12 pages and 3 exhibits.

Organizations mentioned in this research note include: ACI Worldwide, FIS, Paym, SWIFT, VocaLink, and YouGov.

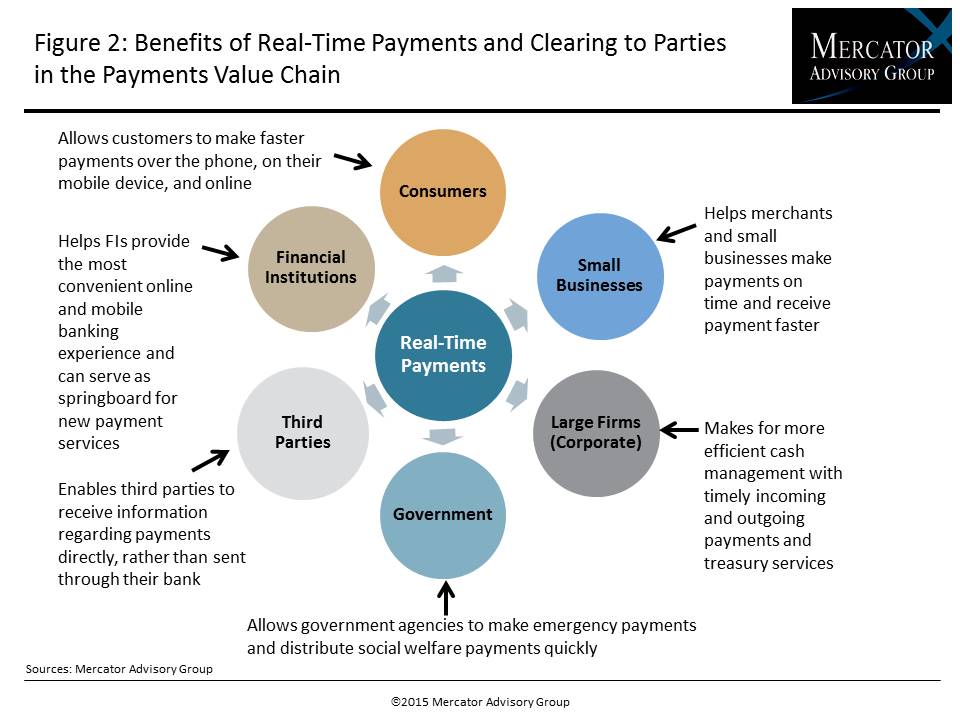

One of the exhibits included in this report:

Highlights of this research note include:

- The critical components of a real-time payment network

- Use cases

- Review of real-time payment solution around the world

- Hurdles the United States faces in the planning for a national solution

Book a Meeting with the Author

Related content

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

2026 Commercial & Enterprise Trends

Commercial payment providers are strategically reimagining their infrastructure, pricing, sales, and risk management strategies. This strategic flexibility ensures they purpose-fit...

Make informed decisions in a digital financial world