Risk Management in the Corporate Credit Card Market: A Problem Waiting To Be Solved?

- Date:November 25, 2008

- Author(s):

- Mercator Research

- Research Topic(s):

- Commercial & Enterprise

- Credit

- PAID CONTENT

Overview

Boston, MA

November 2008

Risk Management in the Corporate Credit Card Market: A Problem Waiting To Be Solved?

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

Consumer credit cards were created from the simple idea of "buy now, pay later" and from their humble beginnings in the 1950's to their lofty status in the payment universe today, that basic value proposition has not changed for any stakeholder. In much the same way, business credit cards were created from the simple idea of providing organizations with a convenient, generally accepted method of paying for and tracking company expenses. Since the first commercial credit cards were issued until today, these products have been refined to appeal to specific corporate market segments, including small business (<100 employees), middle-market commercial (100-500 employees), and corporate commercial (>500 employees). Different products, certainly, yet also not so different, in that any credit card account is still a loan. Regardless of the use, a lender is underwriting the purchases made on any credit card and in so doing, accepts a certain level of risk that their money may not be paid back.

Ken Paterson, Director of Mercator Advisory Group's Credit Advisory Service and principal analyst on the report, comments, "From a top line perspective, corporations are offered incentives by issuers through rebate programs based on a combination of factors including a company's travel volume, spend per card, payment terms, average transaction size, and credit losses."

In the consumer card market, risk is basically a straight through relationship between the issuer and the cardholder. The small business market operates in a similar manner; even though initially the company may be held responsible, these accounts are almost always guaranteed by the owner. The commercial card market however, has some very fundamental differences from a risk perspective.

Highlights from this report include:

- The success and utility of commercial credit cards is counterbalanced by unique risk management challenges for issuers.

- Credit exposure, limit utilization, access to credit, and risk transparency are particular issues among corporate issuers.

- Most generally available solutions are adaptations of consumer and small business risk management tools, and do not fully address the needs of commercial card and commercial relationship risk management.

- Issuers have a particular gap or blind spot in creating a comprehensive view of exposure to a corporation, encompassing both commercial loan and card relationships.

- Solutions providers are just beginning to develop segment specific scoring models and analytics to properly manage the corporate card segment in the context of the broader corporate lending relationships.

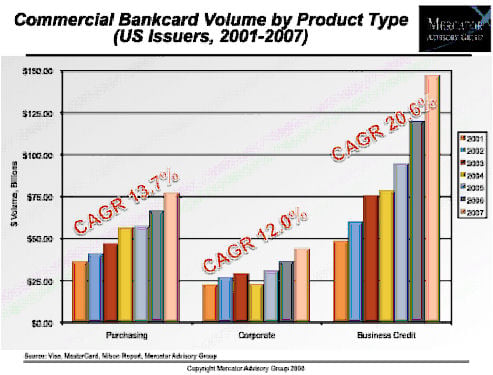

One of the 9 Figures included in this report

This report contains 33 pages and 9 exhibits.

Book a Meeting with the Author

Related content

One Year On: Tariff Impacts on U.S. Imports and What They Mean for Treasury and Payments

The 2025 tariff regime triggered sharp, policy driven shifts in U.S. import patterns, with tariffs reliably pushing trade away from high duty lanes and toward lower duty or exempte...

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

Make informed decisions in a digital financial world