Overview

Boston, MA

September 2008

Re-examining Debit Rewards at the Top Fifty Banks

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

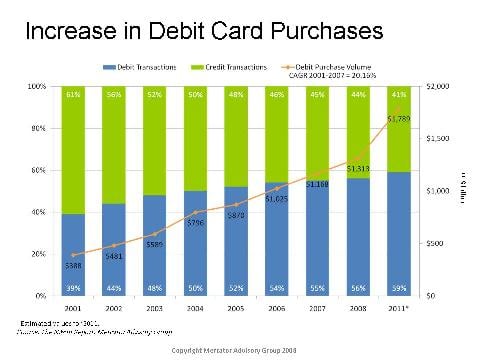

Financial institutions are expanding and diversifying debit reward program offerings as more consumers are using debit cards to pay for their everyday purchases than ever before. Forty of the Top Fifty banks currently have at least one reward program in place, and nearly half of these financial institutions offer multiple loyalty programs to debit cardholders. Most debit loyalty programs at top fifty banks only reward signature-based transactions, while a select few reward both signature and PIN based transactions. Most of the reward programs are funded by interchange revenue, which is substantially greater for signature than PIN debit transactions, but significantly less than credit card transactions. As such, most debit reward programs are less lucrative than their credit card counterparts. While traditional airlines, points-based and cash back programs are still common, a number of financial institutions are offering philanthropic rewards whereby cardholders can choose to donate their reward earnings to a cause of their choice. Such programs enable customers to give more painlessly, and allow financial institutions to benefit from tax deductions. Rewards that promote savings and cash back are the most popular, especially since many consumers are facing financial challenges given current unfavorable economic conditions. Banks are increasingly promoting business across product areas and rewarding customers for using multiple services at the same bank. For example, financial institutions are allowing their customers to earn reward points faster from multiple types of accounts with the same back, and redeem them for additional deposit or a reduction in fees.

Given the significant rise in debit card usage, there is certainly opportunity for continued growth in debit reward programs, however, the overall effectiveness of these programs in fostering customer loyalty is less clear. "It is questionable how much weight customers put on a debit reward program when choosing a new checking account, since they are often viewed as a feature of the account. Although banks aim to differentiate themselves from their competitors with perks such as reward programs, they become less distinguishing when most financial institutions offer them," notes Elisa Athonvarangkul, Analyst, International Advisory Service. "Banks should continue to develop more innovative reward programs to attract loyal customers and set programs apart from their competitors. Sometimes, the most attractive reward is not necessarily redeemable by points or cash back, but rather an efficient and pleasant customer service experience. A customer that feels valued and well treated is more likely to be a loyal customer over the long haul."

Sample Exhibit

The report contains 30 pages and 8 exhibits

The most recent report from Mercator's International Advisory Service provides an overview of developments in debit reward programs at the Top Fifty Banks in 2007 and 2008. The report also presents a review and analysis of recent trends and innovations in debit reward programs at these institutions.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

State of Debit 2026

Despite headwinds that include significant financial strain on consumers despite a broadly stable economy, debit remains resilient—especially among younger consumers and lower inco...

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Make informed decisions in a digital financial world