Overview

Boston, MA – May 14, 2014 – The way consumers interact with their primary financial institutions (FIs) is rapidly changing around the world as people increasingly turn to alternative channels to conduct activities that have traditionally been conducted in the branch. In mature payment markets, where smartphone, tablet, and online penetration have revolutionized customer interaction with FIs, consumers have a myriad of options from which to choose.

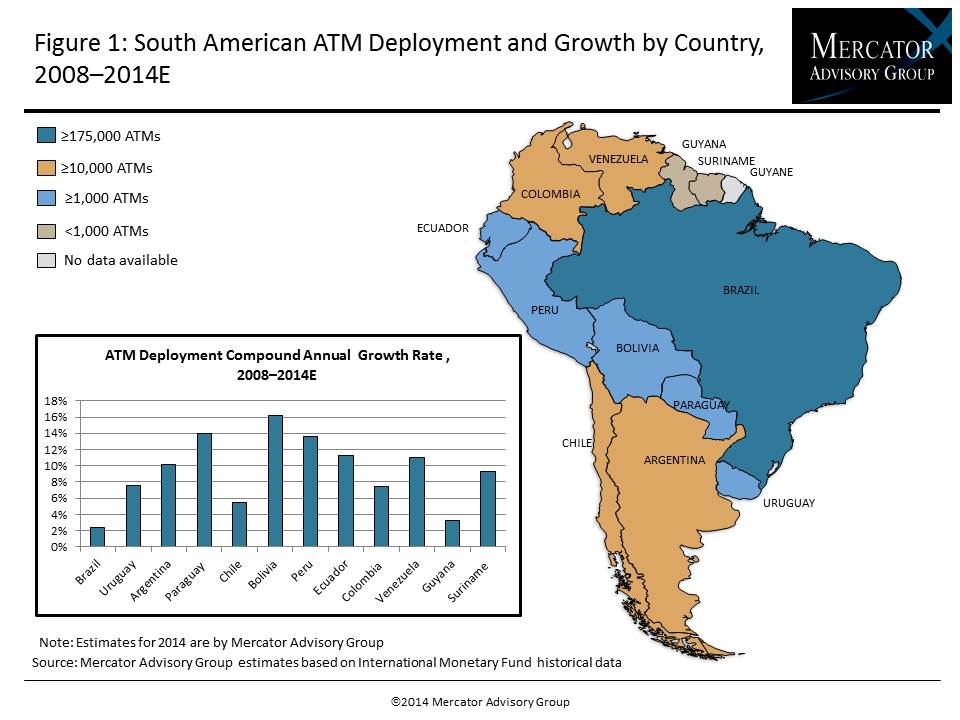

In South America, the branch and ATM are still the major banking channels. While in past five years, FIs across South America have made concerted efforts to extend their branch locations beyond major urban areas, the ATM channel remains the most effective means of providing financial services to consumers in remote locations.

Mercator Advisory Group’s latest Research Note, Profiling the South American ATM Landscape seeks to provide a better understanding of the South American ATM landscape by providing insight into its growth and its value to consumers as indicated by usage compared to other usage of banking channels, most notably branch and bank agent. The Note also reviews common ATM functionality offered by the leading ATM networks in South America and use of the channel as a means of interacting with financial institutions.

“With growth in the number of ATMs installed across South America likely to continue near double digits in the foreseeable future, the market’s potential is immense. The wide range of functionality available in South American ATMs demonstrates that the channel is already an important medium for financial institutions to interact with their fast-growing consumer base,” comments Tristan Hugo-Webb, Associate Director, International Advisory Service at Mercator Advisory Group and the primary author of the note.

This Research Note contains 9 pages and 4 exhibits.

Companies mentioned in this Research Note include: Banco 24 Horas, Banelco, Banred, GlobalNet, Redbanc, Suiche 7B

Members of Mercator Advisory Group’s International Advisory Service have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

One of the exhibits included in this report:

Highlights of the Research Note include:

- Estimated total number of ATMs installed in each South American country

- Consumer usage of ATM channel compared to other popular banking channels (branch, bank agent, and retail outlet) as preferred method of withdrawal and deposit

- Overview of the functionality offered by some of the leading ATM networks across South America

Book a Meeting with the Author

Related content

Payment Hubs Stand at a Crossroads

Payment hubs promised to simplify payments, but many never lived up to that vision. As real-time payments, open banking, and platform modernization reshape the landscape, banks are...

Stablecoins vs. Tokenized Deposits

Stablecoins and tokenized deposits are redefining how banks participate in digital money. Much of the current discussion centers on which of these instruments banks should emphasiz...

Real-Time Payments: Use Cases in Acquiring

The real time payments made possible through The Clearing House’s RTP and the Fed’s FedNow payment rails are making headlines, with promises of efficiency and lightning fast paymen...

Make informed decisions in a digital financial world