Payment Acceptance in a Complex Environment

- Date:November 28, 2016

- Author(s):

- Ken Paterson

- Research Topic(s):

- Small Business PaymentsInsights

- PAID CONTENT

Overview

In March 2016, Mercator Advisory Group fielded a web-based survey of U.S. small businesses (between $500 thousand and $5 million annual sales) regarding their use of banking and payments service. Payment Acceptance in a Complex Environment is the first of three reports summarizing the results of the 2016 Small Business Payments and Banking Survey.

The survey contained questions on today’s business sentiment, payment acceptance services, business-to-business (B2B) payments, and banking depository and loan services. Forthcoming companion reports summarize the survey’s findings on business-to-business payments and business banking services. A copy of the survey questionnaire, developed by Mercator Advisory group in consultation with our clients, can be found in the report’s appendix.

“What emerges from our survey data is a picture that is both reassuring and threatening to providers of payment services,” notes Ken Paterson, Mercator Advisory Group’s Vice President of Research Operations, the author of this report. “On one hand, small businesses deal primarily with one payments provider On the other hand, ancillary payment service providers are joining the mix, offering businesses an alternative source of expertise and service that address their increasingly complex and specialized payments needs.”

In total, over 1,600 qualified responses were obtained from decision makers at revenue-qualified small businesses that accept credit and/or debit cards for payment. The sample included a geographically dispersed quota of 500 responses from businesses with annual sales of $2–5 million and the remainder from businesses with annual sales of $500,000–$1.99 million.

This report contains 60 pages and 57 exhibits.

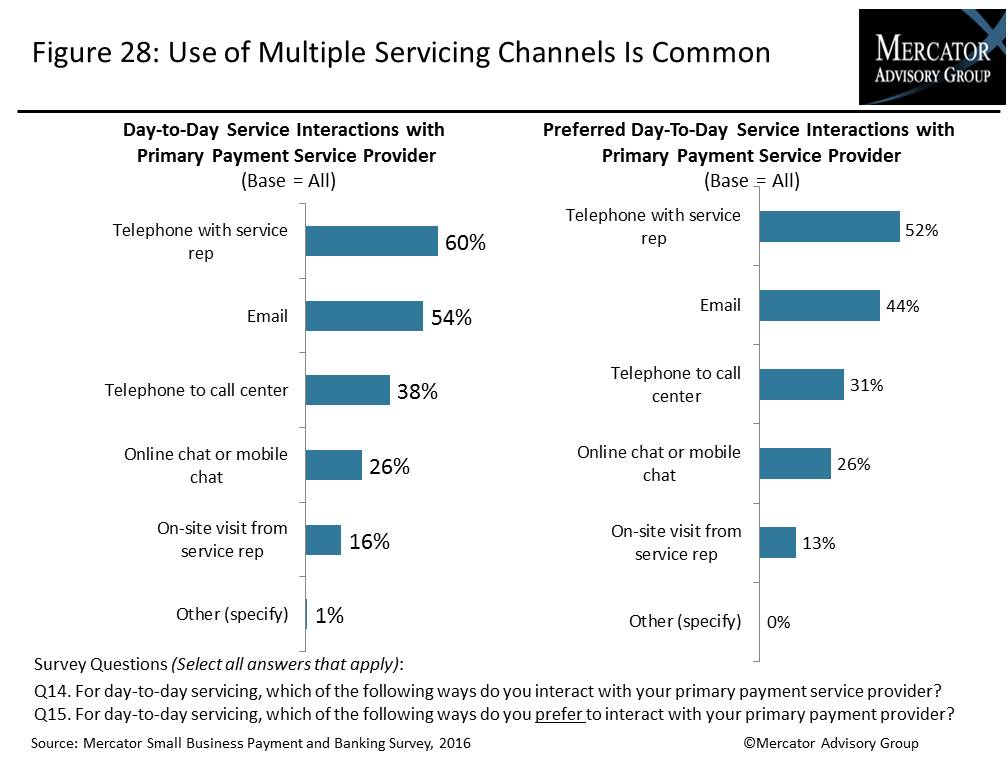

One of the exhibits included in this report:

Highlights of this Insight Summary Report include:

- Most common sales channels by sales volume

- Most common methods of payment by sales volume

- Extent of adoption of omnichannel strategies

- Acceptance of Bitcoin and other cryptocurrencies

- Prevalence of “steering” of customers to cash payment

- Extent of use of acquiring/merchant banks

- Most common pain points

- Prevalence of on-site ATMs, owned or hosted

Book a Meeting with the Author

Related content

AI’s Expanding Role in Small Business

This Primary Data Snapshot—a Javelin Strategy & Research report focused on small business payment usage and behavior—shows which generative AI tools are most popular among small bu...

2025 Small Business PaymentsInsights: U.S.: Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between October 13 – 29, 2025, using a U.S. online ...

POS Systems Used For In-Store Card Payments

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on small business payment usage and behavior—shows which point-of-sale system brands are most popular among...

Make informed decisions in a digital financial world