Overview

Online grocery vertical growth in 2021 poses ample opportunity.

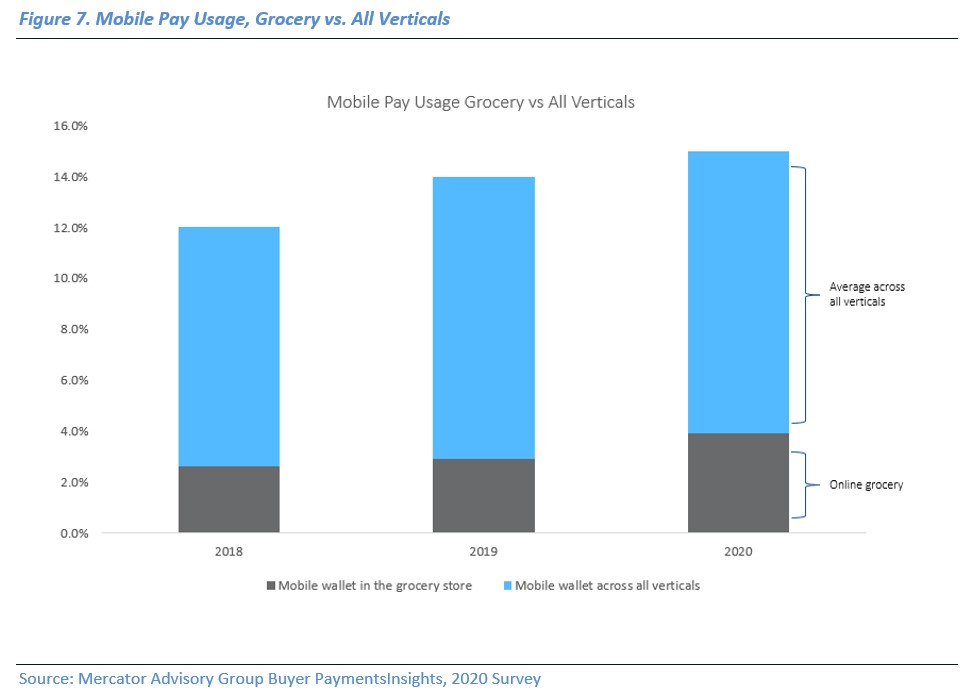

Although online grocery struggled against other online verticals prior to 2020, recent growth shows the vertical is here to stay. As consumers shopped online due to COVID-19, online grocery growth outpaced the rest of the e-commerce segment. Given recent consumer sentiment, Mercator predicts growth will remain strong in the coming years. Grocers were able to match consumer demand by utilizing cost-saving investments and implementing innovative technology to facilitate fulfillment. While consumers expressed the desire to continue shopping online, they also noted pain points with online grocery shopping. Given the new growth in this budding industry, Mercator believes that merchants and payment processors have the ability to gain market share by implementing cost effective fulfillment strategies and facilitating technology-driven payment methods. This research report from Mercator Advisory Group explores the trajectory of the market and the ways in which merchants and payment processors can take advantage of consumer sentiment to cut costs and drive sales.

”The pandemic-driven, stay-at-home lifestyle in 2020 propelled U.S. online grocery sales to record volume as consumers sought ease of ordering, seamless payment, and convenient delivery. As the Great Reopening occurs in 2021, online grocery shopping will remain popular among consumers. Grocery merchants and their payments vendors can benefit from this digital channel opportunity, but must meet the challenges of online order fulfillment,” commented Raymond Pucci, Director, Merchant Services at Mercator Advisory Group, and author of this report.

This report is 17 pages long and has 8 exhibits.

Companies and other organizations mentioned in this report: Ahold Delhaize, Albertsons, Amazon, Incisiv, Instacart, Kroger, Meijer, Nuro, Ocado, Oxbotica, Stop & Shop, Walmart, Whole Foods.

One of the exhibits included in this report:

Highlights of this research report include:

- Market growth of the vertical

- Merchant innovations that helped bolster growth

- Current consumer sentiment

- Primary data results of growing consumer payment preferences

- Future outlook of further innovations in the online grocery vertical supply chain payments space

Book a Meeting with the Author

Related content

Agentic Commerce: Green Light or Flashing Yellow for Merchants?

Agentic commerce is forecasted to reach $500 billion in sales by 2030, but what’s driving that growth? Consumers will vote with their wallets on which product categories and sales ...

Merchants Should Planogram Payments

Enterprise merchants have increasingly adopted payment orchestration strategies to drive new payment types, increase payment success rates, and optimize platform performance. Howev...

2026 Merchant Payments Trends

As payment technology advances and offers greater options and flexibility for consumers, merchants are put in the position of prioritizing how to manage payment acceptance, what pl...

Make informed decisions in a digital financial world