Omnichannel and Branch Banking: The Current U.S. Consumer Banking Environment

- Date:March 22, 2019

- Author(s):

- Peter Reville

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

Mercator Advisory Group’s most recent Insight Summary Report, Omnichannel and Branch Banking: The Current U.S. Consumer Banking Environment, reveals that U.S. customers are highly satisfied with their banking relationship and comfortable with their current primary bank or credit union. The report is from the Banking and Channels Survey in the bi-annual CustomerMonitor Survey Series, a part of Mercator’s Primary Data Service. It is based on findings from Mercator Advisory Group’s CustomerMonitor Survey Series online survey of 3,000 U.S. adult consumers in November 2018.

The survey also found that only about 1 in 3 consumers want to be contacted by their financial institution (FI) about new products and services. This necessitates that FIs be very strategic in the way they cross-sell and up-sell to their customers

While the incidence of opening an account digitally is moderate (28%), satisfaction with the digital account opening process is very high (approx. 85%).

The report, Omnichannel and Branch Banking: The Current U.S. Consumer Banking Environment, shows that consumers are resolute in their determination not to pay ATM fees. More than 7 in 10 report that they actively try to avoid paying a fee when they withdraw money from an ATM. Further, about one-third only use an ATM for cash withdrawal.

Although only about one-third of consumers use mobile banking, those who do are quite satisfied with the experience. Inertia and security concerns are barriers to mobile banking adoption

“Banks need to show consumers value beyond dollars and convenience. And this needs to be balanced with security and safety,” states the author of the report, Pete Reville, Director of Primary Data Services including CustomerMonitor Survey Series at Mercator Advisory Group.

Companies and Other Organizations or Services Mentioned in this Report:

Affirm, Amazon, American Express, Apple, Facebook, Charles Schwab, Discover, Google, Mastercard, PayPal, People Pay, Popmoney (Fiserv), Square, Target, Venmo, Visa, Walgreens, and Zelle (Early Warning Services).

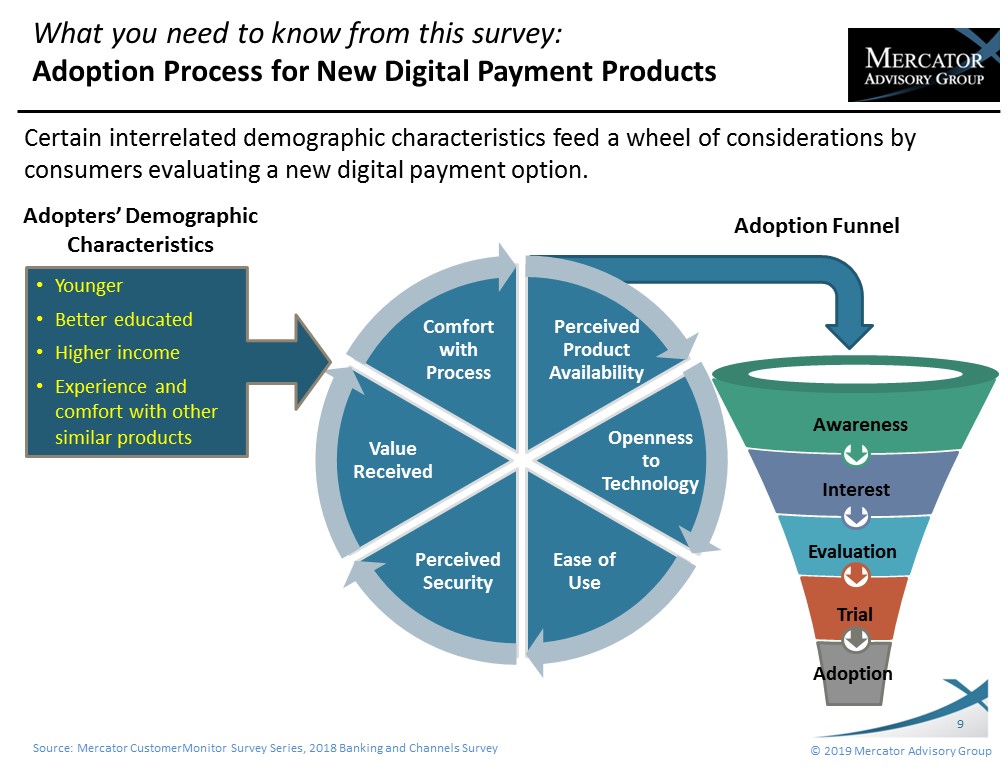

One of the exhibits included in this report:

Highlights of this report include:

- Currently, the vast majority of consumers are satisfied with their primary FI and the services the FI provides. This, coupled with inertia, makes the relationship sticky.

- Alternative FI providers will have a difficult time overcoming the trust barrier that exists between consumers and their FIs.

- ATM fees are a considerable hurdle to overcome for organizations looking to lure consumers out of network.

- Inertia and security concerns prevent consumers from using mobile banking.

- With regard to new financial products and services consumers will evaluate them based upon the perceived value (convenience, cost/savings, etc.) balanced against security.

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: Canada: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 22 – 30, 2025, using a Canadian online...

Make informed decisions in a digital financial world