Overview

The NFC Revolution: Anticipating Changes

in the U.S. Payments Landscape

Boston, MA - Many people in the payments industry have become frustrated with the slow pace with which NFC-based payments technology has been developing in the U.S.--Google Wallet's initial launch left minimal impact, Isis keeps postponing its own rollout, and a number of other companies have made a lot of noise but produced little in the way of concrete results. NFC technology is starting to gain traction. Handset manufacturers are including NFC in most of the new mobile devices on the market, and they are heavily advertising the non-payments capabilities it offers. Although NFC payments are still a few years away, NFC itself is here right now.

Mercator Advisory Group's new research report, The NFC Revolution: Anticipating Changes in the U.S. Payments Landscape, examines the current status of Near Field Communication (NFC) technology in the United States, explores NFC's non-payments functions currently on the market, and analyzes the challenges faced by organizations attempting to support NFC payments. The report forecasts the influence NFC-based payments will have in the market through 2020, explaining the factors influencing periods of growth and stagnation.

Highlights of the Report Include:

Review of the current state of domestic NFC market, including popular devices with NFC capabilities, networks supporting NFC, and non-payments uses for NFC

Breakdown of the problems facing major NFC wallet providers, the causes of those problems, and some potential solutions

Forecast of the influence of mobile payments through 2020, with annual volumes of NFC payments and remote (e-commerce) payments via mobile devices, in the context of total card-based payments and total e-commerce

"The use of NFC is no longer in question. NFC is here," says Dave Kaminsky, analyst in Mercator Advisory Group's Emerging Technologies Service and author of the report. "How far along we are, what we will do with the technology, and when we will do it are the areas that are worth discussion."

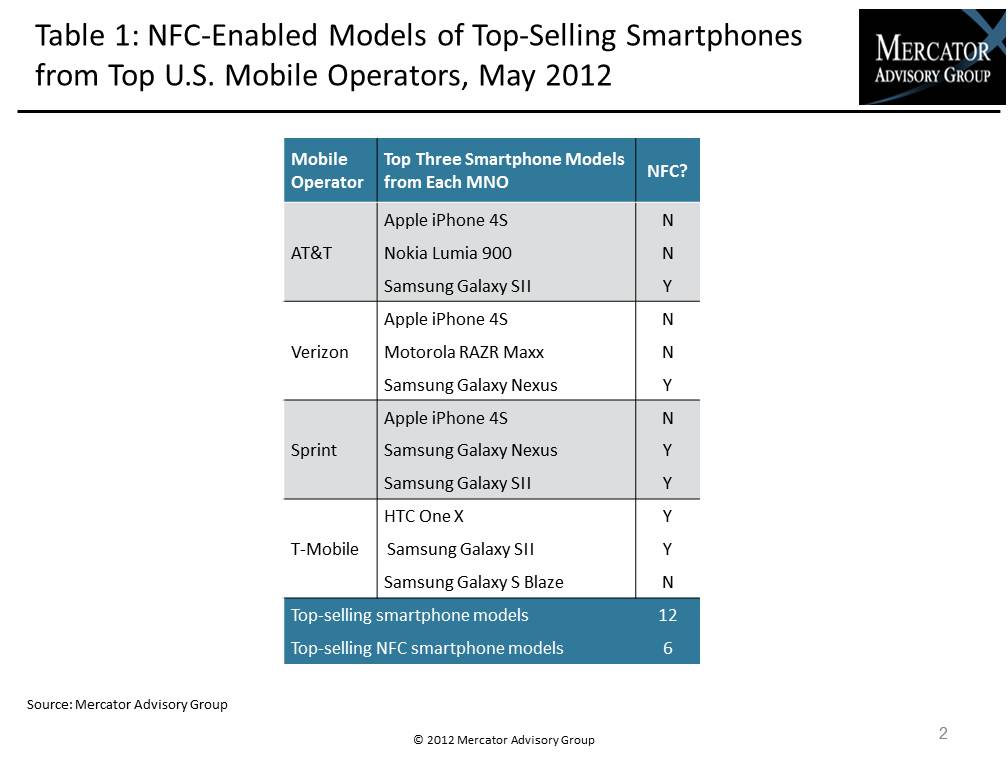

One of the 12 exhibits in this report:

This report is 24 pages long with 12 exhibits.

Companies mentioned in the report include: Verizon Wireless, ATT Mobility, T-Mobile, Sprint, Samsung, Apple, Nokia, Motorola, Android, Microsoft, Google, Narian Technologies, VeriFone, Equinox, Visa, MasterCard, Discover, American Express, Tagstand, Sony, Isis, Citi, RapidNFC, EMVCo, and NFC Forum.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com. For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected]. For free industry news, opinions, research, company information and more visit us at www.PaymentsJournal.com.

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group:

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors. Mercator Advisory Group is also the publisher of the online payments and banking news and information portal PaymentsJournal.com.

Book a Meeting with the Author

Related content

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

2025 Emerging Biometric Authentication at the Point of Sale Scorecard

This inaugural Javelin Strategy & Research scorecard assesses the emerging market for biometric authentication at the point of sale and identifies three Pillars in this emerging te...

Make informed decisions in a digital financial world