Overview

Multi-Channel Execution: Customer Satisfaction in a

Hostile Environment

Research Maps Strategies for Banks to Improve

their Customer Satisfaction

With the rapid growth of online banking over the past decade, banks have started to measure the quality of the online experience from the customer's perspective and are using this data to improve how well their solutions meet customer needs. As a result, customer satisfaction scores for online banking compare very favorably with other businesses and rank higher than the top 100 Online Retailers long considered the gold standard for online performance. Bank's overall satisfaction scores however, lag their online scores by almost 10%.

Mercator Advisory Group's new report Managing the Multi-Channel Experience: Who's Satisfied? examines the challenges banks face and maps a set of strategies that banks can implement to improve overall customer satisfaction.

Highlights of this report include:

While the majority of customers now chose the online banking as their preferred channel, they also want the convenience of the other self service channels and the person-to-person interaction provided by branches and contact centers.

To improve the multi-channel experience, banks need to overcome the challenges created by a diverse customer set, complex technology infrastructures and sub-optimal product centric organizations.

A comprehensive Voice of the Customer program and enterprise agreement on customer experience objectives are essential.

To improve multi-channel satisfactions banks need to focus on: relationship products, staff motivation and incentives, standard cross channel sales and service processes, consistent customer information and multi-channel interaction management for data continuity and transactional context across channels.

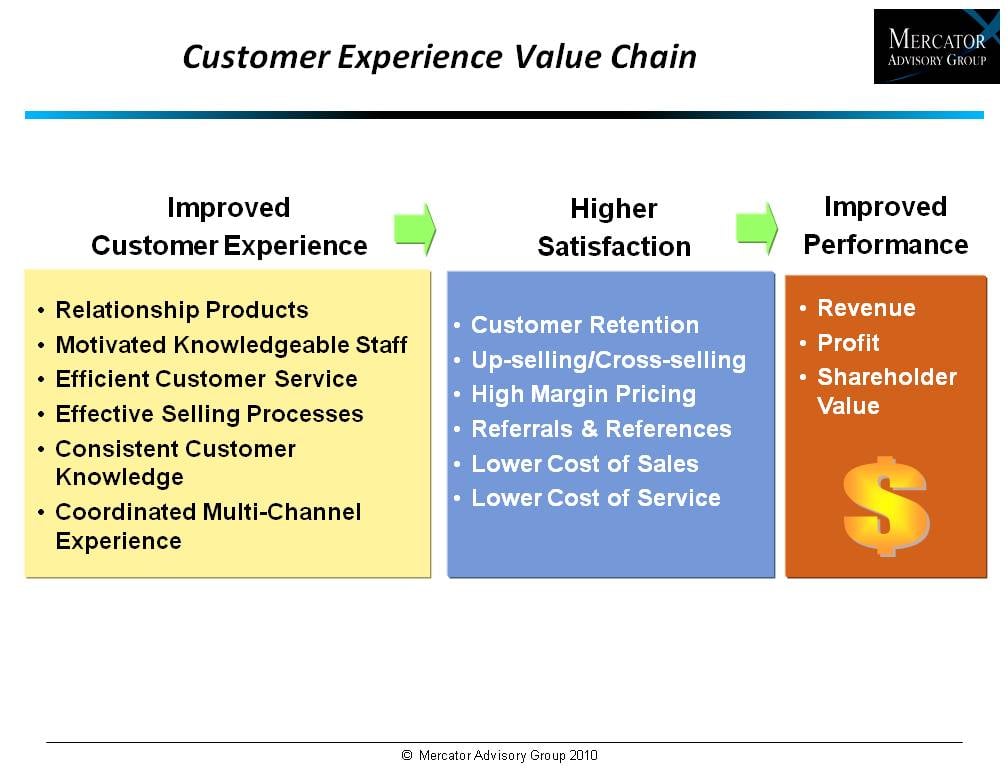

"Quality customer experiences lead to high levels of satisfaction which in turn increases loyalty. High satisfaction and loyalty correlate with increased customer retention, revenue and profitable relationships," states Mercator Advisory Group's Bob Landry, vice president, Banking Group Advisory Services. "Companies with high satisfaction deliver significantly higher shareholder value than organizations with low satisfaction. Banks have long focused on channel specific issues and must broaden their perspective to improve experience across channels. Quality multi-channel experiences are the key to leveraging the investments banks have made in branches, contact centers, ATMs, IVRs, online banking and now mobile phones. The banks that succeed will improve overall customer satisfaction and that will deliver results to the bottom line and increase shareholder value."

One of the exhibits included in this report:

Multi-Channel Experience: Who's Satisfied? contains 41 pages and 19 exhibits.

Companies covered in this series include: ACI, ACSI, Ally Bank, Argo, CFI Group, CompuCom, Diebold, FIS, First Data, Fiserv, ForeSee Results, ING Direct, Intuit, Harland Financial Solutions, Jack Henry & Associates, J.D. Power and Associates, NCR, Open Solutions, Oracle, Pegasystems, Raymond James, S1, Sybase, TD Ameritrade, TD Bank, Unisys, USAA, and Wal-Mart.

Members of Mercator Advisory Group have access to this report as well as upcoming research for the year ahead, presentations, analyst access and other membership benefits.

For more information, please call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest banks, payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Book a Meeting with the Author

Make informed decisions in a digital financial world