Overview

Moving Parts: EMV, NFC and Contactless

Deployment in the US

Boston, MA -- If Visa's view of the world comes to pass, merchants, acquirers, and issuers will be embarking on the most complex update to their payments infrastructure in 20 years. The EMV card security standard, designed to eliminate counterfeit cards, is now an issue for U.S. organizations. At the same time, interest in smartphone-based mobile payments based on NFC is ramping up. Both technology waves will come to U.S. shores simultaneously, and entities that accept, process, route, or assume the risk for payments must prepare.

Mercator Advisory Group's new report Moving Parts: EMV, NFC and Contactless Deployment in the U.S. examines the larger issues as well as specific instances of EMV and contactless payment acceptance. The report details the state of global EMV deployment, dissects the nuanced deployment options for EMV authorization and authentication, and (given the Durbin Amendment's impact on debit processing fees)examines the likely role of the PIN code in debit card issuance based on the EMV standard.

Highlights of this report include:

The fundamental shifts in payment transaction origination and acceptance the United States will soon see, and the impact they will have on how merchants will make acquisition decisions.

The ramifications of Visa's support for EMV contact and contactless payments in the United States and the choices that now abound for issuers.

The nuances affecting successful contactless payment acceptance, and the reasons PayPass and PayWave cards may behave differently.

The long-term outlook for the personal identification number, or PIN, chip-and-pin, and chip-and-signature.

"The expected EMV rollout in the US will require no little choreography on the part of merchants, acquirers and issuers because it will touch every payment device." states George Peabody, director of Mercator Advisory Group's Emerging Technologies Advisory Service. Given the coincident timing of the EMV announcement and the arrival of NFC, merchants have to carefully plan their POS infrastructure investments over the next five years and more. Timing is everything."

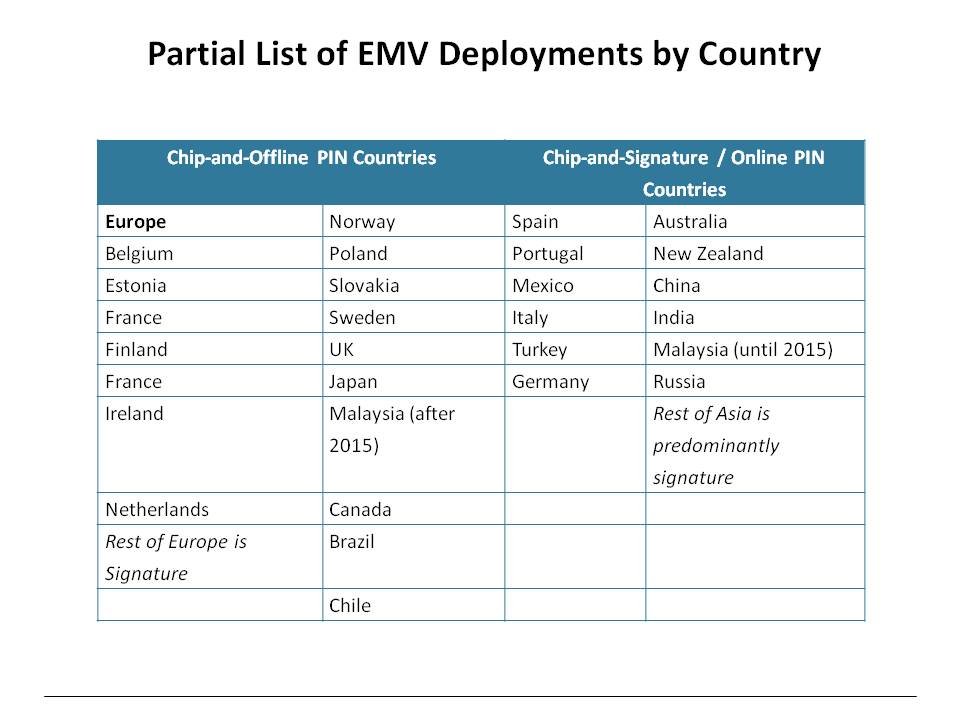

One of four exhibits in this report:

This report is 23 pages long, with four figures and three tables. A valuable glossary of contactless terms is included.

Companies mentioned in this report include: Visa, MasterCard, Michael's, Maestro, U.K. Card Association, VELO, Silicon Valley Bank, and Bank of America.

Members of Mercator Advisory Group's Emerging Technologies Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

For free industry news, opinions, research, company information and more visit us at www.PaymentsJournal.com.

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors. Mercator Advisory Group is also the publisher of the online payments and banking news and information portal PaymentsJournal.com.

Book a Meeting with the Author

Related content

Building the Bridge to Payments: 3 Investment Trends for 2026 and Beyond

Investment in fintechs’ payment technology in 2026 is being shaped by a strong shift toward “bridging technologies” that connect legacy systems with emerging capabilities. Investor...

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

Make informed decisions in a digital financial world