Overview

A research note from Mercator Advisory Group, A Mobile Payments Taxonomy and Forecast, 2014–2025, identifies a taxonomy that accounts for the diversity of mobile payment transactions made in the market today and provides a forecast for each segment, including browser- and app-based payments, as well as transactions performed at the point of sale, or POS, associated with closed-loop and network-branded transactions.

The total dollar volume on mobile devices continues to grow rapidly while dollar volume based on network-branded solutions, such as Softcard, Google Wallet, and Apple Pay, trails existing card-on-file based solutions that include mobile browser and app-based solutions.

“Merchant-based payment solutions will retain their leadership in dollar volume through 2025 while network-branded solutions just begin to gain share,” said Tim Sloane, VP, Payments Innovation, and author of report.

This report is 12 pages long and contains 5 exhibits.

Companies mentioned in this report include: American Express, Apple, Dunkin’ Donuts, Google, Gyft, MasterCard, Softcard, Starbucks, and Visa.

Members of Mercator Advisory Group's Emerging Technologies Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

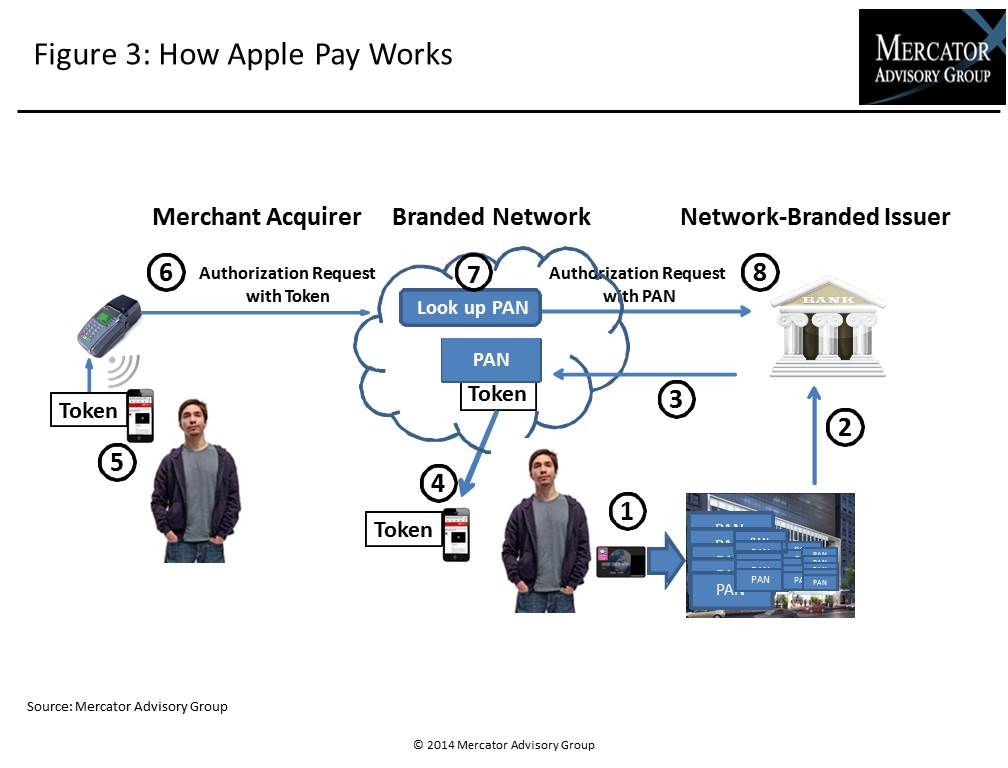

One of the exhibits included in this report:

Highlights of the report include:

- A taxonomy and definition for mobile payments that includes m-browser, m-app, and m-card based mobile solutions that together comprise the entire m-commerce market

- An overview of the many aspects of a mobile implementation that differentiates implementations based on how they interact with the POS, how the app controls access to credentials, how data communications are managed, how the apps implement resilience to errors, and how credentials are protected

- A detailed description of the process associated with Apple Pay that connects the issuer, the network, Apple, the iPhone, and the merchant

- A forecast for the U.S. to 2025 that includes e-commerce, e-commerce on the PC, m-browser, m-app, and m-card, as well m-commerce as a percentage of both all commerce and all e-commerce

Book a Meeting with the Author

Related content

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

2025 Emerging Biometric Authentication at the Point of Sale Scorecard

This inaugural Javelin Strategy & Research scorecard assesses the emerging market for biometric authentication at the point of sale and identifies three Pillars in this emerging te...

Make informed decisions in a digital financial world