Overview

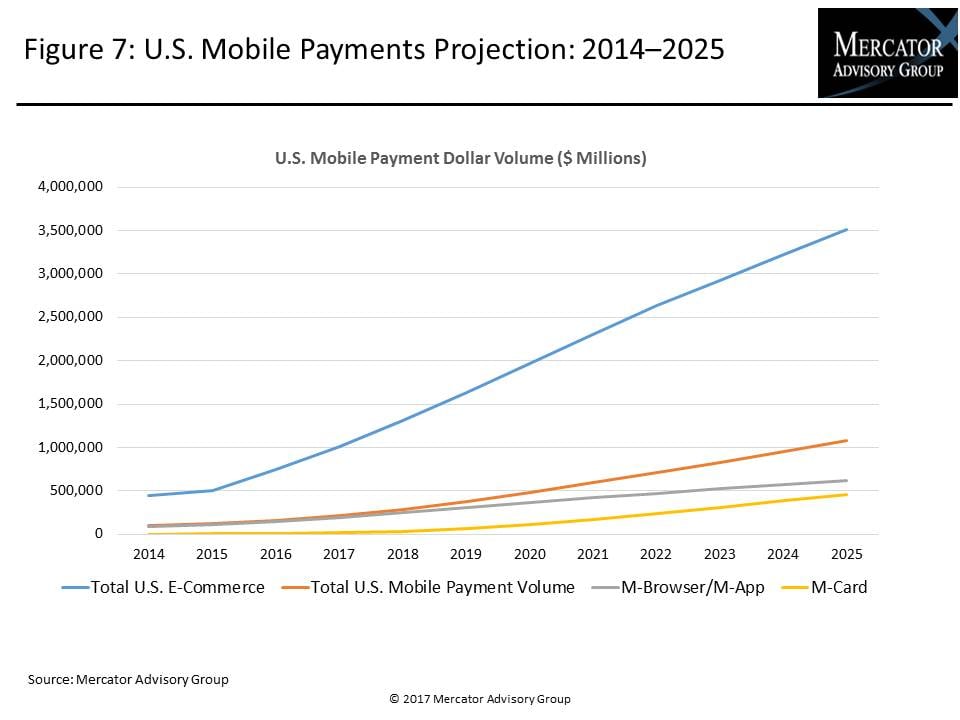

Mercator Advisory Group’s most recent research report, Mobile Payments Platforms and Markets: How High Is Up?, presents a framework for the assessing the U.S. mobile payments market. The report describes the current market landscape and discusses future implications for payments technology vendors, developers, merchants, and consumers. With e-commerce activity becoming the growth engine for U.S. retail sales, mobile payments technology and applications are expanding at a rapid clip to cash in on increasing consumer purchase transactions made via mobile browsers and smartphone apps.

Competition is intensifying among financial institutions, card networks, and alternative payment vendors seeking to grab their share of mobile payments transactions, now available to both online and in-store shoppers. While the smartphone makers were first to market with the mobile apps Apple Pay, Android Pay, Samsung Pay, financial institutions and card networks have joined with their own entries into the mobile payment universe such as Chase Pay and Citi Pay. Not to be left behind, single merchants, led by nationwide chains and franchises such as Starbucks and Dunkin’ Donuts are launching their own mobile apps with special features to meet the needs of their customer bases.

Despite early optimism that mobile payment adoption would be widespread among both merchants and consumers, various inhibiting factors are in play. Challenges to higher mobile payment utilization include systems complexity and consumers’ concerns about the security of the mobile payment method. Some emerging technologies are arriving that can address the mobile pay challenges making transactions more seamless and easier to use. This Mercator Advisory Group research report delves into the current state of mobile payments and discusses implications and areas of opportunity for technology developers, financial vendors, and merchants.

“Mobile shoppers want more integrated features and need more engaging reasons to use mobile payments, but most payment vendors and their merchant clients have simply not yet provided that,” comments Raymond Pucci, Associate Director of Research Services at Mercator Advisory Group, author of the report.

This research report contains 26 pages and 11 exhibits.

Companies mentioned in this report include: Amazon, Apple, Capital One, Chase Bank, Chipotle, Citibank, Cybersource, CVS Health, Discover, Domino’s, Dunkin’ Donuts, EMVCo, Facebook, FIS Global, Google, Groupon, GrubHub, Kohl’s, Lyft, MasterCard, OpenTable, PayPal, Samsung, Starbucks, Square, Target, Uber, Visa, Walgreens, Walmart, and Whole Foods.

One of the exhibits included in this report:

Highlights of this research report include:

- An overview of the current state of the U.S. mobile payments landscape

- Consumer behavior preferences when considering mobile payment use

- Projections of U.S. mobile payment market volume through 2025

- Challenges and opportunities for mobile payments in certain vertical markets

- Emerging technology that is positioned to enhance mobile payment utilization

- Recent trends from both universal and single-merchant mobile payment apps

Book a Meeting with the Author

Related content

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

2025 Emerging Biometric Authentication at the Point of Sale Scorecard

This inaugural Javelin Strategy & Research scorecard assesses the emerging market for biometric authentication at the point of sale and identifies three Pillars in this emerging te...

Make informed decisions in a digital financial world