Mobile Payments: Greater Value Needed for Widespread Adoption

- Date:October 19, 2017

- Author(s):

- Karen Augustine

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

New research presented in the latest Insight Summary Report from Mercator Advisory Group’s CustomerMonitor Survey Series, titled Mobile Payments: Greater Value Needed for Widespread Adoption, reveals that half of smartphone owners in the United States have used their mobile device to pay for goods and services in stores or online within the previous year. While smartphone ownership continues to grow, reaching 82% ownership among U.S. adults, fewer than in 2016’s survey say they use mobile payments at the checkout terminal.

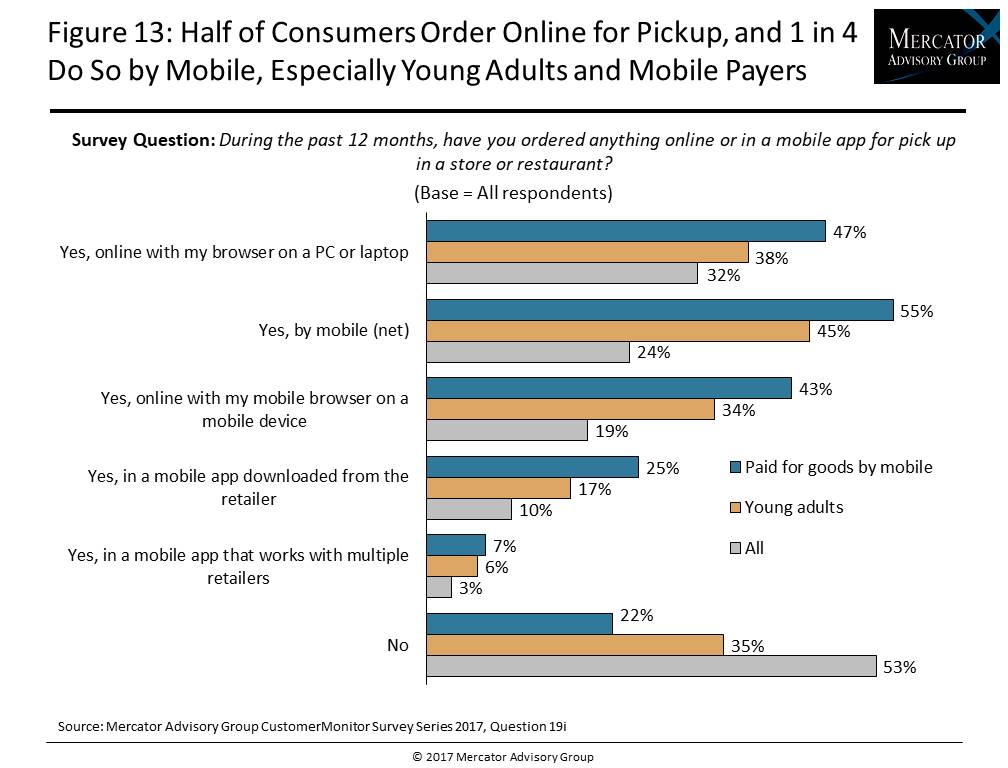

As mobile payments apps seek to improve the value and convenience of their use compared to traditional cards, many consumers are finding that ordering ahead by mobile for pickup in stores (for example, Starbucks) is becoming a valuable convenience.

The study finds that nearly half of all consumers and two-thirds of young adults report ordering ahead for goods and services for pickup in stores online or by mobile device. More consumers now order ahead online (32%) than by mobile (24%), but young adults are more likely to order by mobile (45%) than online by computer or laptop (38%). While more order ahead from fast food or coffee retailers than any other category, casual dining restaurants, apparel, footwear or other accessories, department stores and supermarkets or groceries are other popular types of retailers for ordering ahead.

Early implementation of order ahead caused logistical problems at some of the most popular order ahead retail locations, but those retailers appear to be fixing these issues, making order ahead even more convenient.

Consumers who see value in their mobile payment app continue to use it more often. Survey data in this report reveals that 7 in 10 U.S. consumers would use mobile payments more often if they automatically received rewards or discounts, whether for every purchase or accrued over time.

This study, based on Mercator Advisory Group’s CustomerMonitor Survey Series payments survey conducted using an online panel of 3,011 U.S. adults in June 2017, examines the demographic shift and changing landscape of web-enabled mobile users, consumer use of mobile devices for making payments and shopping online and in stores, use of in-app payments, related payment features including e-couponing, e-receipting, and e-loyalty as well as payment, balance, and fraud alerts, experience with universal mobile payment apps such as Apple Pay and Android Pay, use of voice-activated conversational interfaces for payments, and use and ownership, purchase plans, and important features of wearable technology for payments.

“Consumers expect more benefits and usefulness from a payment app than just a way to pay. Stimulating use as a primary payment tool will require clear benefits for rewards, shopping aids, and perhaps social interaction, not to mention broad merchant acceptance,” stated Karen Augustine, author of the report and manager of Primary Data Services at Mercator Advisory Group, which includes the CustomerMonitor Survey Series.

The report is 95 pages long and contains 41 exhibits.

Companies mentioned in this report include: Airbnb, Amazon, Apple, Burger King, Capital One, Chase, Chipotle, Cumberland Farms, CVS, Dunkin’ Donuts, ExxonMobil, FitBit, Google, Lyft, McDonald’s, Papa John’s, Pizza Hut, Samsung, Subway, Target, Uber, Walmart, and Wells Fargo.

One of the exhibits included in this report:

Highlights of this report include:

- Year-over-year trends in smartphone and tablet ownership by screen size

- Year-over-year trends in use of mobile phones for shopping online and to support in-store shopping

- Use of mobile payments to merchants including retailer-specific merchant-sponsored, branded mobile payment apps online and in stores

- Universal mobile payments app experience: payment cards loaded in the digital wallet to fund mobile payments, preferred card, frequency of changing the preferred card in the app, links to merchant apps, types of merchants where the app is used, and satisfaction compared to use of payment cards

- Use of mobile and online order ahead, types of retailers where used, frequency and reasons for use

- Demographics of mobile users and mobile payment users and satisfaction with operability mobile phones and availability of service

- Challenges to mobile payment adoption

- Shifts in use and delivery methods for six types of financial alerts

- Shifts in use and interest in e-couponing, e-receipting, and apps for coupon and receipt storage and management

- Use, interest, format, and importance of features for wearable technology including payments, mobile banking, and money transfers

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: Canada: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 22 – 30, 2025, using a Canadian online...

Make informed decisions in a digital financial world