Overview

Mobile Incentives: The Next Step in Device Based Transactions

New research from Mercator Advisory Group examines the landscape of mobile retail incentives, their future potential, and the multiple

approaches currently available

Boston, MA -- Americans' growing interest in retail incentives programs along with the rapid development of smartphone technology has resulted in the launch of mobile device-based incentive programs from a number of different organizations. Among these programs are coupon providers, loyalty/rewards services, and various adaptations and combinations of the two. The programs differ based on development, targeted consumers, and delivery strategies, and as they become more advanced, they appear increasingly likely to serve as the next step toward mobile transactions.

Mercator Advisory Group's new report, Mobile Incentives: The Next Step in Device-Based Transactions, analyzes the potential of the current market in terms of incentives, mobile device development, and adoption as well as consumer demand for the ability to manage their incentives programs on their mobile devices. The report then surveys the current landscape of mobile incentives, providing an in-depth analysis of the most significant products currently on the market. Additionally, the report includes insights into anticipated future developments of mobile incentives.

Highlights of the Report include:

Discussion of recent developments in retail incentives, mobile device technology, and consumer demand for the integration of the two

Analysis and categorization of 16 of the most significant mobile incentive applications currently on the market

Data by application on price, platform availability, market availability, parent company background, and more

Insights into the future developments of mobile incentive apps, including their implications for the advancement of mobile payments

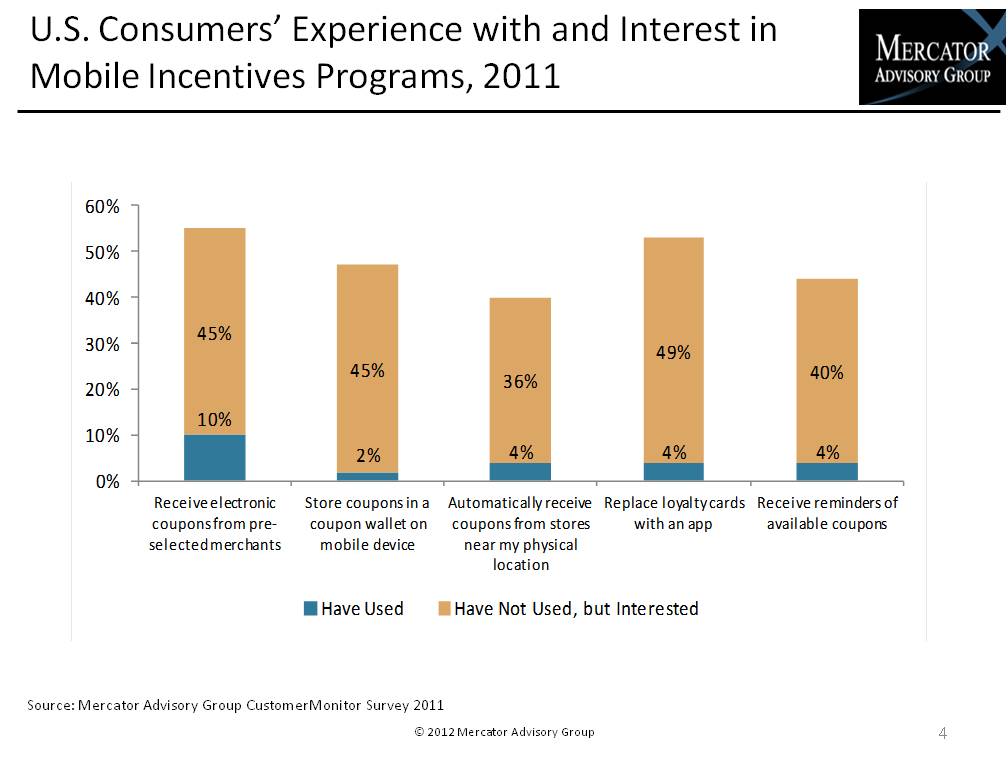

"Among consumers who had not previously engaged in any mobile incentives programs, between one-third and one-half claimed that they would be interested in each of the various programs discussed," says Dave Kaminsky, analyst in Mercator's Emerging Technologies Service and author of the report. "As merchants begin to realize mobile incentives' potential for driving sales, the decision to mobilize their couponing and loyalty programs will become increasingly easy to make."

One of the seven exhibits in this report:

This report is 23 pages long with seven exhibits.

Companies mentioned in the report include: Square, Google, Isis, Apple, Yowza!!, Coupon Sherpa, TabbedOut, Groupon, LivingSocial, PayPal, Target, Starbucks, Key Ring, LevelUp, Punchd, Paycloud, FourSquare, and shopkick.

Members of Mercator Advisory Group's Emerging Technologies Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

For free industry news, opinions, research, company information and more visit us at www.PaymentsJournal.com.

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors. Mercator Advisory Group is also the publisher of the online payments and banking news and information portal PaymentsJournal.com.

Book a Meeting with the Author

Related content

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

2025 Emerging Biometric Authentication at the Point of Sale Scorecard

This inaugural Javelin Strategy & Research scorecard assesses the emerging market for biometric authentication at the point of sale and identifies three Pillars in this emerging te...

Make informed decisions in a digital financial world