Overview

Merchant acquiring is an increasingly visible component of the U.S. financial services industry. It is a pivotal driver of electronic payments in e-commerce and at the point of sale. Technology advances, changing consumer buying habits, and more demanding retailer needs are bringing about new business approaches for merchant acquirers. The payments landscape is being transformed by a new cast of industry players providing emerging services such as e-commerce gateways and value-added services such as fraud management systems. Mergers and acquisitions have altered the market share position of some of the top merchant acquirers, and more market share changes are expected to occur.

Mercator Advisory Group’s research report, Merchant Acquiring’s Ecosystem: Evolving Beyond Transactions examines the current state of merchant acquiring in the U.S. market and provides a set of strategic recommendations for market participants.

“Size and scale in the payments transaction world are no longer the be-all, end-all of merchant acquiring. Instead, agile merchant services delivery and tech-savvy solutions have become differentiating competitive advantages,” comments Raymond Pucci, Associate Director of Research Services at Mercator Advisory Group and author of the report.

This research report contains 29 pages and 12 exhibits.

Companies mentioned in this report include: Adyen, Airbnb, Amazon, Apple, Bank of America, BlueSnap, Booker, Braintree, Capital One, Celect, Chase Commerce Solutions, Citi, CyberSource, Discover, Domino’s, Elavon, First Data, Forter, Global Payments, Heartland, Identity Mind, Ingenico, MasterCard, NoFraud, NuData Security, Paymentwall, PayPal, PNC, Riskified, Samsung, Sift Science, Simility, Square, Stripe, SunTrust, ThreatMetrix, TransFirst, TSYS, 2Checkout, Vantiv, Vesta, Visa, Uber, Wells Fargo, Worldpay, and Zooz.

One of the exhibits included in this report:

Highlights of this research report include:

- An overview of the current state of U.S. merchant acquiring market

- A review of the leading U.S. merchant acquirers and key factors influencing their businesses

- Estimates of market share positions with payment transactions volumes, for pre-and post-merger scenarios

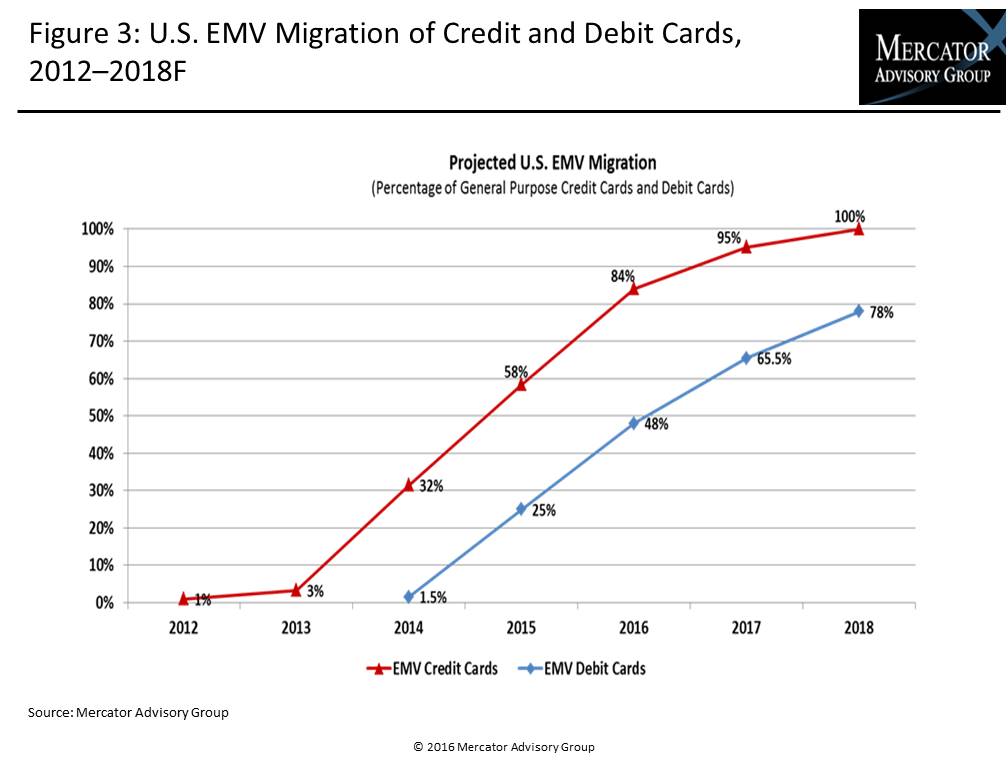

- Analysis of merchants’ challenges and opportunities such as the impact of e-commerce, omnichannel, EMV transition, and security issues

- An exploration of emerging participants within the U.S. payments infrastructure

- Strategic recommendations for merchant acquirers and the threats and opportunities facing them

Book a Meeting with the Author

Related content

2026 Credit Card Risk: Happy Days are Here Again (For Top Issuers)

The year bodes well as 2026 approaches the end of the first quarter. Economic indicators are strong, the credit card market is growing at a healthy rate, and credit cards rem...

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Make informed decisions in a digital financial world