Overview

The Mercator Map of India: An Overview of the

Subcontinent's Payments Market

Boston, MA -- With 2.97 million square kilometers of land and 1.17 billion people, it is no surprise that the Indian subcontinent is drawing a lot of interest from payment companies worldwide. While reports of a growing middle-class may make this seem like a market ripe for the picking, India is a complex market that holds unique challenges and opportunities.

The Mercator Map of India: An Overview of the Subcontinent's Payments Market report lays out an overview that covers outlines of the Indian banking, credit card, debit card, prepaid card, and emerging payment technology markets.

Although India has a growing technological industry and growing middle-class, nonetheless, compared to the size of its population, India still has a relatively nascent financial services industry. But the Indian government wants to see the country adopt electronic payments more broadly than it has so far.

"For those who understand it, the Indian payments market presents tremendous opportunity," Ben Jackson, Senior Analyst of Mercator Advisory Group's Prepaid Advisory Service and principal analyst on the report, comments. "Success will come to those who can find the right partners and understand the market and the regulations that government."

Mercator's latest research presents an overview of the growing Indian electronic payments market. Provided is an up-to-date overview that covers outlines of the Indian banking, credit card, debit card, prepaid card, and emerging payment technology markets. This report updates some of the information found in an earlier Mercator Advisory Group report entitled "India's Electronic Payments Future" that was published in May 2008 and also provides a wide range of new information.

Highlights of the report include:

The Indian payments market is underdeveloped, diverse, and fragmented, leaving a lot of room for growth. And due to its openness, it has become one of the hottest in the global payments market.

Though most of the Indian population does not have a banking relationship, it is a priority for the government to change that.

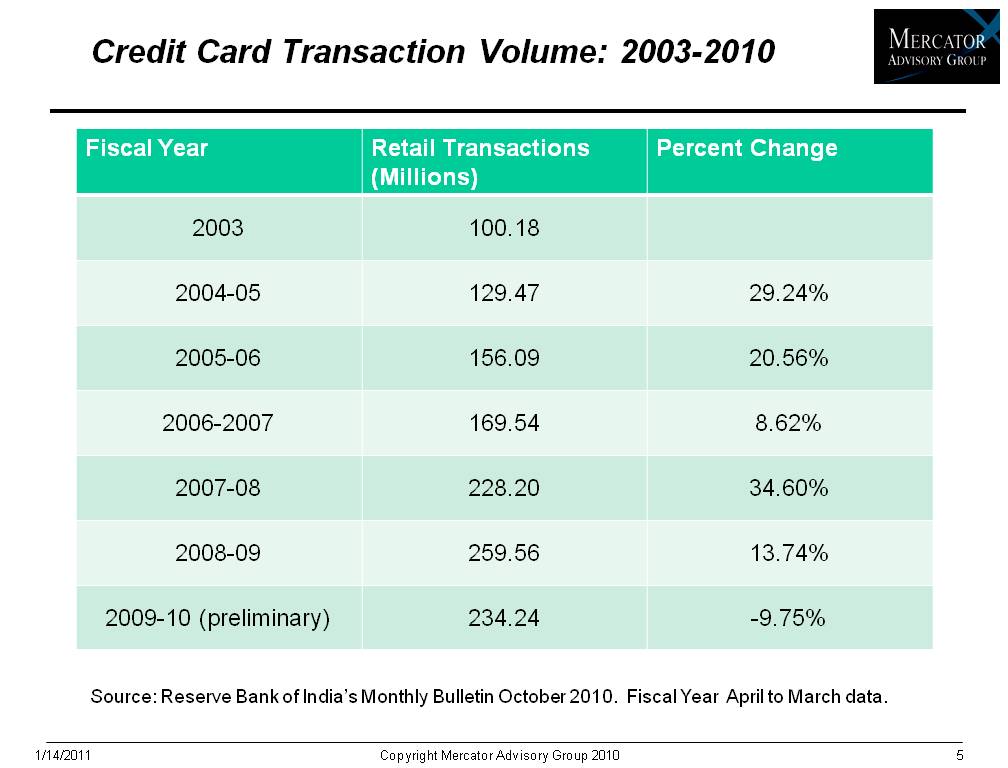

After several years of growth, the credit card market has begun to shrink. Whether it will grow again if the economy improves is an open question.

The debit card market continues steady growth as consumers prefer debit cards to credit cards and government policies promote debit cards.

Prepaid and emerging payments technologies remain nascent sectors of the payments market but are likely to grow as time goes on.

One of the 12 exhibits included in this report:

This report contains 29 pages and 12 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Book a Meeting with the Author

Related content

Payment Hubs Stand at a Crossroads

Payment hubs promised to simplify payments, but many never lived up to that vision. As real-time payments, open banking, and platform modernization reshape the landscape, banks are...

Stablecoins vs. Tokenized Deposits

Stablecoins and tokenized deposits are redefining how banks participate in digital money. Much of the current discussion centers on which of these instruments banks should emphasiz...

Real-Time Payments: Use Cases in Acquiring

The real time payments made possible through The Clearing House’s RTP and the Fed’s FedNow payment rails are making headlines, with promises of efficiency and lightning fast paymen...

Make informed decisions in a digital financial world