Overview

Boston, MA

February 2008

Loyalty and Rewards: Welcome to the New Normal

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

The first report from Mercator Advisory Group's new launched Retail Banking Practice explores the hazardous route retail banks are taking disintermediating the loyalty of customers through overdraft fee maximization and onerous, templatized, rewards programs.

Bank management frequently attributes the persistence of low-grade loyalty of retail banking customers to the commoditization and ubiquitousness of banking institutions and banking products and services. We find that a significant component of customer disaffection corresponds to prioritization banks have given to investment banking, securities trading and insurance underwriting.

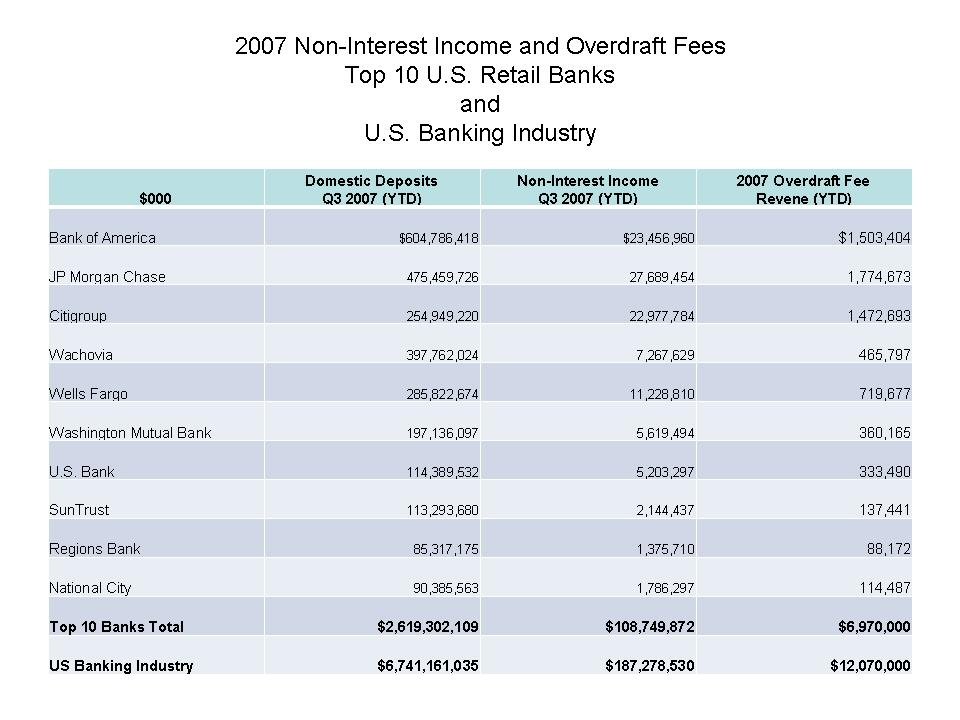

While Q4, 2007 net income of the ten largest retail U.S. banks was - $6.4 billion (a Q4 2007 versus Q4 2006 change of $30 billion), those same 10 banks have increased their annual check fee income to $7 billion.

While banks as a whole are awash in red ink, they have adopted an ultimately self defeating course of optimizing overdraft fee income by holding checks for 2 to 5 days before giving customers access to funds and paying checks largest-to-smallest to maximize the number of bounced checks hitting a customer's account. Concurrently, banks have begun marketing rewards programs featuring unobtainable merchandise. For instance, a top 10 retail bank will reward a customer with a "free" iPod nano after that customer spends almost $400,000. on a signature debit card.

It is impossible for the stable revenues of retail banking to shoulder the profitability mandate of the entire financial institution. Customers are disgruntled and defecting and legislators and courts are assessing overdraft loan fee income.

It is imperative that retail banks step down from maximizing the number of non-sufficient checks and reassess their current customer rewards and loyalty strategies. We believe that a competitive advantage will go to banks revamping their retail income streams and assuming the mantle of trusted advisor. Those trusted advisors who embrace fair retail practices, real-time virtual customer service and social networking technologies will benefit from a huge upswing in customer acquisition, loyalty and ultimately, profitability. Also, they may avert legislative and judicial oversight of their retail-generated non-interest income components.

Report Highlights:

- Totaling $17.5 billion industry-wide, retail bank overdraft loan fees are principally responsible for the banking industry hitting an all time low in the loyalty of retail customers.

- Rewards programs have evolved from their central roles as customer acquisition and loyalty drivers to commoditized web-site graphic placeholders featuring impossible to earn rewards.

- The rise of templatized, unattainable rewards programs has corresponded with retail bank reliance on the generation of overdraft loan fee income. Customers cannot earn rewards for their transactions, but those same transactions may earn the bank bounced check fees.

- Overdraft loan fee income creates a windfall of customer dissatisfaction, defections, negative press coverage and invites regulatory and judicial scrutiny of largest-first check clearing and check holding policies.

- We estimate that the 10 largest U.S. banks generate $7 billion in overdraft loan fees as a portion of their total non-interest income of $109 billion. These banks are incurring huge customer and employee goodwill costs and jeopardizing a component of their independence for 6.4% of total non-interest income.

- We predict that banks embracing the New Normal through real time virtual customer interactions, social networking technologies and rationalizing their overdraft policies will win profitable and fiercely loyal customers.

Elizabeth Rowe, Group Director of Mercator Advisory Group's Banking Advisory Service and author of the report, comments, "Naturally banks are efficiency and profit maximers, but current rewards and overdraft fees policies are jeopardizing the long-term health of retail customer satisfaction and loyalty. By retaining 2 to 5 business day check clearing schedules and largest-first check payment policies, banks have seen their insufficient check fee income increase to $17.5 billion. However, that income, which represents only 6% of the U.S. banking industry's total non-interest income, has generated outsized customer discontent and defections and we predict, that left unaddressed, will prompt both legislative and judicial scrutiny and regulation.

Banks have given too much responsibility to a $34. fee. Retail banks must refocus by embracing new social networking technologies and real-time virtual customer interactions to sell bank products and services. In the New Normal, banks must reassume their trusted advisor mantle and imbue sales with human interactions and indeed, humanity. Fair customer engagement and non-punitive fee schedules ultimately will generate new fees and income without customer pushback or defection. However, the regeneration of goodwill by retail bankers will take significant time."

One of 5 Exhibits included in this report

The report contains 23 pages and 5 exhibits.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Make informed decisions in a digital financial world